Market update

Another week of bullish price action saw Bitcoin top the US $12,000 ($16,600) mark yesterday, to record its highest weekly close since January 2018 – and the highest price since June 2019. Bitcoin is currently up 4.4% on seven days ago to trade around $16,650. But all eyes were on Chainlink which gained another 50%. EOS gained 5.8%, Bitcoin Cash was up 1.2% while Ethereum and Stellar finished the week flat. XRP (-6.1%), Bitcoin SV (-2.3%) and Litecoin (-1%) lost ground.

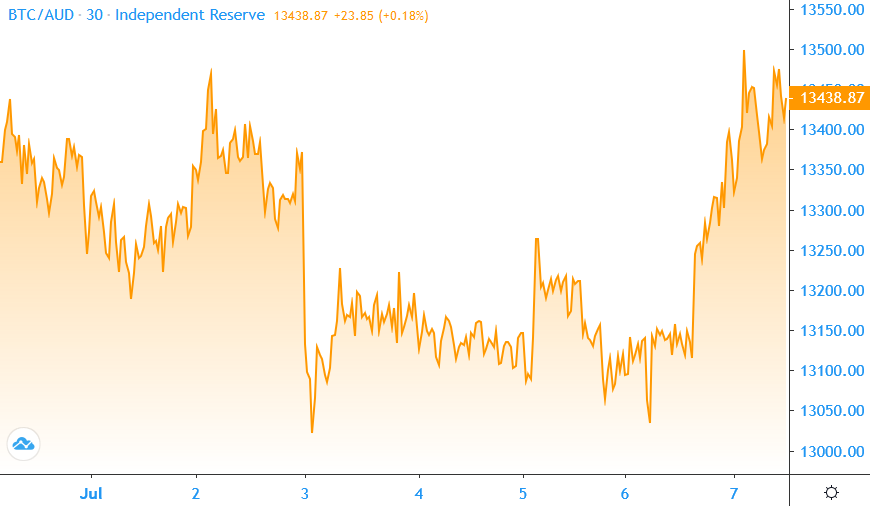

July was a great month in the markets, with almost every major coin appreciating in price. Social media sentiment appears to indicate we could be entering a bull market with the Fear and Greed Index at 75 (Greed). Markets barely broke a sweat after the weekend’s flash crash and Bitcoin is currently up 4.6% on the same time last week to trade just above $16,000 at the time of writing (23% up on a month ago). Ethereum was up 18.9% this week, and 67% this month, while XRP has awoken and recorded 37.5% gains this week and 72% for the month. Everything else is up on a week ago: Bitcoin Cash (8.7%), Bitcoin SV (8.6%), Litecoin (99.3.3%), Chainlink (23.5%), EOS (6.3%) and Stellar (10.5%). The total crypto market cap is $482 billion which is within sight of the 2019 peak of $531 billion.

Fundstrat’s Tom Lee likes to point out the majority of Bitcoin’s gains come in the “ten best days” each year. Today may well be one of those ten, with Bitcoin up 11.23 percent in the past 24 hours to trade around $15,600 at the time of writing. Bitcoin blew right past the psychological US$10,000 barrier yesterday and topped US$11,250 this morning for a new year-to-date high. The total market cap is at $284 billion with dominance at 63%. The price spike followed Ethereum’s big move earlier in the week which has led to 36.5% gains on seven days ago to trade around $450. The DeFi coins that led this cycle have pulled back, including LINK, which is down 4.6% this week. Most of the top ten were green though with XRP up 14.5%, Bitcoin Cash (20.5%), Bitcoin SV (22.5%), Litecoin (27.2%) and EOS (11). Stellar pulled back 1.4%.

Bitcoin suffered no lasting effects over the past week as 130 of the biggest Twitter accounts were roped into an amateurish BTC ‘giveaway’ scam. It’s traded in a narrow range around $13,000 and is currently around $13,100 to finish the week 0.9% down. Trading volumes are as low as they’ve ever been and data analytics firm Skew pointed out that BTC has traded in a 1% range over the last ten days. The last time that happened was in November 2018 just before BTC plunged nearly 50%. However, Morgan Creek Digital executive Jason Williams interprets the same data as suggestive of a major price increase this week: “Bitcoin volatility could be extraordinary to the upside.”

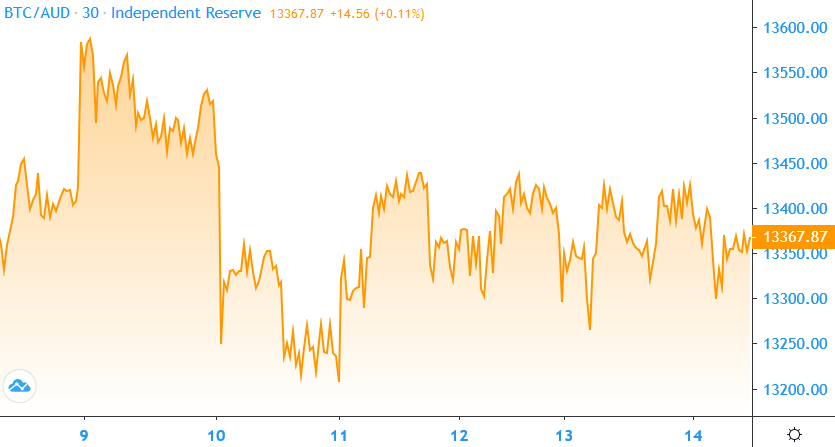

Another week of steady as she goes for neo-stablecoin Bitcoin, with the price trading in a narrow range and no major moves. BTC ends the week 0.7% down and is currently trading around $13,350. Research firm Skew says the correlation between Bitcoin and the S&P 500 reached a new all-time high this week. Ethereum and Litecoin also finished flat. XRP was up 6%, Stellar increased 27%, while Bitcoin Cash lost 3.1%, EOS lost 1.2% and BSV was down 3.8%. All eyes this week were on IR’s newest listing Chainlink (LINK) which surged from under $8 to around $11.50. It’s currently $10.40 and to finish the week up 34%.

Although Bitcoin has been showing signs of life in the past 24 hours (up 3%), the price action this week traded in a fairly narrow range above $13,000. It’s currently just over $13,400 and is up 1.78% for the week. Zooming out, the price has essentially stagnated over the month, down 3.3%. But zooming out even further and Bitcoin is up 27% for the year, outperforming gold and stocks. Crypto Compare’s report shows that the low BTC volatility has coincided with low volumes, which are down 36% on top tier exchanges. But altcoins made strong gains this week: Ethereum recorded its best price in a fortnight and is up 5.6%, XRP is up 6.3%, Bitcoin Cash (7.6%), Bitcoin SV (21%), Litecoin (5.3%), EOS (10.1%) and Stellar (10.3%).