In Markets

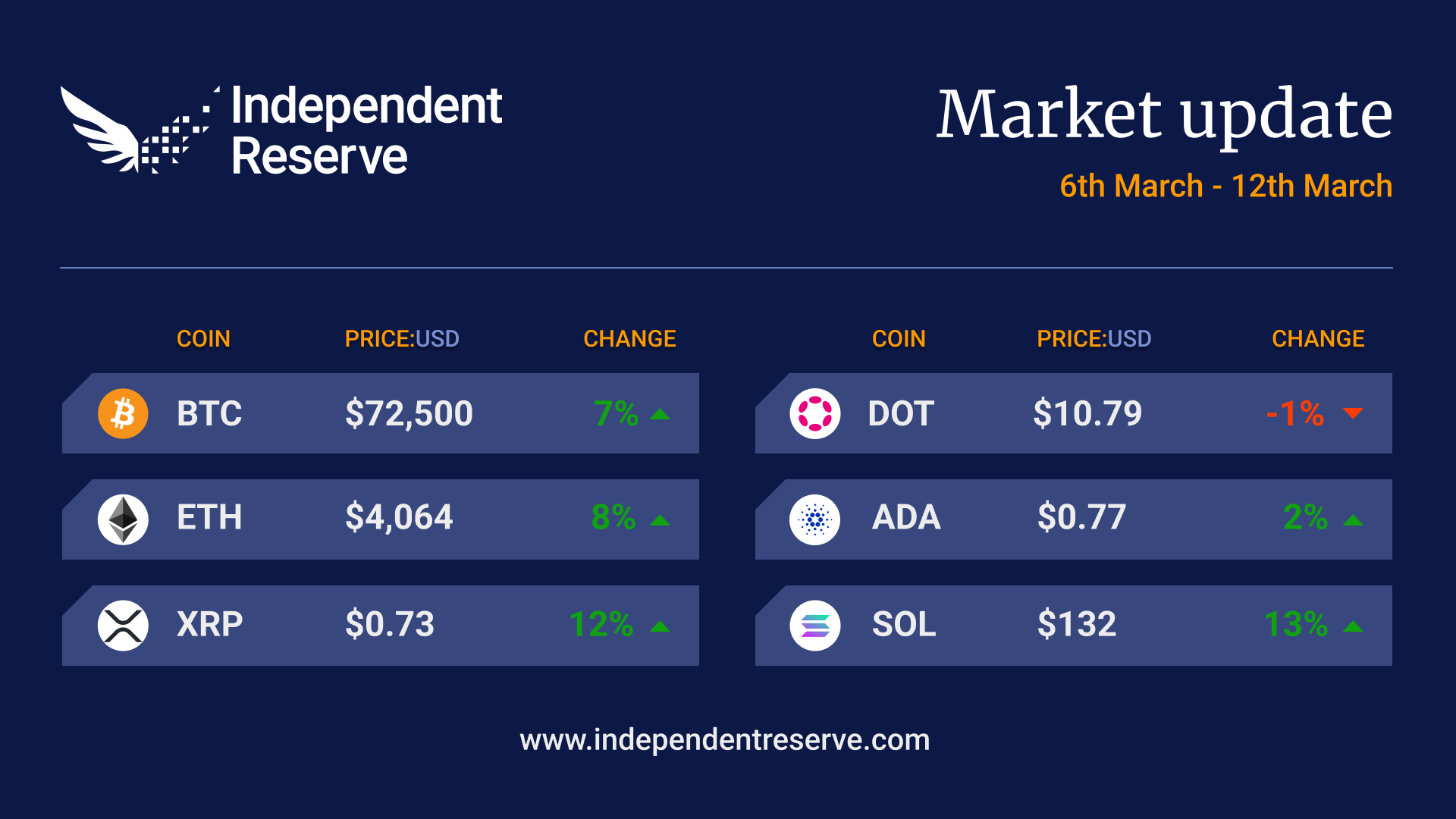

The 2024 bull run has begun in earnest with Bitcoin trading at new all-time high prices in US dollars, up 7% this week to US$72,500 (A$109,500). Ethereum has topped the US$4,000 mark for the first time since late 2021, and finishes the week up 8% to trade at US$4,064 (A$6,138). The market cap of Bitcoin is now higher than the market cap of silver, and Coinbase is worth more than PayPal. Around 1,500 Bitcoin addresses are becoming “millionaire wallets” every day, and MicroStrategy has just bought another US$821.7M (A$1.24B) of Bitcoin. With the halving just over a month away and market pricing in US interest rate cuts in June, the future looks promising. Almost everything else was up, including Solana (13%), XRP (12%) and Cardano (2%). However, Dogecoin pulled back 1%. The Crypto Fear and Greed Index is at 82, or Extreme Greed.

From the IR OTC Desk

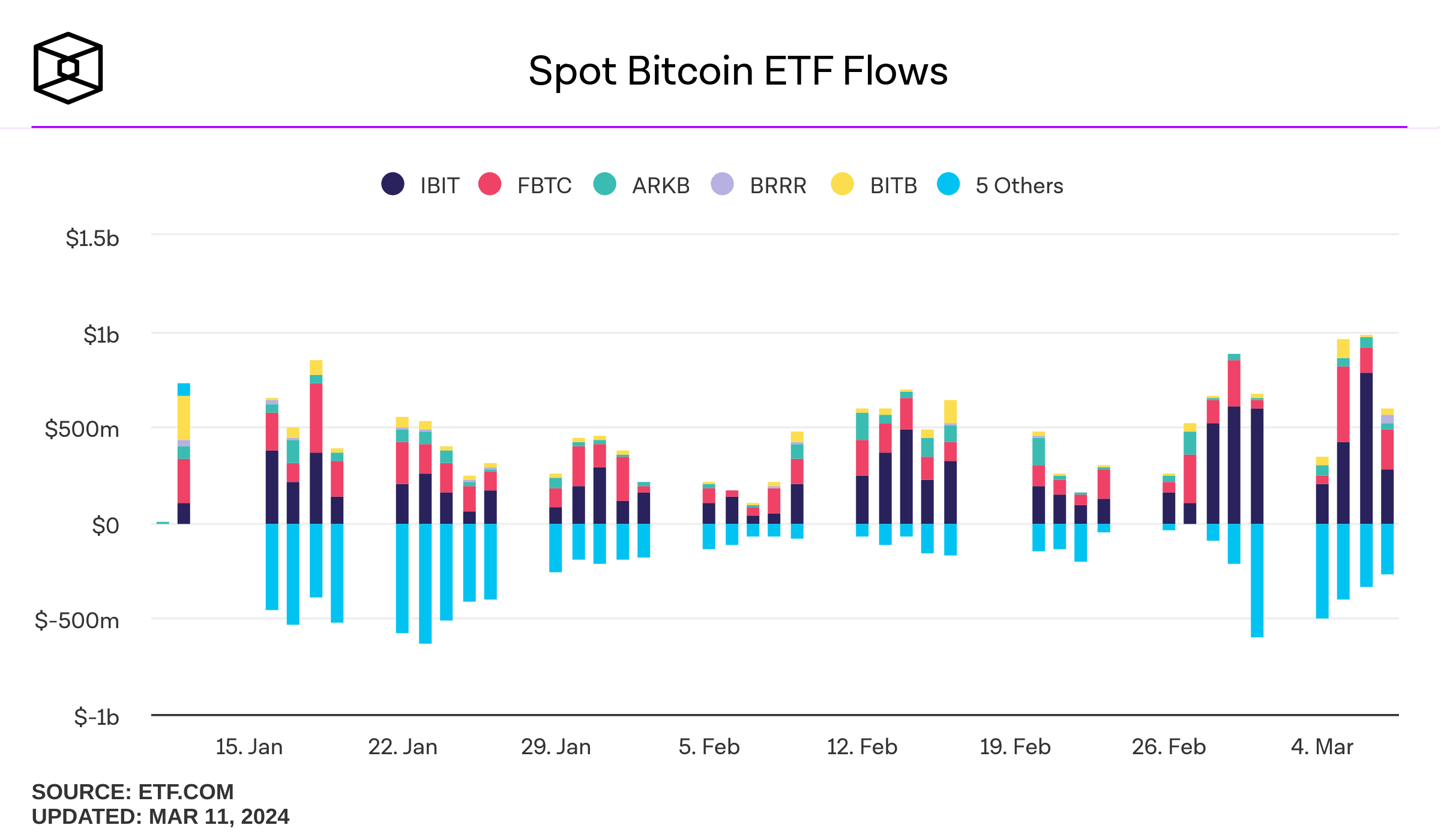

Bitcoin continues to make new all-time highs. It is our estimate, however, that bitcoin has not yet reached an inflation-adjusted high, which comes in much closer to USD 80k. In a similar rhetoric to last week, ETF inflows continue to swamp the issuance of the miners.

The daily on-chain flows (in BTC) for spot bitcoin ETFs with known on-chain addresses, namely BlackRock (IBIT), the Grayscale Bitcoin Trust (GBTC), Fidelity (FBTC), Ark Invest/21Shares (ARKB), Bitwise (BITB), Franklin (EZBC), Invesco/Galaxy (BTCO), VanEck (HODL), Valkyrie (BRRR) and WisdomTree (BTCW).

With the halving expected to take place on the 20th of April 2024 at block 740,000, bitcoin miners have become highly topical. Historically, bitcoin miners have provided an underlying asset alternative to holding the BTC token due to the ease in allocating to self-managed super (not just in Australia). For many managed account holders who wanted exposure to BTC, purchasing and storing underlying cryptocurrencies was quite simply not an option in these accounts; purchasing a NASDAQ-listed bitcoin miner, was, however.

Post the US spot ETF approval, mainstream exposure to underlying BTC has eased. And quite naturally, this has seen a large amount of switching between products. In this column, we have highlighted extensive liquidations and product switching from the Grayscale Bitcoin Trust (GBTC) and have speculated that much of this has been to do with the heavy fee schedule in the GBTC relative to the newer ETFs. It also appears that switching has been quite material between BTC miners and the ETFs. Because, at the end of the day, if you want exposure to the underlying, why not just source exposure to physical BTC if available?

This hypothesis might help explain much of the deviation between the underlying price of the bitcoin miners and the underlying price of bitcoin over the last few weeks. With BTC making new all-time highs, the bitcoin miners are trading at a material discount to their float price. It should be expected that bitcoin miners should provide a ‘high beta’ return on the underlying, due to company leverage. This hasn’t proven to be the case more recently. It might also be the case that the market is quite simply unsure of the path for Bitcoin miners post the halving. As we move towards this event, the relationship between BTC (the currency) and Bitcoin miners will prove incredibly interesting for the investment complex. Watch this space.

On the economics front, tonight delivers US CPI. This is the most important data event on the calendar. With US equities stalling at their historic highs and US 10-year bond yields continuing to trade north of 4%, all eyes will remain on inflation (although this seems to have little bearing on cryptocurrencies). Core inflation YoY (Feb) is forecast to fall from 3.9% to 3.8%. Headline inflation YoY (Feb) is forecast to rise from 3.1% to 3.2% YoY.

On the OTC desk, USDT buyers remain, and this has been the case at all pricing levels of USDT. Fast money has been more comfortable lightening up on both BTC and ETH near historical highs, particularly on those days of equity underperformance. We continue to see good appetite for low/mid-market cap alts, and have had broad enquiry into meme tokens – although their traded size has been relatively small to market movements. We continue to track ETF inflows relative to BTC mining supply – this is a theme that isn’t going away anytime soon.

For any further information, please feel free to reach out.

In Headlines

Ethereum hard fork on Thursday

Ethereum’s Dencun upgrade will go live Thursday 1 AM AEDT and is “the most significant hard fork since the Merge”, according to analyst Eric Wall. The upgrade (which went live on the ETH-compatible chain Gnosis overnight) sees the introduction of blobs, which store data temporarily (rather than permanently like now) and is expected to reduce gas costs for Ethereum L2s like Arbitrum and Optimism by at least 80%. It comes at an opportune time with the memecoin frenzy pushing gas costs to the highest point in almost two years and an average transaction costing US$1 (A$1.51) on Arbitrum and US$28 (A$42) on Ethereum. However, don’t expect a big improvement for gas fees on Ethereum itself (L1). The upgrade also includes an EIP related to an enshrined oracle, to improve communication between the execution and consensus layer, and will enable “transient storage opcodes”, which will apparently allow Uniswap V4 to ship. Ethereum creator Vitalik Buterin has also proposed a quick hard fork method to save most users funds in the event of a sudden Quantum computing breakthrough (which would be able to break encryption for most cryptocurrencies).

Bitcoin ETFs top US$55 billion in assets

After two months, the Bitcoin ETFs have topped and crossed US$110 billion (A$166B) in trading volume. “If these were the numbers at the end of the year, I’d call them a success. To do it in eight weeks is simply absurd,” said Bloomberg ETF analyst Eric Balchunas, who noted BlackRock and Fidelity’s Bitcoin ETFs are third and fourth for year-to-date flows among all ETFs in the US. Last week, the Bitcoin ETFs took in an average of, even after accounting for the average US$330.9M (A$500M) flowing out of Grayscale’s Bitcoin Trust. In Bitcoin terms, the ETFs bought a net 33,600 Bitcoin, while Grayscale sold 10,200 BTC, and spot Bitcoin ETFs now hold 1% of the entire Bitcoin supply. BlackRock has unveiled plans to add Bitcoin holdings to its Strategic Income Opportunities Fund and to its Global Allocation Fund. Bitwise CIO Matt Houghan meanwhile says the firm is having “serious due diligence discussions with major wirehouses, institutional consultants, large corporations” that want to invest in its Bitcoin ETF and expects to see the “first significant flows from these three groups in Q2 2024.”

Retail is returning slowly

Retail is cautiously returning to crypto, according to data from K33 Research. Crypto exchanges saw a 45% increase in traffic in the past quarter compared to the previous one, and traffic to data aggregation sites like Coingecko and Coinmarketcap is up by two-thirds. Searches for “how to buy Bitcoin” are at 74 out of 100 over the past 12 months (with 100 representing the high point of interest for the year), while “How to buy Ethereum” hit 82.

Singapore’s Safepal unveils crypto Visa and USDC accounts

Singapore fintech SafePal has partnered with Swiss bank Fiat24 on a USDC-powered Visa card. Transactions are recorded on Ethereum L2 Arbitrum, and the related SafePal wallet account credentials are minted as NFTs. The crypto Visa card is plugged into Paypal, Google Pay, Apple Pay and Samsung Pay.

Ethereum ETF hopes fade

Hopes for a May approval of an Ethereum ETF are fading fast, with Bloomberg ETF analyst Eric Balchunas cutting the chances to 35% because the SEC is yet to give any comments to issuers (which they had done with the Bitcoin ETFs by the same point). Coinbase and Grayscale met with the SEC this week to discuss the potential conversion of Grayscale’s Ethereum Trust to an ETF. Coinbase’s presentation showed a very strong correlation between Ether futures and spot markets (a big factor in getting the Bitcoin ETFs approved) and claimed “spot markets for ETH are highly indicative of a market resilient to fraud and manipulation.” While ETF Store president Nate Garaci said the correlation was “every bit as strong as w/ Bitcoin markets … I’m not sure what grounds for disapproval of spot Ether ETFs would be” crypto lawyer Jake Chervinsky believes the SEC’s natural “dislike” for crypto, combined with political pressure, means that it might be “willing to take litigation risk and lose in court based on a preference for being viewed as ‘fighters’ in a war against crypto rather being accused of rolling over.” Separately, Balchunas raised the intriguing prospect that Grayscale might be less likely to sue the SEC to force an Ethereum ETF, given that doing so for Bitcoin had resulted in the SEC approving ten Bitcoin ETFs at once, causing GBTC to lose market share.

Until next week, Happy Trading!