In Markets

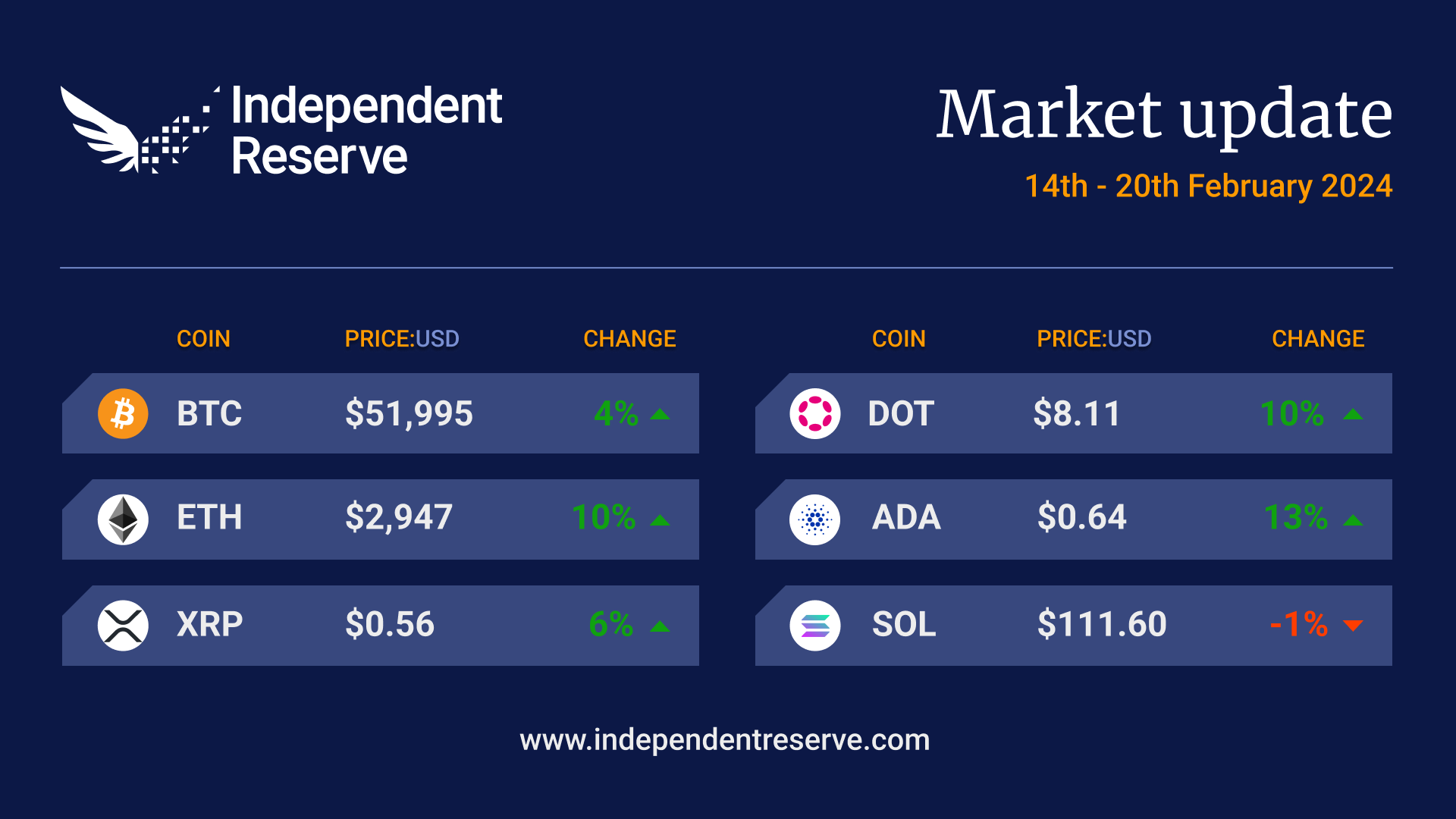

Bitcoin’s market capitalisation is back over the US$1 trillion mark (A$1.53T), and assets under management in global institutionally focused crypto funds are back at December 2021 levels – around US$67 billion (A$103B), according to Coinshares. The crypto turnaround has been pretty sudden with Coinbase’s fourth quarter report showing it has finally returned to profit for the first time since 2021 after a US$2B (A$3.1B) loss the previous quarter. It forced JPMorgan’s analysts to grudgingly upgrade the stock all the way to “neutral.” Bitcoin is currently up 4% on seven days ago and trading at A$79,840 (US$51.9K) while Ethereum gained 10% to trade at A$4,562 (US$2,970). Everything else was up except Avalanche (down 2.1%) and Solana (down 1.3%), XRP (6.4%), Cardano (13.1%) and Dogecoin (4.5%). The Crypto Fear and Greed Index is at 75 or Greed.

From the IR OTC Desk

With the spot BTC ETF euphoria continuing, it seems appropriate to discuss the supply side of BTC. The halving is now circa two months away, and that means a reduction in the block reward for BTC miners. Practically, the adjustment will change the increasing supply from 6.25 BTC per solved block to 3.125 BTC per solved block (roughly every 10 mins). As the market continues to tabulate and assess the quantity of funds being deposited into the US BTC ETF, the reduction in supply caused by the halving will soon become highly topical.

Different from any other commodity, BTC new supply is capped by the block reward schedule, with total supply also being capped by the protocol. This is an important difference to traditional commodities, like gold. In the public media, the BTC ETF has been frequently compared to the gold ETF. From the supply side however, there are some very significant differences between the two commodities that I would like to point out.

Economic profit is the difference between:

- Revenue received from sales, and

- The explicit costs of producing its goods or services, as well as any opportunity costs.

For gold, if economic profit exists, supply will be increased by running the extraction process for longer or building a new mine. That is, capital will be allocated to increase the supply side of gold if the gold price increases sufficiently to drive economic profit. This supply change can be positive or negative – gold mines can also be taken out of production. Under the scenario of rapidly increasing gold demand (and in turn prices), the supply of gold can also be rapidly increased, in a smooth process to match demand. The same can’t be said for BTC.

The scenario of rapidly increasing BTC demand would see capital allocated to BTC miners and mining infrastructure, causing an increase to the hash rate. This delivers an economic profit cycle for the BTC miner, but importantly, has no change to the supply schedule of BTC as outlined in the BTC protocol. The role of the BTC miner is to secure the network and make a profit; the role of the gold miner is to balance supply and make a profit. In no way are these supply side dynamics like each other, making it difficult to equate the gold and BTC ETFs as being similar. Watch this space.

On the OTC desk, the Chinese New Year holiday period continues to lesser traded volumes – although volumes across the desk remain highly elevated. The reduction in general has been associated with less sell side flow from USDT to fiat (AUD/USD/SGD). With this change in flow dynamic caused by the holiday period, it makes sense that USDT has moved above 1:1 USD. We continue to follow ETH/BTC closely as an indicator of underlying sentiment for DeFi/lending protocols, as well as market sentiment for any upcoming ETH ETF. On the economic front, listen out for the details included in the FOMC meeting minutes which will be released on Wednesday at 6:00am AEDT.

For any further information, please feel free to reach out.

In Headlines

The halving in two months

The Bitcoin halving is coming in April and will see the block reward for miners halved to 3.125 BTC per block. Around 900 Bitcoin are mined per day currently, but that will fall to 450 Bitcoin per day. Galaxy Digital estimates that up to 20% of Bitcoin’s hash rate will be forced offline. The supply reduction is good news for hodlers though and Hal Press from North Rock Digital argues that afterwards there will be about US$25 million (A$38M) of “daily structural supply to absorb (per business day)” and estimates the Bitcoin ETFs will gobble up an average of US$40M (A$61M) per business day putting upward pressure on prices.

Huge week for Bitcoin ETFs

It was another massive week for the Bitcoin ETFs, with net inflows of US$2.273B (A$3.47B), equating to 43,000 Bitcoin taken off the market in just five business days. The biggest single day was on Feb 13 when inflows hit an astonishing US$631.3M (A$966M). Since launch the ETFs have taken in a net US$4.93B (A$7.54B) and bought a net 102,887 Bitcoin, even after accounting for the massive US$7B (A$10.7B) outflows from Grayscale. On the other side of the ledger, Gold ETFs have bled US$2.4B (A$3.7B) in outflows so far in 2024.

Banks want a slice

Having watched 90% of the Bitcoin flowing into the ETFs being custodied by Coinbase, the big banks are now clamouring for piece of the action. A trade coalition of banking organisations wrote to the SEC pushing to change the guidance to potentially allow them to custody crypto. They said that “notably absent from those approved products are banking organisations serving as the asset custodian, a role they regularly play for most other ETPs.”

ETF conference Miami

Fox Business reports that the Bitcoin ETFs were the talk of the annual Exchange ETF Conference in Miami last week, with the panel discussion on the topic the best attended of the entire event. Sentiment on the possibility of an Ethereum ETF launching was mostly positive. Grayscale’s head of ETFs, Dave LaValle was asked if the firm would take legal action to force the SEC to approve an Ethereum ETF, as it did with the Bitcoin ETF. He said the company would “have to wait and see and look at the facts,” and thinks the odds of approval by May are 50/50.

Singapore and Hong Kong challenges

The South China Morning Post reports that Singapore and Hong Kong are facing challenges in their bids to become global crypto hubs due to the revival of interest in the US after the launch of Bitcoin ETFs. However, most firms are still taking a “wait and see” approach “before making a beeline back into the US” according to Danny Chong, co-founder of Tranchess. The report also noted that “the potential listing of the first Bitcoin ETF on the Hong Kong Exchange is expected within a few months” and said the guidelines will be similar to the US.

Where to from here?

The consensus seems pretty bullish, with many analysts predicting fresh all time highs as a result of the ETF inflows and the halving this year. Anthony Pompliano said the performance of the Bitcoin ETFs shows that “Wall Street doesn’t just like Bitcoin, they love Bitcoin” while the CEO of Bitcoin rewards app Lolli Alex Adelman said that “increased mainstream demand, especially from Bitcoin ETFs, will continue to drive strong upward price momentum.” Analysts at the brokerage Bernstein predict record highs this year driven by a “higher price-higher inflows feedback loop.” Interestingly, retail doesn’t appear to have even shown up for this rally yet, with Glassnode data suggesting the number of new Bitcoin addresses is actually trending down. Analyst Michael van de Poppe also sounded a note of caution and posted a four-year price chart which he said suggested markets “super bullish [and] slightly overheated. I wouldn’t be unhappy if we got a slight correction to return to reality.” The ETH price also stands to benefit from speculation over the potential approval of Ethereum ETFs, with Standard Chartered predicting that ETH will hit US$4,000 (A$6,122) in May if the ETFs are approved – and the analysts expect that to happen on May 23.

Bits and pieces

Federal Reserve Governor Christopher Wallace says that crypto isn’t a threat to the global reserve currency status of the US dollar: “Crypto-assets are de facto traded in U.S. dollars. So, it is likely that any expansion of trading in the DeFi world will simply strengthen the dominant role of the dollar.” Caroline Hill, from USDC issuer Circle, urged lawmakers to look into rival Tether’s terror financing links at a hearing. However, Brian Nelson, the undersecretary for Terrorism and Financial Intelligence, said the politicians and the Wall Street Journal were essentially making up a panic over terrorists using crypto. “We assessed that terrorists still prefer, frankly, to use traditional products and services.” Thirteen years ago, on this day, Bitcoin was worth 90c in USD, or $1.37 in Australian dollars.

Until next week, happy trading!