In markets

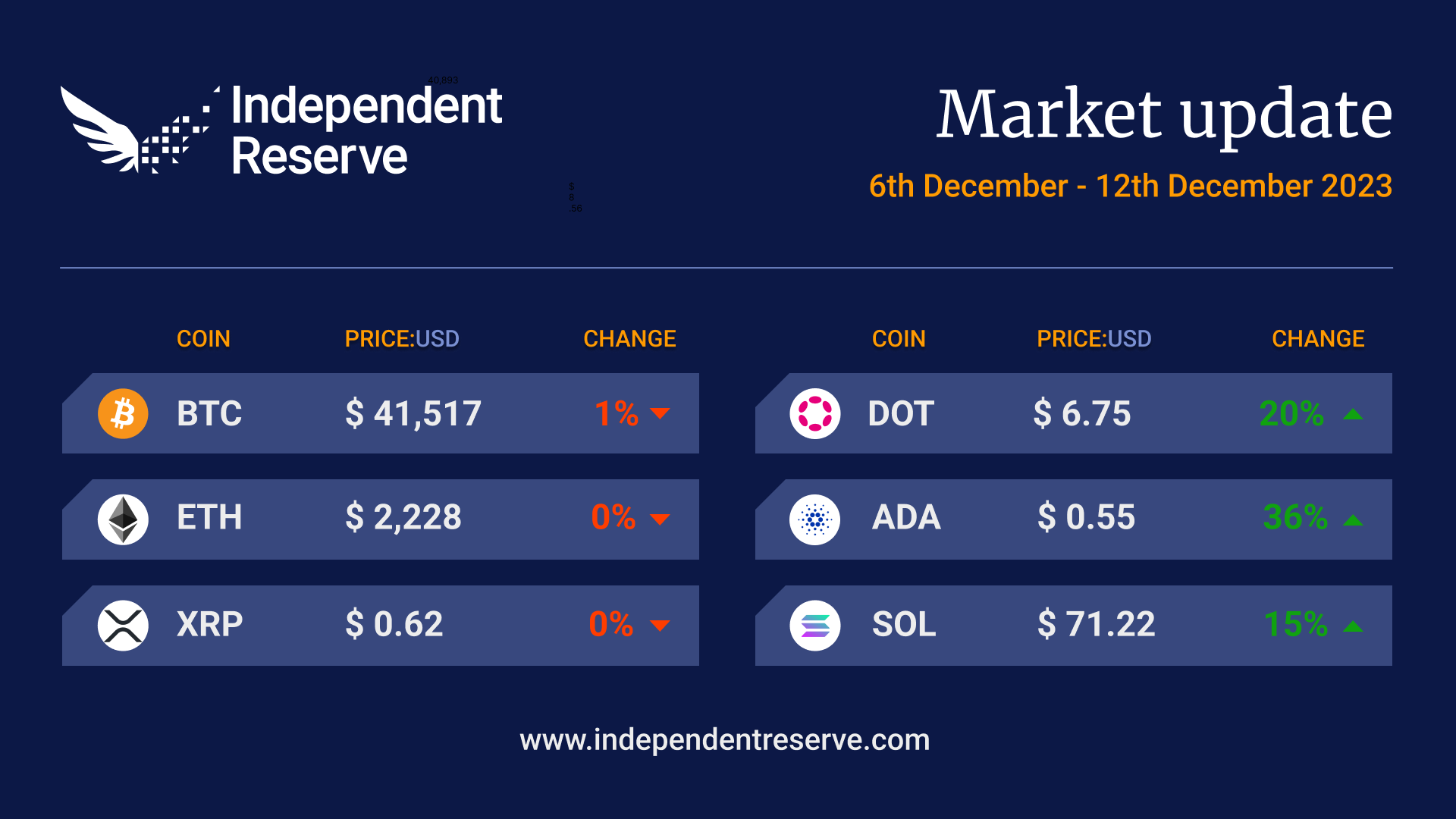

We’re just one month before the final deadline for Ark Invest’s Bitcoin ETF application. It’s the expected trigger for approval of up to a dozen spot Bitcoin ETFs, a mere 125 months after the Winklevoss twins submitted the first application. To celebrate, the Bitcoin price reversed an entire week’s worth of gains by falling 6.5% in 20 minutes yesterday. But sentiment is so high the reversal was seen by many as bullish — the expected correction after two months of climbing prices. “Corrections shake out ‘weak hands’ and leverage, allowing for a stronger foundation for eventual moves higher,” tweeted analyst Will Clemente. Bitcoin finishes the week down 1% (at the time of writing) to trade around A$63,770 (US$41,517), while Ethereum was flat at A$3,425 (US$2,228). XRP was also flat, but Cardano surged 37%, Avalanche leapt 76.5%, and Dogecoin was up 5.9%. The Crypto Fear and Greed Index is at 67 or Greed.

From the IR OTC Desk

Cryptocurrency liquidity is expected to reduce into the end of the year, although this variance can be somewhat unpredictable. This can have the effect of causing short and sharp pricing movements (in either direction). This week’s price action highlights what happens when large, profit-taking orders try to clear all at once. And while ‘water always finds its level’ and markets will stabilise, sharp pullbacks send a reminder of just how far, and how fast, the cryptocurrency complex has moved since the beginning of November.

It is important to note that after this week, there is very little Central Bank activity until the end of January. With many financial institutions running calendar-based financials, traders take holidays before P&Ls are reset for the new calendar and financial year. For many, this week represents the last trading week of the year. Take note.

With that said, it makes sense that the economic calendar is extremely busy.

In Australia, Thursday at 11:30am (AEDT) delivers the November employment series. In the US, Wednesday at 12:30am (AEDT) sees US inflation for November; and Thursday at 6:00am (AEDT) the US Federal Open Market Committee (FOMC) meeting.

Currently, there are four 25bp rate cuts implied by the US interest rate futures market for calendar year 2024. In Australia, the total is closer to a 30bp reduction. Historically, the differential would see the AUD/USD look to gain support as forward-looking interest rate differentials converge (amongst other things). For the time being, however, AUD/USD has been stuck within a 0.6500 / 0.6700 range, with little sign of immediate breakout. Perhaps the post-FOMC meeting may change this.

While cryptocurrency price volatility has accelerated over the week, the ETH/BTC cross is very much range-bound, towards the support level of mid-2022. Alt performance has remained unaligned to ETH outperformance. A new iteration for this cryptocurrency upcycle.

On the OTC desk, relative value has become the dominant theme. With the SOL token leading the cryptocurrency market rally, other ‘lesser’ performing layer 1s like AVAX have started to outperform (play catchup). BTC buyers have now emerged, although they remain cautious of ‘buying the top’ and appear to be level targeting. OTC ETH trading remains much more balanced. Alts enquiry has aligned to underlying protocol token performance. That is, SOL token outperformance has seen Alts on the Solana ecosystem receive significant enquiry. It seems logical that this will also be the case as other protocol ecosystems are catching up. Continue to listen out for an update on a US spot BTC ETF.

For any further information, please feel free to reach out to our crypto OTC desk.

In headlines

IR’s best month in two years

Independent Reserve has just seen its best month of trading in two years as volume topped half a billion dollars in November, a 50 percent increase on a year earlier. “I can definitely say optimism’s returned to crypto markets,” Adrian Przelozny, founder and chief executive, told the Australian Financial Review. “People are bullish, and the positive sentiment is driven by the halving in the Bitcoin supply around next April as a price support for Bitcoin.”

Accept crypto from your customers

Independent Reserve has partnered with RelayPay to allow businesses across Australia and New Zealand to seamlessly accept cryptocurrency payments. This enables business customers to use cryptocurrencies, such as Bitcoin, Ethereum, USDC, and USDT, to pay for goods and services. Through RelayPay, customers can conveniently pay in crypto while businesses receive payments in dollars. This collaboration reflects Independent Reserve’s dedication to innovation in the cryptocurrency industry as the demand for digital payments continues to grow.

Learn how your business can accept cryptocurrency payments.

PayNow deposit is now available for Singapore users

Customers with a Singapore bank account can now deposit SGD to their Independent Reserve account using PayNow. Enjoy the smooth and secure process of depositing Singapore Dollars (SGD) with zero-fee deposits just by scanning the PayNow QR code.

Lasanka Perera, CEO of Independent Reserve Singapore, said, Seamlessly integrating our wallets with PayNow will bring greater convenience and improve the overall user experience. This also aligns with our mission of providing a safe and secure way for the mainstream adoption of crypto, as well as the growing crypto and Web3 community in Singapore. PayNow is just one of many enhancements to help optimise our customers’ journeys, and we’ll definitely plan for more products and improvements in the future.”

Worrying legislation

Senator Elizabeth Warren’s anti-crypto army in Washington is growing stronger, with five new senators signing on to co-sponsor her draconian Digital Asset Anti-Money Laundering Act. The act would extend KYC rules to miners, validators and wallet providers and “effectively ban crypto in America”, according to Alex Thorn, Galaxy’s head of research. Coin Center called it “an opportunistic, unconstitutional assault of cryptocurrency self-custody, developers and node operators.” Hopefully, America’s gridlocked legislative system, and Warren’s 319-11 record of legislative failure, will mean the bill never becomes law.

Bankers support crypto crackdown

JPMorgan Chase CEO Jamie Dimon has doubled down on his anti-crypto views in a hearing before the US Senate Committee on Banking, Housing, and Urban Affairs. Under questioning by Elizabeth Warren, he said, “The only true use case for it (crypto) is criminals, drug traffickers, money laundering, tax avoidance”. “If I was the government, I’d close it down.” The crypto community was quick to point out that JPMorgan has been fined US$39.3 billion (A$59.9B) across 272 separate violations since 2000 and was in no position to lecture anyone on abiding by the law. Warren later went on CNBC and said Dimon and the other bankers at the hearing all agreed with her on the need to extend the Bank Secrecy Act to crypto.

Crypto and terrorism

A bipartisan group of legislators in the US has introduced a new bill called the Terrorism Financing Prevention Act. It aims to counter crypto’s role in financing terrorism, citing the Israel-Hamas conflict. The 10-page bill would allow the Treasury to prohibit transactions with a “foreign digital asset transaction facilitator” listed as a sanctioned entity.

Bitcoin ETF proceeding towards finish line

The SEC has been working through the details of Bitcoin ETF applications with issuers. Reuters reported the discussions “have advanced to key technical details, in a sign the agency may soon approve the products.” The SEC last week met with Fidelity to discuss Fidelity’s Wise Origin Bitcoin Trust and VanEck has now submitted its fifth amended application and revealed its ticker will be $HODL. The deadline for the ARK 21 Shares Bitcoin ETF is up on January 10, and while the SEC could ask Ark to withdraw its application and refile, this would be legally risky in light of the recent Grayscale decision (which reversed the SEC’s refusal to convert the Trust into an ETF). The main point of contention is that the SEC is pushing for a cash model — where the issuer sells Bitcoin first and hands over cash to an investor who wants to redeem their shares or an in-kind model, where the investor gets actual Bitcoin back.

Van Eck’s 15 predictions

VanEck has released a new report stating it expects approval for the Bitcoin ETFs in the first quarter of next year, for US$2.4B (A$3.65B) to flow into them by March, and a new all-time high for Bitcoin by the end of the year. The report made 15 predictions in total, including that Binance will be overtaken as the top crypto exchange, the ETH/BTC flippening won’t happen, Solana will challenge ETH, decentralised exchanges will reach a new peak for trading volume, KYC DeFi platforms will outnumber non-KYC ones, and the stablecoin market cap will hit US$200M.

Bits and pieces

While overall sentiment on the stock market suggests interest rates have peaked and the US economy will see a “soft landing”, Warren Buffett’s Berkshire Hathaway quietly sold US$28.7 billion (A$43.7B) of stocks in the first three quarters of 2023 and veteran investor Jeremy Grantham thinks a bubble on the stock market is set to unwind violently. Binance founder Changpeng Zhao has been ordered by a judge to stay in the US until he is sentenced on money laundering violations in late February and the SEC has vowed to continue its case against Binance. The number of unique Bitcoin wallet addresses with at least $100 of Bitcoin hit a new all-time high in the last month, and more than 57% of Bitcoin in circulation has not moved in two years. Bloomberg reported that Bitcoin crossing the US$42K mark was “just the start of a fresh crypto supercycle that will push the world’s biggest token above US$500,000” (A$761K) although the article went on to rubbish the claims. “It’s getting crazy again,” said Matt Maley, chief market strategist at Miller Tabak & Co said. “Those kinds of comments show just how quickly sentiment can change for this asset class.”

Thank you for your support

The Independent Reserve Singapore’s team of 11 runners has successfully raised over S$30,000 in support of the local non-profit charity, Extraordinary People. The runners completed in all categories in this year’s Singapore Standard Chartered Marathon. “On behalf of Independent Reserve, we are incredibly grateful for your support in our fundraising efforts,” said Lasanka Perera, CEO of Independent Reserve Singapore. “Your generous donations will empower individuals with special needs to reach their full potential and actively participate in their communities. We are excited to continue supporting them and finding even more ways to make a positive impact in the lives of individuals with special needs.”

Until next week, happy trading!