In markets

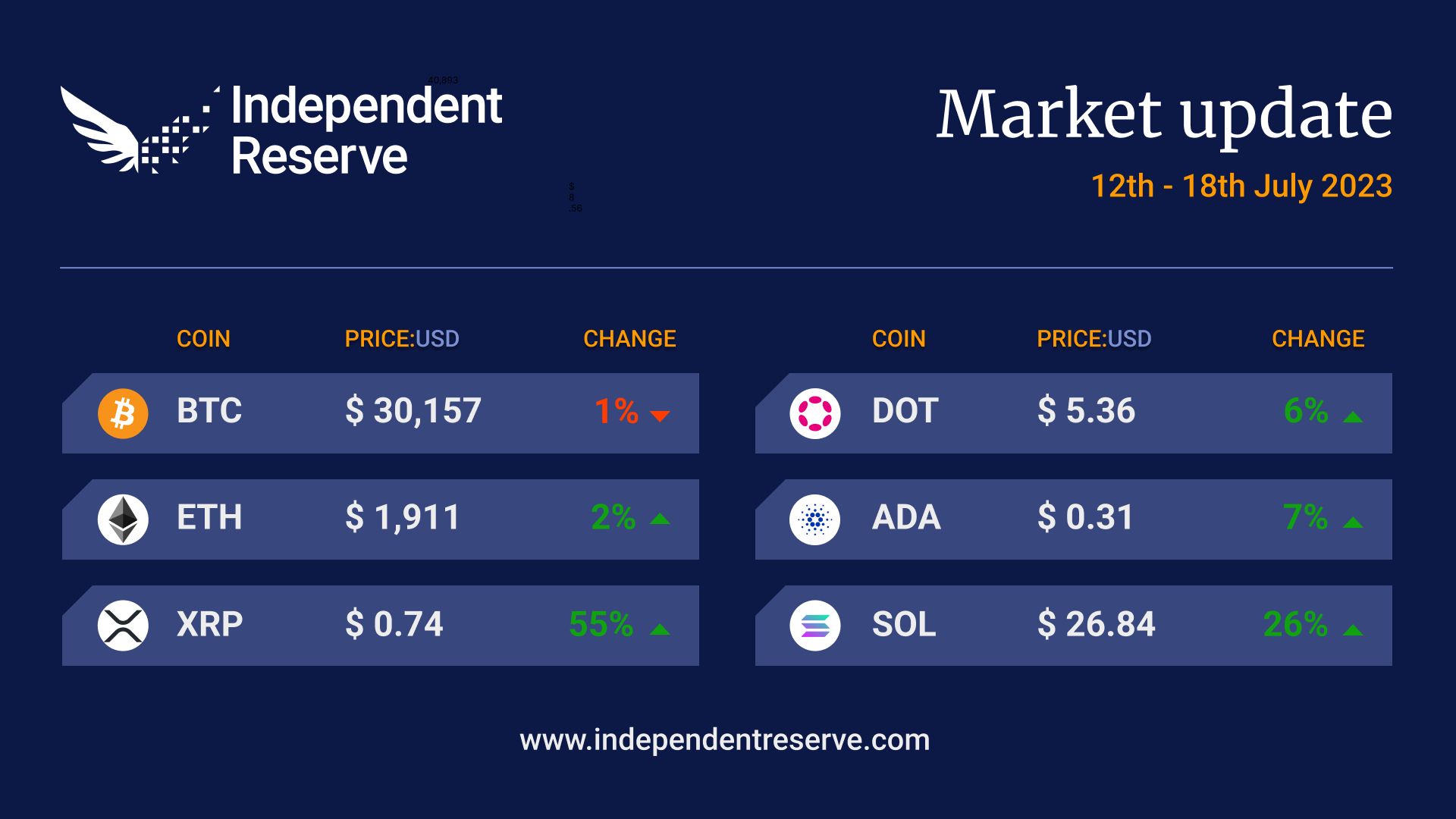

We’re back! That seems to be the majority opinion on Crypto Twitter following the landmark Ripple ruling. The Block reports an immediate surge in the seven-day moving average volume of crypto trading from US$12.74 billion to $16.56B (A$18.7B to A$24.3B). That’s still about 60% below this year’s peak, but it’s a start. As you might expect, XRP was the big mover this week, up 54.6% on seven days ago. Bitcoin fell slightly by 1% while Ethereum gained 1.5%. The ruling gave a vote of confidence to other coins the SEC believes are securities, with Cardano (8.1%), Solana (25%) and Polygon (5.6%) all making gains. Dogecoin gained 6.7%. The Crypto Fear and Greed Index hit greed in the days after the ruling but is currently 54 or Neutral.

From the OTC desk

Cryptocurrency markets have been somewhat euphoric this week, following a mixed ruling in the SEC vs Ripple (XRP) court case that has broadly been accepted by the market as positive. In macroeconomics, China data continues to be a significant market driver, with China’s Q2 GDP printing at 6.3% (YoY) – well short of the 7.1% (YoY) expectation.

This week, we receive limited economic data (relative to other weeks). Key events will include Canada’s June inflation data (Tuesday 10:30 pm AEST); US June retail sales (Tuesday 10:30 pm AEST); New Zealand Q2 inflation data (Wednesday 8:45 am AEST); and Australia’s June employment data (Thursday 11:30 am AEST). Additionally, we remain highly attentive to any announcement from the SEC regarding the institutionally placed XRP tokens – which have currently been deemed a security.

Last week we highlighted that the disinflationary pressures in China had started to weigh on US bond yields. This trend has continued, with US 10yr treasury yields falling this week from 3.90% to circa 3.80%. US 2yr bond yields have also moved lower, from 4.88% to circa 4.74%. The outright level of US treasury yields will remain critical to risk asset pricing and the relative funding costs for cryptocurrencies.

In Australia, Treasurer Chalmers has made the announcement that the incumbent Deputy Governor of the Reserve Bank of Australia (RBA), Michele Bullock, has been appointed to the Governor’s role in a seven-year term commencing the 18th September 2023. In a historical appointment, Ms Bullock will be the first female Governor of the RBA.

Today, the RBA Meeting Minutes for June, have highlighted an ongoing data dependency for further cash rate increases (currently at 4.1%). Quite specifically, the data point of consideration is the Q2 inflation report, which is scheduled for release on Wednesday the 26th of July at 11:30 am. Currently, the market is forecasting a 30% chance of a 25bp cash rate increase at the August meeting. Watch this space.

On the OTC desk, token picking following the SEC vs Ripple announcement has been evident. In general, this has supported layer 1 tokens, with SOL, Stellar, Kaspa and Celo all up by more than 50% over the last 30 days. We continue to monitor closely the price action of BTC, ETH, LTC and BCH as risk proxy for the cryptocurrency market. Historically, USDT has tended to trade above 1:1 USD when significant alt flow has emerged (due to on-ramping requirements in DeFi). This week USDT has traded above 1:1, broadly clearing around 1.0003. In correlated markets, attention is now being drawn to the key relationship between the majors (BTC and ETH) relative to the DXY (the USD currency index). This feels like a developing relationship to follow.

For any further information, please feel free to reach out.

In headlines

Ripple is back

After three long years, the SEC’s court battle against Ripple for selling unregistered securities is over — and the result was about as good for the industry as anyone dared hope. Judge Analisa Torres ruled that Ripple was guilty of selling unregistered securities in the form of XRP to institutional investors — but ruled that “programmatic sales” on exchanges were not securities. Overlooked by many is the fact the Judge didn’t actually rule on secondary sales (ordinary people buying XRP and selling from each other on exchanges) and neither did the judge in the LBRY case. Lawyer Stephen Palley cautioned that: “While persuasive, it’s not binding precedent on other courts and will likely be appealed and could be reversed.” Any appeal would take many months though, and in the meantime, the ruling may spur Democrats to actually try and pass crypto regulations to clear things up. Tom Emmer (Republican), Ritchie Torres (Democrat), Cynthia Lummis (Republican) and Kirsten Gillibrand (Democrat) are all pushing for legislation to fill the void.

Will the SEC appeal?

The default assumption by many is that the SEC will appeal the ruling and boss Gary Gensler has told journalists, “We’re still looking at it and assessing.” But XRP supporter, attorney Jeremy Hogan points out that appeals don’t usually start until there is a final judgement and notes that appeals are very difficult to win in any case. Probably most importantly, the SEC has more to lose than it stands to gain from an appeal. If it loses “at the appellate level, now every Court in the 2nd DCA (district court of appeals) MUST follow the decision. They could literally turn a mole-hill into a mountain.” Former SEC and CFTC official Justin Slaughter told Politico the XRP ruling has also increased the stakes in Grayscale’s case against the SEC for refusing its application for a Bitcoin ETF “The SEC’s position is weak right now,” Slaughter said. “Another bad decision could have a multiplicative effect.”

XRP is back

XRP surged by 73% following the ruling, as major US exchanges Coinbase and Kraken relisted the token. It was the second-largest daily increase in the token’s history, and it remains up by more than 50% for the week today. Ripple put out a statement saying: “XRP is not a security. This victory for Ripple is a win for the entire industry and a step toward regulatory clarity in the U.S.”. Ripple moved back into the fourth spot by market cap and Kaiko reports that XRP accounted for 21% of crypto volume in the past month, ahead of Bitcoin (20%) and Ethereum (8%).

Dealer’s Choice NFT show in Melbourne

Dealers Choice, founded in 2022, promotes Australian art by transforming 54 playing cards designed by local artists into limited-edition NFTs. Celebrating 13 years of Just Another Agency, the ‘Dealer’s Choice’ collection offers unique physical and digital art pieces. Attend the launch at Oshi Gallery this Friday, 21 July, at 6 pm, and stand a chance to win artwork through a game of poker.

Coinbase case gets a boost

Gemini founder Tyler Winklevoss tweeted that the Ripple ruling “decimates” the SEC case against Coinbase for selling 13 unregistered securities, and his brother Cameron theorised “The sale of XRP on exchanges is NOT a security. This means the sales of all cryptos on exchanges are NOT securities and @SECGov and @GaryGensler have NO jurisdiction over them.” But as noted above, the Judge didn’t actually rule on secondary sales, even if the ruling seems very positive in that regard. JPMorgan put out a note to clients saying the ruling would make it “more difficult for the SEC to show that the 13 tokens are securities and Coinbase is an unregistered securities exchange.” It’s worth noting the SEC is also going after Coinbase’s staking and wallet service, so JPMorgan says it “doesn’t appear to be completely out of danger yet”. In court, Judge Katherine Polka Faila seemed sceptical of the SEC’s behaviour, saying it seems like the agency is trying to regulate crypto in its entirety. She also noted the SEC’s approval of Coinbase’s S-1 to list on the stock exchange meant “It’s not crazy for Coinbase to think what they were doing was OK based on the issuance of the S-1.” She pointed out the SEC could have forced it to register as a securities exchange at the time.

Two steps forward one step back

Monochrome Asset Management has filed an application to offer a spot Bitcoin ETF on the Australian Securities Exchange in partnership with Vasco Trustees. It would offer direct exposure to Bitcoin without investors having to learn about wallets and keys. But National Australia Bank headed in the opposite direction this week, barring account holders from sending payments to certain “high risk” crypto exchanges including Binance. Westpac and CBA have already implemented similar blocks.

Celsius boss arrested

Alex Mashinsky, the former CEO of bankrupt crypto lender Celsius, was arrested on Thursday in New York a year to the day that Celsius filed for bankruptcy. He’s been charged with seven counts including securities fraud and market manipulation. Mashinsky pleaded not guilty and is out on US$40 million (A$58.7M) bail secured by his house and his brokerage account.

US Bitcoin futures premium

Chicago Mercantile Exchange Bitcoin futures are priced at a premium compared to international platforms, suggesting US-based investors are bullish about BTC’s future. Lucas Outumuro, IntoTheBlock’s head of research, said: “All major futures contracts expiring at the end of the quarter are currently in contango, being priced at a premium relative to spot markets. This premium has also been increasing (typically it reduces as the expiration date approaches), showing strong optimism in the market.” IntoTheBlock said the premium increased following the Ripple ruling. On Friday the vast majority of Bitcoin addresses were in profit on their positions, with just 20% underwater.

Until next week, Happy Trading!