In markets

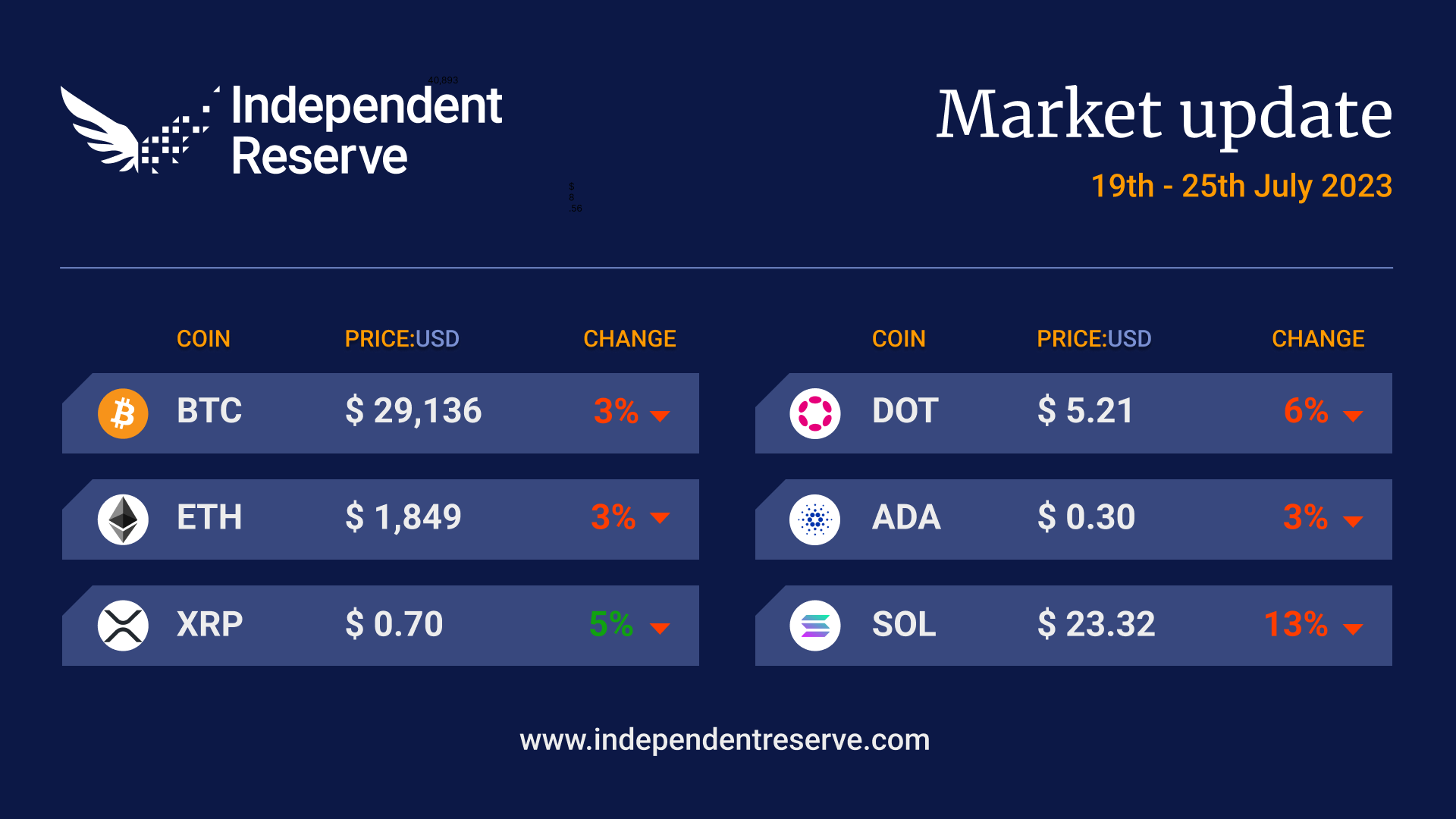

It’s been a fairly quiet week for Bitcoin, which has been trading just above, and just below, the US$30K mark. It’s currently trading around US$29,100, down 3% on seven days ago. Ethereum has been almost as dull, although the trend was slightly downward, and it finishes 3% down at US$1,849. XRP (-5%), Cardano (-3%), and Solana (-13%) all eased while Dogecoin traded flat. The Fear and Greed Index is at 50 or Neutral. It’s shaping up as an interesting week in finance and the economy more broadly, with Microsoft, Google, Visa and Meta all releasing earnings reports and a 25bps interest rate hike expected in both the US and the Eurozone. US GDP, jobs and personal consumption data come out, any or all of which could impact crypto markets.

From the OTC Desk

Cryptocurrencies will likely be driven by central bank policy this week. With the economic calendar scheduled to receive an influx of key data, short term interest rate markets remain near certain that on Thursday, the US Federal Open Market Committee y), and the European Central Bank, will both increase their underlying cash rates. For the FOMC (if delivered), the fed funds rate would be set to a new target band of 5.25-5.50% (currently 5.00-5.25%); for the ECB this would see the underlying cash rate move to 4.25% (currently 4.00%).

With a lack of specific cryptocurrency data, and the euphoria of the ‘ripple effect’ softening, front end funding appears to be weighing on the price of BTC and ETH. For the last few weeks, we have highlighted that imported disinflation from China had started to weigh on US bond yields (and in turn funding rates). This week, the trend of lower yields has stalled, with the US 10yr treasury up 6bps on the week, to trade at 3.86%. US 2yr bond yields have also moved higher, from 4.74% to circa 4.97%! As previously communicated, the outright level of US treasury yields will remain critical to risk asset pricing and the relative funding costs for cryptocurrencies.

In Australia, Q2 inflation data is scheduled to be delivered on Wednesday at 11:30am (AEST). The quarterly inflation series remains the most critical input to the 1st of August Reserve Bank of Australia (RBA) meeting. Historically, the RBA has placed additional weight on the ‘Trimmed Mean CPI’ (above ‘headline’). Currently, the market is forecasting a Q2 Trimmed Mean CPI (YoY) of 6%, relative to a Q1 reading of 6.6%. With Governor Philip Lowe concluding his appointment in September, Wednesday’s data may not just determine the outcome of the August RBA meeting, but also September, before Governor Lowe’s departure.

On the OTC desk, we are seeing increased activity in stable coin conversion back to AUD and USD. This is occurring mainly in USDT, although USDC also remains highly active. Interestingly, stablecoin volumes have remained particularly dependent on the outright level of the (relative) foreign exchange rate. With so many macroeconomic events occurring this week, stable coin/fiat trading is expected to remain elevated. This will remain an ongoing and interesting development for cryptocurrencies, and highlights an ever growing day-to-day application.

For any further information, please feel free to reach out.

In headlines

Crypto consumer protection rules

The Financial Stability Board (FSB) released a framework to supervise the cryptocurrency sector globally, allowing jurisdictions to implement varying controls on crypto assets. In Singapore, the Monetary Authority of Singapore (MAS) is already ahead with measures aligned to the FSB recommendations, including compliance with the Financial Action Task Force (FATF) Travel Rule. MAS also finalised risk management controls and will introduce customer protection, asset segregation, and custody measures for digital asset firms later in 2023. Policy convergence across jurisdictions is expected, but differences will remain based on individual market circumstances.

The Empire Strikes Back

The Securities and Exchange Commission has filed new documents in its case against Terraform Labs, and CEO Do Kwon that suggests: a) it thinks the decision in the Ripple case was wrong and b) that it’s likely to appeal it. The judgement in question found that XRP itself is not a security when traded on exchanges but it was a security when Ripple sold it directly to big investors. The SEC argues this fundamentally misunderstands the purpose of securities laws which are about protecting retail investors rather than more sophisticated investors. The Ripple decision did not set a precedent, and the SEC claims that “portions of Ripple were wrongly decided, and this court should not follow them… the underlying logic of the Ripple ruling is divorced from the basic principles behind Howey (test) and the federal securities laws more broadly.”

What me worry?

XRP supporting lawyer John Deaton says a potential appeal is nothing to worry about. He points out “it will be two years from now before a decision is issued by the second circuit” and notes that even a successful appeal would not necessarily see the SEC win its case that programmatic sales on exchanges are securities. In short, he says “don’t let anyone underestimate how significant this win is for XRP.” However, crypto critic John Reed Stark, formerly the chief of SEC internet enforcement, thinks the SEC is in with a shot to overturn the ruling and says that “an SEC victory on appeal in the second circuit is not at all unprecedented and could happen in the Ripple case.”

Crypto regulation #1

Democrat senator Jack Reed has introduced the Crypto-Asset National Security Enhancement and Enforcement (CANSEE) Act into the Senate. It aims to tighten Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations for DeFi platforms. This project would subject them to the same requirements as centralised exchanges and firms. It will put the onus for compliance on anyone who controls the project or if no controller can be identified, anyone who invested more than US$25M into it. The crypto industry by and large appears to dislike the bill in its current form.

Crypto regulation #2

House Financial Services Committee Chairman Patrick McHenry and House Agriculture Committee Chairman Glenn Thompson have introduced ‘The Financial Innovation and Technology Act for the 21st Century’. The act sets out the difference between digital securities and digital commodities and lays out the path to move from one to the other. It also establishes the Commodities Futures Trading Commission (CFTC) as the key regulator. Some members of Crypto Twitter seized on one provision in the bill that states non-accredited investors are not allowed to spend more than 10% of their annual income or net worth on digital assets… However that provision only related to initial token sales, and would not apply to buying and selling on exchanges or in DeFI.

Presidential hopeful would back USD with BTC

Democratic presidential candidate Robert F Kennedy (RFK) announced this week that he intends to partly back the US dollar with Bitcoin if elected. “Backing dollars and U.S. debt obligations with hard assets could help restore strength to the dollar,” he said. RFK also promised to eliminate capital gains taxes on Bitcoin to USD conversions. Kennedy has polled as high as 21%, but given is considered a huge long shot to win, not least because he appeals more to the right than average left-wing Democrats.

FTX plan to buy Nauru

The craziest scheme hatched in the ill-fated FTX empire has got to be Sam Bankman-Fried’s brother Gabriel’s plans to buy Nauru, so the team could build a bunker to survive the apocalypse and genetically enhance themselves. The insane plan was revealed in a bankruptcy court filing. Gabriel wrote that buying Nauru would enable them to get through “some event where 50%-99.99% of people die [to] ensure that most EAs [effective altruists] survive.” “Probably there are other things it’s useful to do with a sovereign country, too,” he noted.

Bits and pieces

Crypto Twitter is a bit upset about Elon Musk’s apparent plan to rebrand Twitter to X. Still, in true crypto fashion, a totally unrelated altcoin named ‘X token’ surged 1,800% on the news. The UK’s Financial Conduct Authority has announced its ‘Digital Sandbox‘ testing environment for innovative fintechs will be made permanent from August 1 and will be opened up to a broader range of startups. Telsa’s purchase of US$1.5B Bitcoin and subsequent sale of most of it, bookended the last bull run, and the good news is that they’re still hodling the remaining US$184M. There was brief excitement this week when a Twitter user thought they’d discovered that Bitcoin had been once again added to the payments section of the source code for the Tesla website. But further investigation revealed it was likely a hangover from the previous time. While Tesla quickly removed BTC after the publicity, it notably left Dogecoin in the code.

Until next week, happy trading!