In Markets

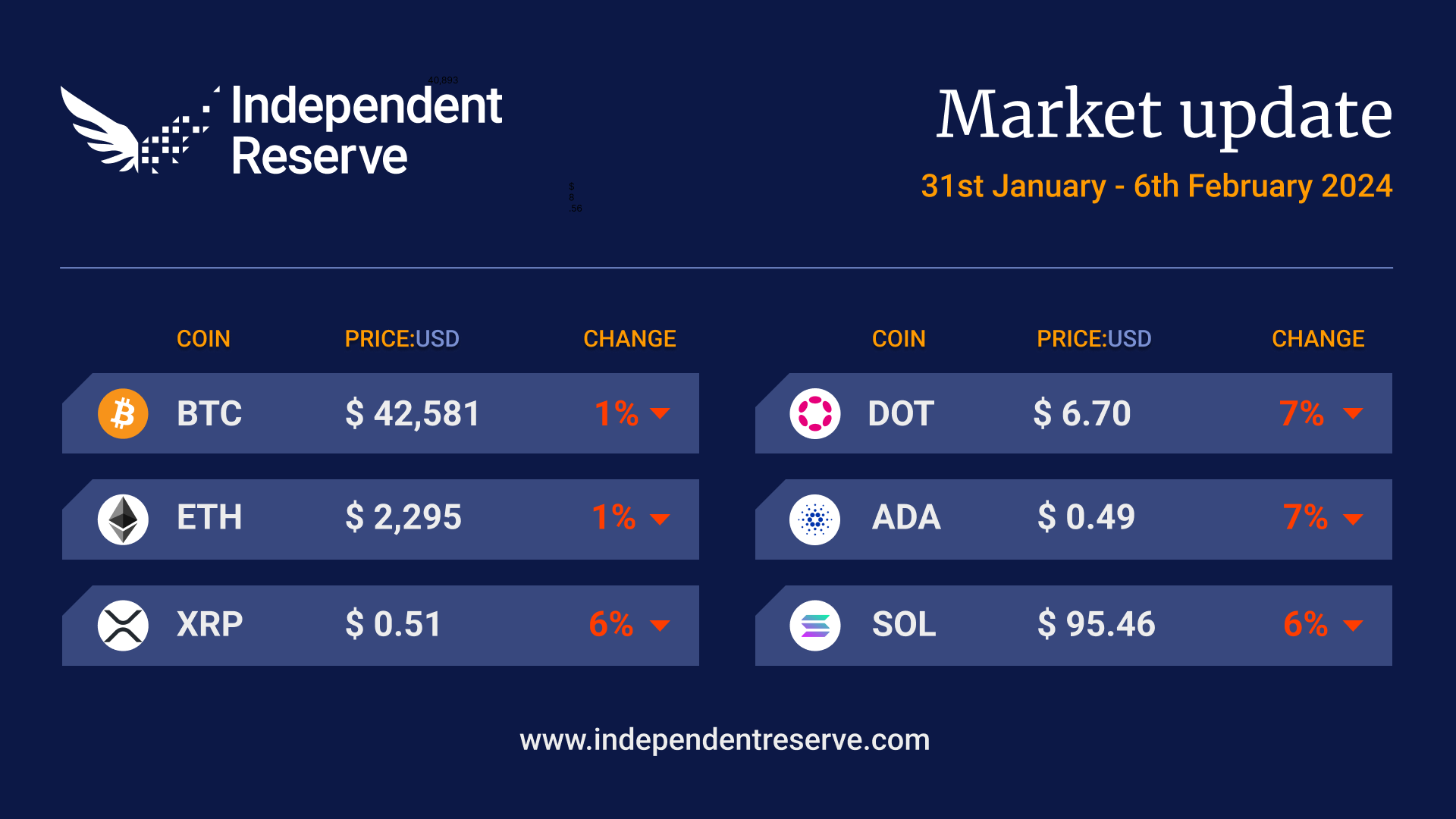

Bitcoin didn’t make any major moves this week and finished down 1.8% on seven days ago at A$65,700 (US$42,580). Ethereum eased down by 1.3% to trade at A$3,519 (US$2,287). Solana lost 7%, Ripple fell 6.4%, and the rest – Cardano (-7.1%), Avalanche (-5.5%) and Dogecoin (-5.3%). Traditional markets are doing well, with the ASX hitting a record high and interest rates expected to stay on hold at the RBA’s meeting today even though inflation has eased to 4.1%. There are undercurrents of danger however, with US Fed Chair Jerome Powell warning about “unsustainable” debt — the US now pays more on interest than defence — and the Chinese stock markets are in trouble. China’s CSI 1000 index fell 8% yesterday, and a third of stocks halted trading. The Crypto Fear and Greed Index is at 60, with markets growing more comfortable with the performance of the Bitcoin ETFs.

From the IR OTC Desk

Cryptocurrency activity this week has been somewhat quieter. This tends to be the case when the market is void of crypto-specific data. For now, cryptocurrencies continue to track broader macroeconomic themes.

While the euphoria of the ETF has not completely expired, it is slowly fading. Inflows/outflows remain well-tracked by market participants, with the net inflow proving to be reasonably stable. There remains an ongoing complication in assessing the net inflow data, caused by product switching. Quite specifically, Grayscale Bitcoin Trust (GBTC) holders have been aggressively moving into the lower-fee ETFs. It is estimated that the net inflow, taking the switching into consideration, has been net positive US$1.5bn to date (US$6bn of outflows from GBTC; US$7.5bn in ETF inflows). We continue to watch this space.

Last week, we highlighted the expectation that near-term pricing would be driven by macroeconomic data, and this has proven to be the case. US employment data remained particularly robust, with US job openings (JOLTS) moving back above 9 million and the unemployment rate holding 3.7%. On the headline, the US created 353k new jobs in January, significantly above the expectation of 180k. Importantly for the Federal Open Market Committee (FOMC), US wages (as expressed by Average Hourly Earnings) grew 4.5% YoY (Jan) versus 4.4% in December. This remains well above the 2% target Federal Funds rate.

At their February meeting, the US FOMC asserted a view that March would be too early to begin reducing the Federal Funds rate. While inflation has fallen for the last 11 months, the employment market remains near its maximum of the last 50 years. Chair Jerome Powell did highlight that the Committee are agreeable that there will be an appropriate time this year for the rate to be reduced.

With the FOMC forward guidance being notably different to the tradable forward yield curve, bond market pricing was quick to realign. The result being one of the largest two-day increases in US 10-year bond yields over the last 12 months. Historically, increasing bond yields have made it difficult for risk assets to perform, and this includes cryptocurrencies.

Today we hear from the Reserve Bank of Australia (RBA), who convene at their February meeting to opine on monetary policy. In a new format for the RBA, they will also hold a press conference post the interest rate announcement. While today’s decision seems moot, the market will closely monitor their forward guidance on inflation and the timing of any interest rate cuts.

On the OTC desk, USDT flow has materially increased. In general, the flow has been selling USDT back to AUD. As we assess this flow, we make note of some important inputs. 1) With the more hawkish stance of the FOMC, the AUD/USD has traded to a two month low. This makes USDT/AUD conversion more appealing. 2) USDC to USD redemptions are no longer at 1:1 in particularly large wholesale quantities. This has increased the trading activity on USDT. 3) Much of the activity may relate to hedging flow before Chinese New Year, which is scheduled to begin on the 10th of February. These three factors have all contributed to USDT/USD trading sub par during the Asian trading day. We will continue to monitor USDT trading activity closely.

For any further information, please feel free to reach out.

In Headlines

Bitcoin ETFs performing well

Although the Grayscale Bitcoin Trust is still losing up to US$255 million (A$393M) a day, the nine new Bitcoin ETFs have been taking even more money in. For six days in a row since January 26, inflows have been positive into the Bitcoin ETFs overall, totalling US$714.6 billion (A$1.1B). Bloomberg ETF analyst Eric Balchunas said it was “really something to see”: “Typically there’s slow decline after big hyped launch. Strong week 3 (and inflows every single day) shows these ETFs have legs.” BlackRock and Fidelity’s Bitcoin ETFs were in eighth and tenth place for net inflows out of all 3,100 ETFs in the US in January. You can keep up to date with the latest (provisional) numbers here.

Celsius out of bankruptcy

Collapsed crypto lender Celsius has exited bankruptcy and is in the process of returning around US$3 billion (A$4.6B) worth of crypto and fiat to creditors. The news comes 18 months after it was forced to suspend withdrawals. It will be closing its website and app and transforming into a crypto mining company.

Genesis to liquidate $1.6B of Grayscale holdings

Another collapsed crypto lender Genesis has applied for permission to liquidate US$1.6 billion (A$2.46B) worth of shares in GBTC (US$1.4B/A$2.15B) and Grayscale’s Ethereum and Ethereum Classic Trusts. There’s disagreement about the impact on markets. Framework Ventures founder Vance Spencer says it will be distributing ‘in kind’ and will need to swap GBTC for Bitcoin. However, Matt Houghan the CIO of Bitwise thinks “it’s unclear” from his reading of the paperwork if that’s how it will play out but he added “I think market can absorb these sales.”

Token unlocks

Holders of Optimism, Avalanche, Aptos and The Sandbox may experience some volatility with US$900M (A$1.4B) worth of token unlocks occurring this month. When tokens are initially distributed to VCs, team members, and influencers, they’re locked up for a period to prevent dumping, but this just kicks the can down the road a bit. Around 9.5 million Avalanche tokens, 24.8 million Aptos, 209 million Sandbox tokens and 24 million Optimism tokens are set to be released into the wild.

AI outsmarts KYC checks

AI is about to disrupt KYC verification checks across the board, after a reporter was able to use an AI service to create $15 fake IDs in minutes able to fool online KYC verification checks. Director of Research at Coin Center Peter Van Valkenburgh said, “This is NOT a crypto problem. Every institution, crypto or traditional is about to face massive ID fraud because of AI. Crypto is, in fact, the only solution,” he said, referring to blockchain-based ID verification systems. Blockchain-based verification and provenance is also being trialled to prevent AI-created fake news and deep fakes, and some think the use case could end up being blockchain’s killer app.

Ripple chair loses 213M XRP

Hacks are so commonplace they’re barely noteworthy any more, but Ripple chair Chris Larson made a splash after losing 213 million XRP this week, according to ZachXBT. The funds are from Larson’s personal stash (he has around 5 billion XRP in total), and the attackers attempted to launder the funds through six different exchanges. “We were quickly able to catch the problem and notify exchanges to freeze the affected addresses,” Larsen reported. “Law enforcement is already involved.” In other XRP news, the SEC has won a motion compelling Ripple to produce its financial statements for 2022-2023. The SEC is pursuing Ripple over XRP sales to institutional clients, which Judge Analisa Torres previously determined fit the criteria for securities.

Where to next?

Analytics platform Decentrader predicts that Bitcoin will trade sideways for another month before markets pick up by the second week of March in the lead-up to the Halving in April. CEO Filbfilb sees “some additional fomo towards the $49k [A$75.6K] level followed by a sell-the-news event again.” He expects Bitcoin to then take around 220-240 days to hit a new all-time high following the halving in line with historical trends. Separately, Capriole Fund founder Charles Edwards posted that “If Bitcoin’s post Halving returns are the same as 2020, we are looking at $280K [A$432K] Bitcoin next year.”

Bits and pieces

Ethereum Name Service has reached an agreement with GoDaddy allowing users to link internet domains to their ENS addresses for free. GoDaddy is the largest internet domain registry and plans to integrate similar services from other chains. OPNX, the bankruptcy claims trading platform set up by the disgraced founders of bankrupt Singapore fund Three Arrows Capital, is closing down this month. Tether is now raking in more money per quarter than Goldman Sachs, with a record-breaking quarterly net profit of US$2.85 billion (A$4.39B). It has total assets of US$97 billion (A$150B), with about US$5.4 billion (A$8.3B) of excess reserves, which it says fully cover outstanding loans. Goldman Sachs made US$2.01 billion (A$3.1B) last quarter.

Until next week, happy trading!