In Markets

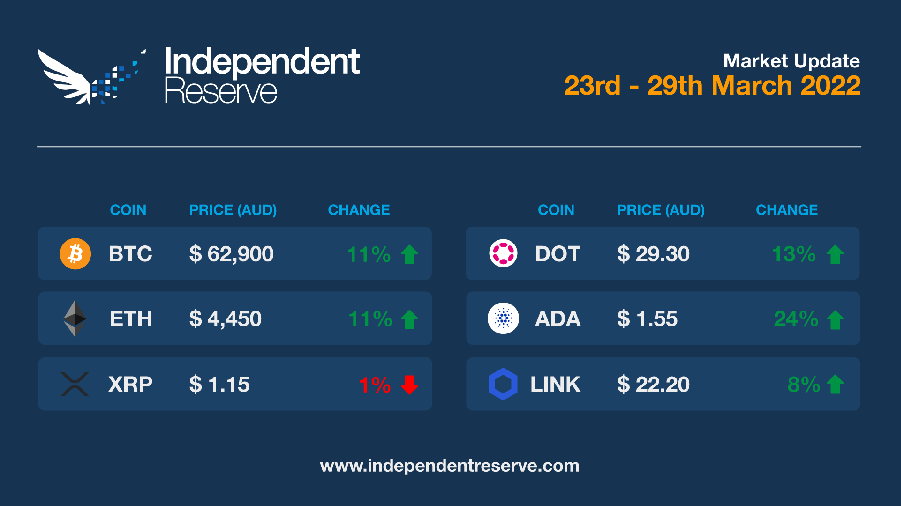

Normal service has resumed, with Bitcoin now up by 35% since Russia’s invasion of Ukraine tanked markets in February. Analyst Will Clemente observed: “Bitcoin has closed above short term holder cost basis for the first time since Dec. 3. Hard to be bearish as long as BTC is above.” Tether just printed 1 billion USDT in four days, Ethereum gas fees for DeFi transactions are back around US$20 (AU$27) and memecoin insanity has returned because of course there’s already a Will Smith slap token and a DAO. The BTC price is up a whopping 11% since this time last week and currently sits at around AU$63,000 (US$47,100). Analysts who were bearish recently, are now talking about a new all time high. Ethereum gained 11% and is trading around AU$4,500 (US$3.3K), XRP was flat, Cardano added 24% and Polkadot was up 13%. The Crypto Fear and Greed Index is at 60, or Greed, for the first time in March.

From the IR OTC Desk

The risk-on sentiment in US equity markets has (for the time being) reduced risk asset caution over the Russian/Ukraine conflict. This has translated into a favourable week for cryptocurrencies, with BTC now trading positive for the year (up over 5% last weekend alone!). The 200 DMA now appears within reach for BTC, hovering around US$48,700 – and will likely form a point of resistance in the near term.

From a monetary policy perspective, Federal Open Market Committee (FOMC) President Jerome Powell continues to be tested by the US bond market. 5yr Treasury notes, through the primary dealer auction process, are trading near 100bps higher on the month, to record a yield of 2.543%. Additionally, the spread between the 2yr and 10yr Treasury have inverted – the first time since 2019. In a clear sign of divergence between FOMC front end monetary policy, and the sustained concern of inflation, expectation of a 50bp increase at the 3-4 May FOMC meeting now appears to be ‘locked in’. Time will tell whether this remains the case as we get closer to the decision date.

In the US this week, key data points include Core Personal Consumption Expenditure Price Index Data (Core PCE) and Non-farm payrolls (Thursday and Friday respectively). For Australia, the incumbent Federal Treasury is set to release their pre-election budget this evening, 29th March. It is expected that shortly after this budget release, an election date will also be announced. Continue to watch this space.

On the OTC desk, cryptocurrencies have focused on two ongoing market events 1) the Ethereum merge and 2) UST’s (Terra) conversion from being an algorithmic stable coin to a partially BTC backed stable coin (more on this below). Previously we have highlighted the importance of ETH/BTC as a leading indicator of alt coin outperformance. This week, despite the sideways trend in ETH/BTC, positive market sentiment has only continued. Over the course of the month, NEAR, DOT, ADA and LUNA have all outperformed ETH (to be up more than 25% on the month). The broader market sentiment appears to correlate nicely to the announcements and actions of the Luna Foundation Guard, and their daily purchases of BTC. The quantum and timing of these daily purchases continues to be something we are closely monitoring. We continue to see good buying interest in both BTC and ETH – we are also seeing very strong interest in UST (Terra), SOL, and USDT as staking pairs.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

DApps all folks

Cardano founder Charles Hoskinson admitted that the DApp rollout for the blockchain had not gone as predicted. “Remember when I predicted thousands of assets and DApps on Cardano? Well I was wrong, there are now millions of native assets issued and DApps are now in the hundreds. #SlowAndSteady,” he tweeted. In actual fact, he predicted in mid-2020 that by 2021 there would be “hundreds of assets and thousands of DApps” on Cardano. While there are a few million assets thanks to NFT minting platforms DeFi Llama shows just seven DApps are operational. However Hoskinson believes that hundreds of DApps – Cardano Cube shows 579 in development – are waiting for the Vasil hardfok in June to launch. In other Cardano news, the Milkomeda Foundation has announced the launch of C1, which is an Ethereum Virtual Machine compatible side chain that allows Eth DApps to connect to the network.

Cardano’s TVL growth throughout 2022 | Defi Llama

Bitcoin ETFs next year

Could spot Bitcoin ETFs finally get approved in the US in mid-2023? That’s what Bloomberg ETF analysts Eric Balchunas and James Seyffart are tipping, based on a proposed change to the Exchange Act that would bring crypto exchanges inside the tent to be compliant with the Securities Exchange Act, making their investment vehicles more acceptable to the SEC.

Thailand bans crypto payments

Thailand’s Securities and Exchange Commission has banned the use of crypto for payments, citing price volatility, cyber theft, money laundering, and personal data leakage. An announcement on the changes was not all bearish, adding: “However, the BOT [Bank of Thailand] and the SEC, as well as other government agencies, recognize the benefits of technologies behind digital assets such as blockchain and value and support the use of technology to further innovation.”

Bitcoin price support #1

US Treasury Secretary Janet Yellen says that while she remains a teensy bit sceptical on crypto due to things like consumer protection, financial stability and illicit transactions, she sees a big upside too. “There are benefits from crypto and we recognize that the innovation in the payment system can be a healthy thing,” she told CNBC. “We would like to come out eventually with recommendations that will create a regulatory environment” for healthy innovation, she said. Meanwhile the noticeably less friendly SEC has dreamed up a new vector of attack, with a proposed redefinition of ‘securities dealer‘ to include crypto platforms, which some fear could cripple DeFi.

Bitcoin price support #2

The Luna Foundation Guard (AKA the Terra blockchain) has raised US$2.2B (AU$2.93B) to create a Bitcoin reserve and has reportedly been buying in daily lots of $125M (AU$167M). It has more than US$1.3B (AU$1.74B) in its wallet and has a goal of reaching $3B (AU$4B) in collateral supporting its UST stablecoin. Terra co-founder Do Kwon has even talked about a long term goal of amassing $10B (AU$13.3B) in bitcoin reserves.

Bitcoin price support #3

A throwaway line about Russia being happy to accept Bitcoin for oil rather than USD, got wall to wall mainstream media coverage everywhere from the BBC to News.com.au. Pavel Zavalniy, Chairman of the State Duma Committee on Energy said during a press conference: “We have been proposing to China for a long time to switch to settlements in national currencies of rubles and yuan. With Turkey, it will be lira and rubles. The set of currencies can be different, and this is normal practice. If there are Bitcoins, we will trade Bitcoins.”

UK crypto regs to be OK

The UK’s new crypto regulations are set to be announced in the coming weeks and “people familiar with the matter” are suggesting they’re relatively crypto friendly. Treasury officials have shown a willingness to learn about the crypto market and have consulted widely on the rules. Over in the US, one potential reason the White House has been friendlier towards crypto of late can be seen in the 2023 budgets which shows $10.9B (AU$14.5B) in additional revenue over the next decade from modernising tax rules around crypto.

Merging searches

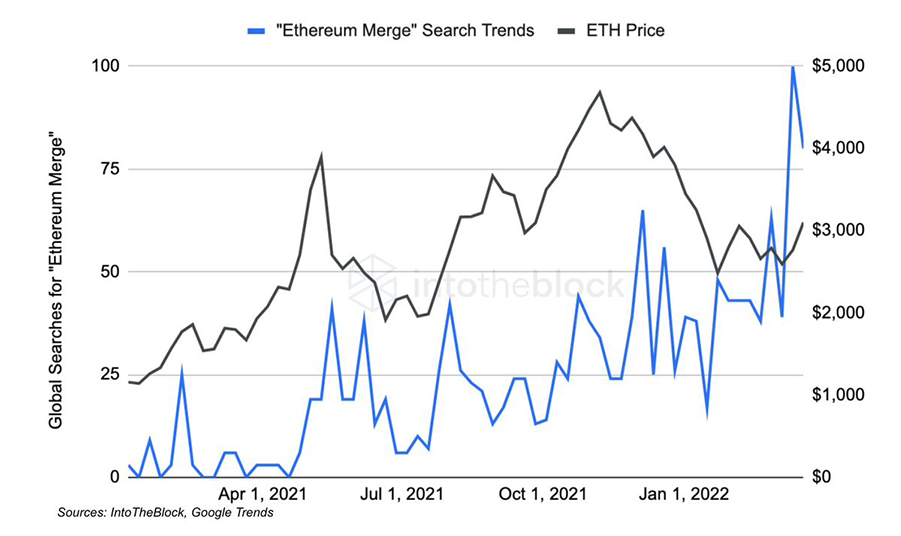

Following the successful Kiln testnet trial of The Merge, the number of google searches for ‘Ethereum Merge’ has hit an all time high. Canadians are most interested, followed by Australians and then Americans. The Merge is when the network switches to Proof of Stake, which is 99.9% more power efficient and is expected to make Ethereum deflationary , which various proponents have suggested is a bit like a Bitcoin block reward halving on steroids, or a ‘triple halving‘.

Ethereum Merge search trends | IntoTheBlock

ExxonMobil utilises excess natural gas to power crypto mining

Oil and gas behemoth ExxonMobil has reportedly been running a pilot program focused on using the energy from excess gas to power crypto mining rigs. In a recent Bloomberg report, ExxonMobil has partnered with Crusoe Energy to use excess gas from oil wells in North Dakota to run Bitcoin miners. The project reportedly uses 18 million cubic feet of natural gas per month (about 0.4% of the oil giant’s reported operations in the state) – which produces 158 million cubic feet of natural gas each day. The program is now considering expanding to Nigeria, Argentina, Guyana, and Germany.

Until next week, happy trading!