In Markets

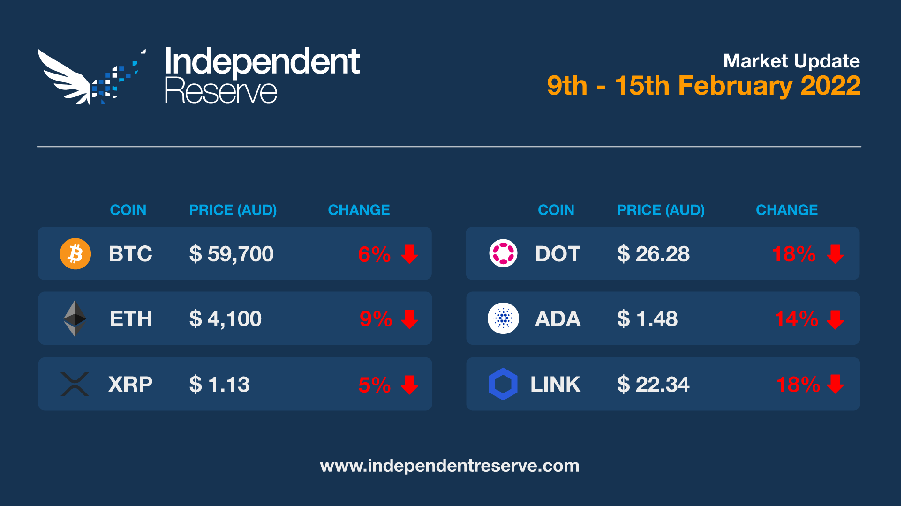

After an all too brief spell of fine weather last week, normal service has resumed, with Bitcoin falling 5.6% this week to trade around AU$59,700 (US$42.6K). Ethereum fell 9.2% to AU$4,100 (US$2.9K), while XRP was down 5.3%, Cardano (-14%), and Polkadot (-17.6%). The falls in crypto markets mirror falls in traditional markets which most blame on mounting fears of an imminent Russian attack on Ukraine. After hitting a local high of 54, the Crypto Fear and Greed Index has again fallen to 46 (Fear). In more promising news the Bitcoin hashrate has hit a new seven day average all time high of 201.3 terahashes per second (TH/s). It’s up 20% since the start of the year and peaked at 248 TH/s in the past 24 hours.

From the IR OTC Desk

Last week’s US inflation release continued the theme of accelerating inflation. The US inflation rate YoY (Jan) came in at 7.5% on the headline, and 6.0% for the core inflation YoY (Jan) – well above the Federal Reserve’s 2% inflation target. St. Louis Fed President James Bullard (a voting member for 2022), mentioned to CNBC that the Fed’s credibility is now ‘on the line’, as he called ‘100bps of movement on the policy rate by July 1’. With the Fed Fund futures markets now tilting towards a 50bp increase at the March meeting, the scheduled 16 March 2022 FOMC meeting date continues to feel a long way away.

Late Friday afternoon, the Federal Reserve announced a Closed Board Meeting for February 14th prompting speculation of an intra meeting rate adjustment. So far the details of the closed meeting remain unclear, however the underlying cash rate remains unadjusted with several FOMC members confirming that moves between meeting dates are reserved for ‘emergencies’. Interest rate policy updates, as well as any change to the Russian/Ukraine foreign relationship will continue to prove key.

On the OTC desk, the global macro landscape, and lack of outright market direction has resulted in increased stablecoin flow this week. This may be the derivative flow of DeFi staking and NFT gameplay – which have certainly been hot topics. The correlation between BTC and US tech stocks appears to have broken down (at least in the short term), although US Federal Reserve and Russian/Ukraine headlines have capped any material rally on the week. From our wholesale market makers, we are hearing of more sell side pressure in BTC and ETH during the Asian session, and more buy side pressure during US hours – although we are not seeing this directly. Last week we highlighted that ETH/BTC has historically provided a strong signal for altcoin direction. On the week, ETH/BTC has traded flat and within a narrow range, symptomatic of muted attention into the alt sector in general.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Bifinex hack arrest

A terrible comedic rapper with a bizarre online presence and her husband have been arrested in connection to the 120K of Bitcoin (worth AU$5.13B) stolen a few years ago in the Bitfinex hack. While Crypto Twitter seems to think Ilya Lichtenstein and his wife Heather Morgan were the hackers responsible, the DoJ has charged them only with laundering the funds. Netflix has already announced a documentary series about the “married couple’s alleged scheme to launder billions of dollars worth of stolen cryptocurrency in the biggest criminal financial crime case in history.”

Crypto bull case

Happy days will be here again soon according to FSInsight which predicts in a new report that Bitcoin could hit US$222K (AU$311K) and ETH could reach US$12K (AU$16.8K) by the end of the year. That’s an increase of five times and four times respectively. The “Digital Assets in A Post-Cycle World” report bases its rationale in part on a lack of frothy price action this cycle and the fact 75% of the supply is illiquid. “The current supply dynamics can best be described as a powder keg. The question remains who lights the match,” says the uber bullish report.

Crypto bear case

The bear case outlined in the Wall Street Journal this week is that Bitcoin could crash to as low as US$10K (AU$14K) as a result of the US Federal Reserve tightening monetary policy. Barry Bannister, chief equity strategist at Stifel investment bank said, “When the Fed is tight, Bitcoin isn’t the best place to be,” and he tipped the bottom will hit in 2023. His theory is based on historical trends – when the Fed lowers interest rates and prints money Bitcoin does well, but when those policies reverse (which is happening now) so too does the Bitcoin price.

Ethereum bull case

Morgan Stanley strategist Denny Galindo believes that Ethereum may end up with a larger market than Bitcoin. Galindo’s report highlights Ethereum’s use cases in terms of NFTs and DeFi according to Barron’s. Interestingly he points out that “since December 2018, Ethereum has been nearly twice as correlated to the S&P 500, at 0.26, versus 0.14 for Bitcoin” which means investing in ETH “might actually make a portfolio more correlated to equities.”

Gas fees fall

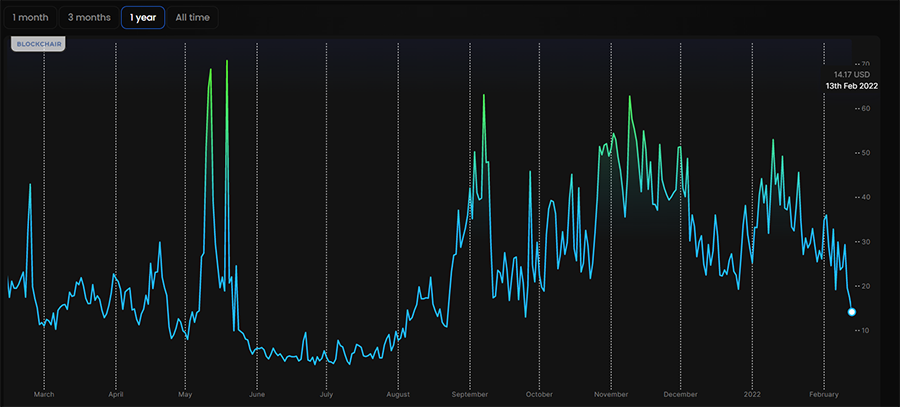

Ethereum’s gas fees are still expensive, but they’re 73.3% less expensive than they were in January, when the average fee hit US$53.03 (AU$74). Data from Blockchair suggests the average fee of $14.17 (AU$20) and the median fee of US$5.67 (AU$8) are at the lowest point since September 2021. The lower fees come amid declining transactions, with a 60.4% drop in the space of a month. Addresses holding more than 1,000 ETH have fallen to their lowest point since 2018, indicating whales might be unwinding their ETH positions.

Average transaction fees on Ethereum | Blockchair

Blockchain Week

The first speakers have been announced for Blockchain Australia’s Blockchain Week, starting March 21. The first day’s topic “the mainstream moment” will feature FTX CEO Sam Bankman-Fried alongside Financial Services Minister Senator Janet Hume and Independent Reserve CEO Adrian Przelozny. Other big names appearing during the week include Animoca Brands chair Yat Siu and Messari CEO Ryan Selkis.

Metaverse

Consulting company Gartner thinks that a quarter of the population will be spending at least an hour a day in the Metaverse by 2025. Its new report also estimates that 30% of the world’s organisations will have a presence in the Metaverse within the next four years. McDonalds has just applied for 10 trademarks for a virtual restaurant that offers home delivery in the real world and for virtual concerts to be held in a McCafe. YouTube is also embracing NFTs and Web3 according to a blog by chief product officer Neal Mohan who said creators could tokenise videos to sell them to fans.

Crypto industry booming

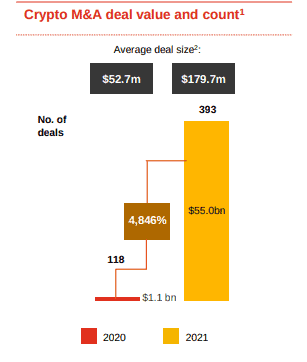

PwC reports that crypto mergers and acquisitions soared by an incredible 5,000% in 2021 to US$55 billion (AU$77B) up from just US$1.1B (AU$1.54B) the year before. Crypto fundraising rounds increased 645% to US$26.3B (AU$36.9B) with the average amount raised up 143%. There are now almost 500 VC firms operating in the space.

Crypto M&A Deals. Source: PwC

Crypto investments rose 13x in Singapore last year

This year, Singapore regulators are vehemently focusing on speculative digital assets, with KPMG still forecasting that crypto investment in the nation-state will remain strong throughout. The number of crypto-related investments in Singapore increased tenfold last year, with US$1.48 billion invested into the market, up from US$110M in 2020, according to KPMG’s Pulse Of Fintech report.

The report also highlighted that Asia-Pacific’s fintech investments hit a record high of US$27.5 billion in 2021, with total funding surpassing US$17.4 billion in the second half alone. In 2021, venture capital funding also rose to US$19.6 billion from US$11.5 billion in 2020. This increase is partly due to the government’s efforts to stimulate the capital market by establishing a special-purpose acquisition company (SPAC) listing framework – making the country a more viable choice for fast-growing firms and unicorns to go public.

Until next week, happy trading!