In Markets

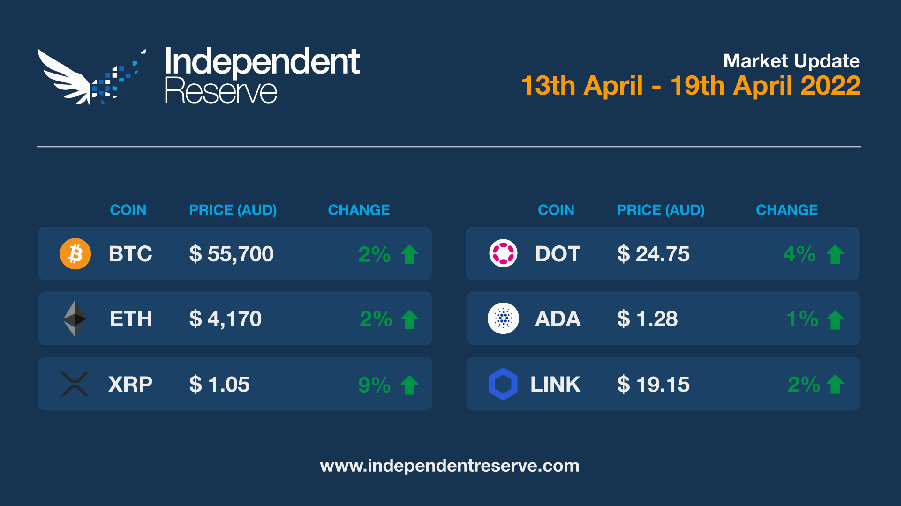

In the absence of a clear overall bullish or bearish narrative driving the Bitcoin price firmly up or down, the price has been meandering above and below the US$40K mark (AU$54.4K) for most of 2022. Bitcoin dropped below that level a few times this week, but finished up 2% to US$41K (AU$55.7K). Ethereum was up 2% to just over US$3K (AU$4,100). Promising signs in the SEC case against Ripple helped XRP to gain 9%, Cardano was flat and Polkadot gained 4%. The Fear and Greed Index is at 24, or Extreme Fear.

From the IR OTC Desk

Last week’s US inflation data proved critically important to the price action of US bonds, equities and in turn cryptocurrencies. The Inflation Rate (YoY) Mar printed at 8.5% (verse 7.9% in February): the Core Inflation Rate (YoY) Mar printed at 6.5% (verse 6.4% in February). In a telling sign that inflation remains of critical concern, Producer Prices showed their biggest increase (to 11.2%) since the current Producer Price Index started to be reported in November of 2010! It must be noted that ‘core’ inflation remains the most critical input for the Federal Open Market Committee (FOMC)’s monetary policy decision making – and while headline inflation and producer prices continue to move aggressively higher, some comfort would have been gained by the lesser increase in the Core. US short term interest rate futures are currently pricing in a 48 bp hike in the federal funds rate at the upcoming 5th of May meeting; US bond yields remain at their three-year highs; the USD sits at a two-year high! Watch this space.

In Australia, labour market data delivered an unchanged Unemployment Rate (Mar) of 4%. Today we receive the critically important Reserve Bank of Australia (RBA) meeting minutes – which will likely deliver further detail on the change in language delivered at the RBA’s April meeting, removing the word ‘patient’. Of additional interest to the RBA, the Reserve Bank of New Zealand (RBNZ) and the Bank of Canada (BoC) both increased their respective cash rates by 50bp last week. This moves the RBNZ cash rate to 1.5% and the BoC cash rate to 1% – Australia remains at 0.10%. The policy movements of the RBNZ and BoC have always been closely watched by Australian market participants due to the similarity in the underlying structure of the economies.

On the OTC desk – ETH, SOL, LUNA and BNB delivered the dominant flow on the week. ETH/BTC continues to move sideways, currently trading at 0.07500. Stable coin accumulation has taken a momentary breather, and while we are still regularly asked about yield earning strategies, the usual right hand side flow in high yielding coins didn’t materialise this week. With so much now baked into the macroeconomic cake, we focus this week on the correlation between cryptocurrencies, US equities and US bond market pricing. Perhaps this is the week we will start to see some decoupling of correlated price movements.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Doge to the moon

Robinhood CEO Vladimir Tenev explained on Twitter this week how Dogecoin (DOGE) could become the “future currency of the Internet.” The fees are already cheap enough, he said, so faster block times and bigger blocks – increasing the size from 1MB to 1GB – would do the trick. Doge fans loved the idea, but others pointed out that if you could scale blockchains that easily everyone would have done it already. Synthetix founder Kain Warwick said “This just in: Guy who loves databases wants to turn memecoin into a database.”

Don’t call it a delay

There was a lot of talk this week about The Merge being delayed to a few months after June. The Merge of course refers to Ethereum’s long awaited move to Proof of Stake. But as one Aussie Ethereum dev pointed out, The Merge has never been delayed because it’s never actually been scheduled in with a firm date. The good news, according to developer Tim Beiko, is that despite this lack of a date “we’re definitely in the final chapter of PoW on Ethereum.” There was very little price response to the “delay” news suggesting it was expected and already priced in.

Ripple CEO: SEC case is going ‘much better than I hoped’

Ripple CEO Brad Garlinghouse told attendees at Paris Blockchain Week that he is increasingly hopeful Ripple will successfully defend itself against the SEC’s case against it for selling unregistered securities. “The lawsuit has gone exceedingly well and much better than I could have hoped when it began about 15 months ago,” he said. Ripple scored a win earlier in the week when a judge denied the SEC’s attempts to privilege internal documents relating to former SEC director William Hinman’s famous 2018 speech where he specified that Bitcoin (BTC) and Ether (ETH) are not securities. A win for Ripple would be a win for the entire industry as it would limit the SEC’s ability to pursue other crypto companies and protocols on similar charges.

MacroBitcoin

MicroStrategy is the world’s largest holder of Bitcoin (if you exclude a few large exchange wallets) with 129,218 BTC, according to wallet tracker Bitcoin Treasuries. Those coins are currently valued at about AU$7.2B. MicroStrategy bought 4,197 more coins on April 5. In a letter to shareholders this week CEO and majority owner Michael Saylor said they can’t stop, won’t stop buying BTC. “In addition to our long-standing corporate strategy to grow our enterprise analytics software business, our parallel strategy to acquire and hold Bitcoin has been a tremendous success. We will continue to vigorously pursue both strategies,” he wrote.

Striking Terra in unbelievers

Terraform Labs (TFL) has gifted the Luna Foundation Guard (LFG) 10 million LUNA, worth around US$820 million (AU$1.1B). Given founder Do Kwon intends to amass US$10 billion (AU$13.6B) worth of Bitcoin (BTC) to back UST’s reserves — many expect that some of the funds will go toward buying Bitcoin. Some of it may also be burned.

Exchange definition

The top Republican on the House Financial Services Committee, Patrick McHenry, and the top Republican on the Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets, Bill Huizenga have penned a public comment letter expressing concerns with the SEC’s proposed redefinition of “exchange”. They’re concerned it will expand the SEC’s jurisdiction over DeFi and “stifle innovation and harm market participants.” The wider crypto industry is also concerned the redefinition is so broad it would define blockchain networks and “communications protocols” as securities exchanges. Coin Center wrote a long and detailed analysis of why the redefinition is a terrible idea and probably unconstitutional, and Consensys and Delphi Digital have also taken aim at it.

Backup is the problem

iOS MetaMask wallet users have been warned by the company to immediately turn off iCloud backup for the app as the backups include their password-encrypted MetaMask vaults. “If your password isn’t strong enough and someone phishes your iCloud credentials, this can mean stolen funds,” MetaMask tweeted.

Zone of heavy opportunity

Blockware Solutions analyst Will Clemente says that BTC is in the “zone of heavy opportunity” based on his analysis of Glassnode data. “This is also the longest time Bitcoin has ever spent in the zone,” he added. Another analyst Dave the Wave thinks Bitcoin has a shot at hitting US$135,000 (AU$183K) next year, while Real Vision founder Raoul Pal pointed out on a podcast this week that despite two years of the pandemic, a major war, and rising inflation Bitcoin hasn’t hit a new low which he said “usually that’s a signal that the market has found its bottom.” He’s also a big fan of Terra buying up Bitcoin as a reserve asset. “This is the start of people using Bitcoin as the collateral layer,” adding “We’ll definitely see sovereign wealth funds owning Bitcoin because it’s a long duration savings asset.”

Bitcoin in the zone of “heavy opportunity” | Will Clemente, Blockware Solutions

Until next week, happy trading!