In Markets

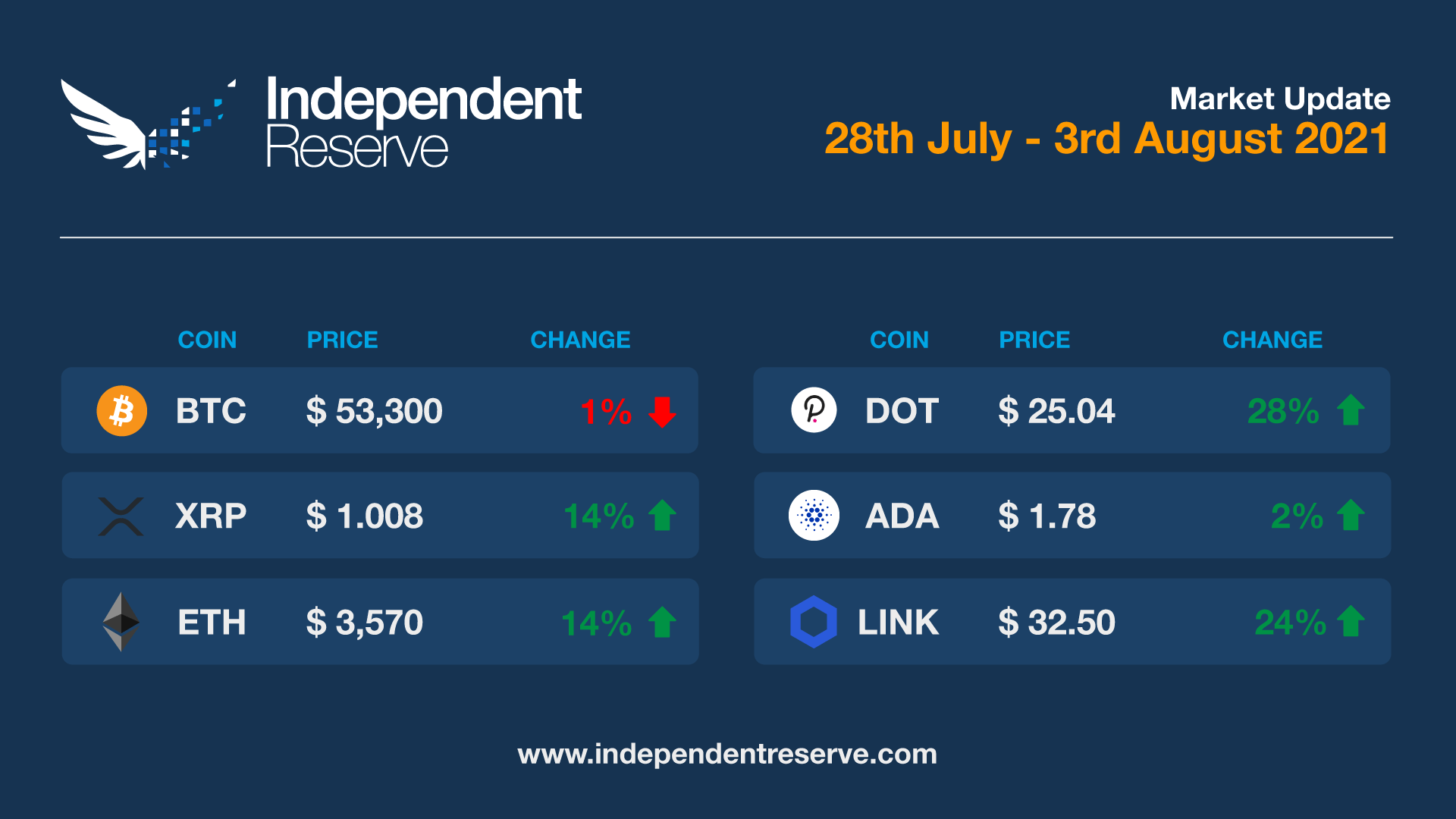

After bottoming out just above A$40K (US$29K) on July 21, Bitcoin rose for ten days in a row, its longest winning streak in eight years. It peaked above A$57,000 (US$42K) yesterday but the price pulled back overnight to around A$53,500 (US$39K). It’s up 5% for the week. Ethereum posted 12 straight days of green for the first time ever and is currently up 17.2% for the week to trade just under A$3600 (US$2.6K). Dogecoin was flat but everything else was up: Cardano (3.9%), Ripple (18.6%), Polkadot (29.9%), Uniswap (20%), Chainlink (30.3%), Bitcoin Cash (13.1%), Litecoin (7.6%), Stellar (5.5%), Aave (5.5%) and Synthetix (1.2%). The Crypto Fear and Greed Index briefly returned to ‘greed’ yesterday for the first time in three months, and is currently at 48, or ‘neutral’.

In Headlines

The most bullish news of 2021

The number of crypto users doubled in the first half of the year to more than 220 million. The user count started from 100 Million in January to 221 Million in June. For comparison, it took nine months for the number of global crypto users to reach 100 million from 65 million. Even more impressive when you consider that attracting the first 100M users took more than a decade. Founder of 10T Holdings Dan Tapiero wondered if the news meant we might see “a billion people using crypto by 2023?”

Singapore regulators approve of Independent Reserve

Independent Reserve has become the first firm to receive in-principle approval from the Monetary Authority of Singapore to operate as a regulated provider of Digital Payment Token services. CEO Adrian Przelozny said the approval was “a reflection of the robustness of the policies, procedures and risk management systems that we have put in place to guide our day-to-day operations,” adding that customers should feel secure in the knowledge “their chosen platform has passed the scrutiny of a world-class regulator.”

Forking hard or hardly forking?

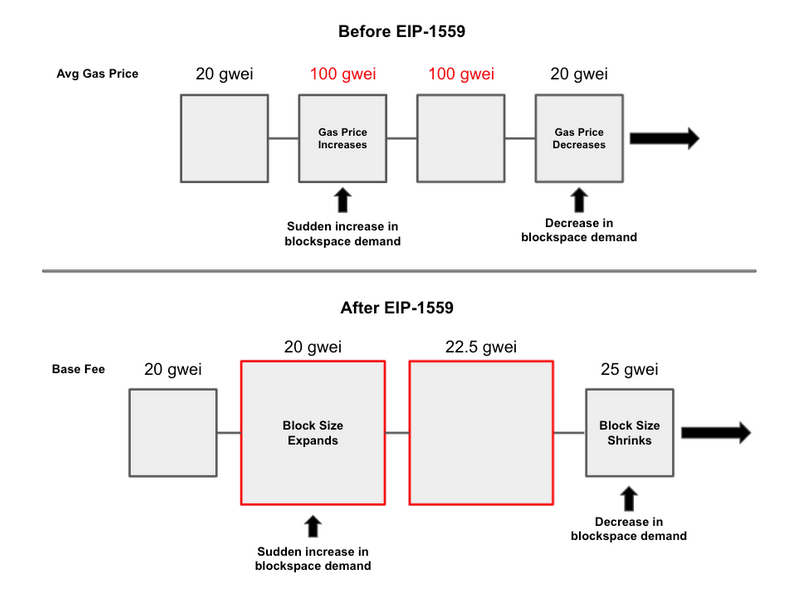

Independent Reserve will disable ETH and ERC-20 token deposits and withdrawals from Thursday at 8AM AEST for about 24 hours for the London hard fork. At block 12,965,000, the fork will go live, deploying five Ethereum Improvement Proposals. The most notable is EIP-1559 which will make gas fees more predictable, and potentially make ETH deflationary by burning fees. Deflation won’t happen immediately though, as gas prices would need to stay above 150 gwei consistently to see more ETH burnt than issued. However, after ETH switches to Proof of Stake that requirement falls to just 20 gwei. In related news, Ethereum miners brought in more revenue than Bitcoin miners in July for the third month in a row, US$1.03 billion (A$1.4B) to US$971.8M (A$1.32B).

Macro Bitcoin Strategy

MicroStrategy’s quarter two results saw revenue up 13.4% to US$125.4 million (A$170.2M). The vagaries of accounting rules meant MicroStrategy had to report an ‘impairment loss’ of $424.8M (A$576.7M) on its Bitcoin holding for the quarter. The report however shows that it has made almost a billion dollars profit on paper from Bitcoin and the 105,085 Bitcoin it bought for $2.74 billion (A$3.72B) is now worth $3.65 billion (A$4.95B). CEO Michael Saylor says the company will be buying more in future.

Square after Afterpay

The big sharemarket news of the week was Jack Dorsey’s Square announcing it is buying Australian fintech Afterpay for $29 billion ($39.4B). Square’s second quarter results show its users bought $2.72 billion (A$3.69B) of Bitcoin and it made $55M (A$75M) profit from the transactions. The company reported an impairment loss of $45 million (A$61M) on its own BTC reserves.

PayPal’s crypto rollout continues

Paypal will be rolling out its crypto “super app” soon and also will switch on crypto purchasing in the UK in the next month or so. The company is also making noises about embracing DeFi. “How can we use smart contracts more efficiently?” CEO Dan Schulman asked on an earnings call this week. “How can we digitize assets and open those up to consumers that may not have had access to that before? There are some interesting DeFi applications as well. And so we are working really hard.”

Mutual funds – check. How about ETFs?

Launching the first publicly available Bitcoin mutual fund in the US, ProFunds, an asset management company with US$60 Billion in AUM, seeks to provide retail investors with access to Bitcoin futures. The fund may provide an entry point to professionally managed portfolios for retail investors although seemingly won’t be as efficient or attractive as an ETF might be. Bloomberg Intelligence ETFs analyst Eric Balchunas says “What people really desire is a physically backed bitcoin ETF, in an ETF wrapper that is tax efficient.” The mutual fund holding Treasurys for margin meant that it could be filed differently with the SEC as compared to current Bitcoin ETF applications. Whilst being positive news for funds that hold bitcoin futures, it may not mean anything for the application of funds that aim to hold physical bitcoin, Balchunas said.

Regulatory clouds

The resilient Bitcoin price is even more impressive considering the regulatory clouds gathering in the US. New stablecoin legislation is due to be introduced soon and Senator Elizabeth Warren has been leading the charge for harsh new crypto regulations. Crypto taxes intended to raise US$28 billion (A$38B) were also added to the massive infrastructure bill in a last-minute deal this week. The hastily drafted addition would expand the tax code’s definition of “broker” to capture everything from DeFi to mining, forcing the use of KYC to report taxes. The definition has already been tightened up once and Republican Senator Pat Toomey is leading efforts to amend the legislation to fix the “unworkable” definition properly.

Due more all-time highs?

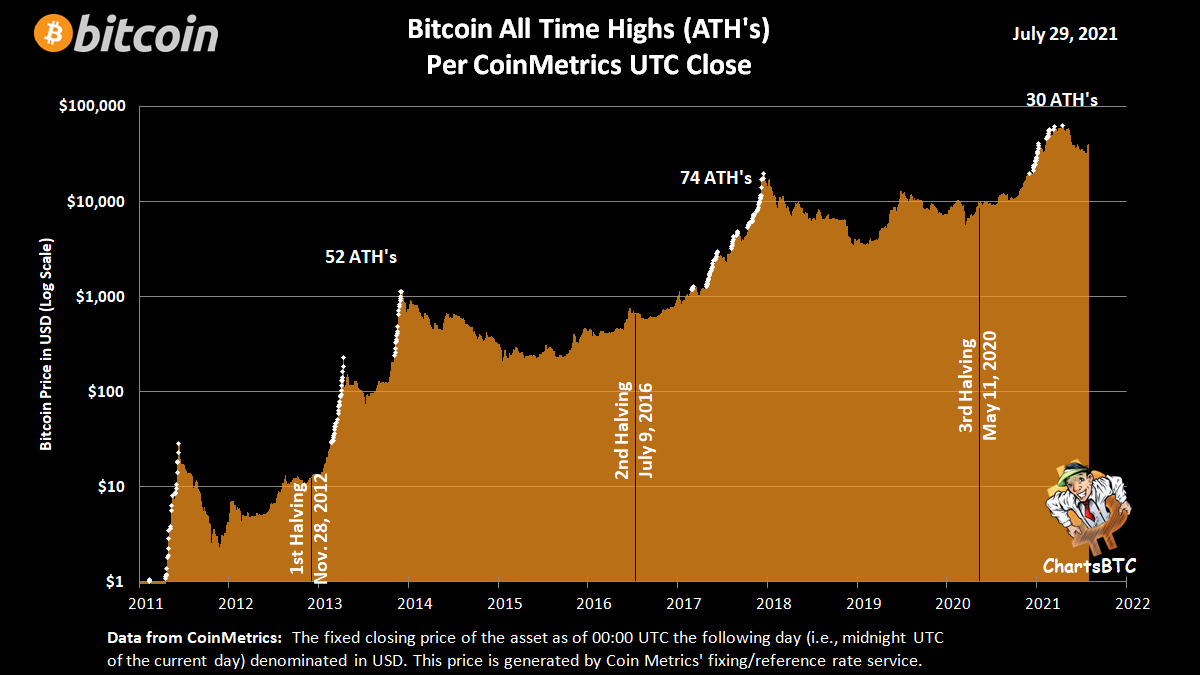

According to Charts BTC, after the first halving in 2012, Bitcoin went on to record 52 new all-time highs. Following the second halving in 2016, Bitcoin recorded 74 new all-time highs. We’ve only seen 30 new all-time highs in the wake of last year’s halving … so are our best days still ahead of us?

Bitcoin bits

Bitcoin this week broke through its 21-week exponential moving average which Rekt Capital describes as a “time tested bull market indicator”. Analyst Willy Woo said on-chain indicators over the past week show that “everyone is buying from shrimps to whales. We’ve not seen a pattern like this looking back 10 years.” However, according to the stock to flow model, Bitcoin should be trading above $95,364 (A$129.5K) right now. The Bitcoin network saw $69.69 billion (A$94.6B) in value transferred yesterday, the second highest ever. And, after a huge dip caused by the great China miner migration, the hash rate has risen back to 100 EH/s.

Until next week, happy trading!