In markets

Bitcoin broke the $50,000 barrier this week and kept climbing, nearly touching $54K over the weekend. But after a massive $14K plunge and a small recovery we’re now back at prices not seen since … last week. In fact, we’re up 13.2% on last Tuesday to trade around $46,000. Ether looked like it was closing in on a new all-time high and topped $1,700 before the plunge. It’s back at $1400 to finish the week up 7.1%. Both coins are up 85% on a month ago. Apart from Litecoin (down 8.2%), and EOS (-3.6%), everything else was up: XRP (24.6%), LINK (9.1%), Stellar (64.6%), AAVE (8%) and SNX (20.3%).

In headlines

The correction we had to have

CNN Business has seized on Bitcoin’s 20% plus plunge to state: “It’s now in a bear market“. It’s not. However, the article also quoted various pundits saying the “pullback was needed” or that it was a “healthy correction” after a “scary” vertical price rise. Naeem Aslam, the chief market analyst at AvaTrade, added, “The bull run is not over yet, and it is still likely to make its journey to the upside.” Bitcoin has seen seven corrections around this magnitude or larger since 2017. The drops invariably happen during raging bull markets and are followed by an average 22% rise. Sentiment appears unaffected with the Fear and Greed Index dropping just 4 points to 90 or ‘Extreme Greed’.

Stats a wrap

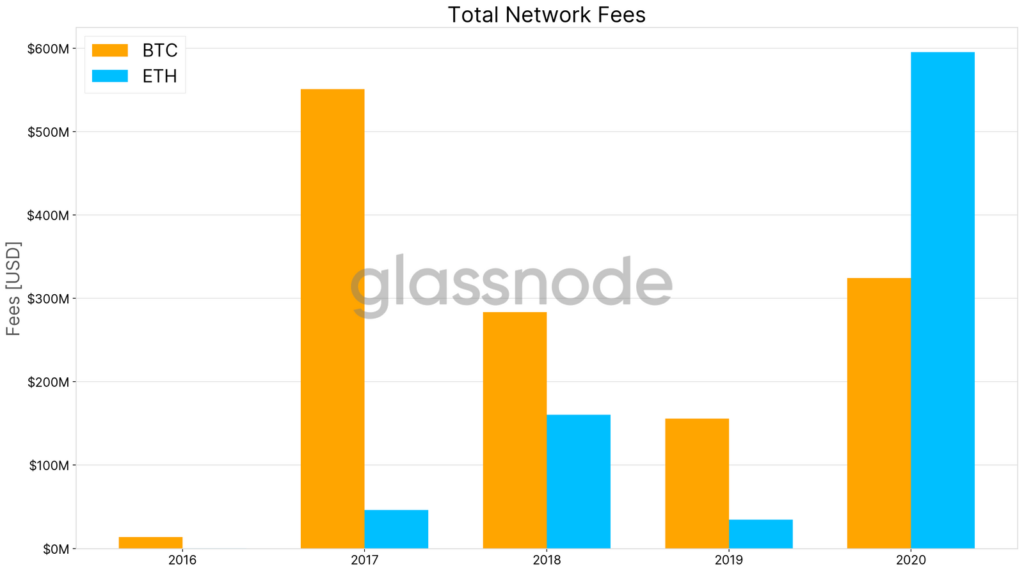

Active addresses on the Bitcoin network have reached a new all-time high and peaked at 1.3M addresses active in a single day last week. Bitcoin mining difficulty has increased 11% to a new record high – a little surprise after mining revenue tripled in recent months. CryptoQant says miners are now selling coins at the highest levels since July 2019. Meanwhile, Ether fees have gone through the roof as a result of the price volatility. In 2020, the Ethereum network hauled in 83% more in fees than Bitcoin did.

The trouble with Tether

Tether FUD has also hit new all-time highs, thanks to a chorus of critics directly tying it to Bitcoin’s bull run. Tether printed up a record batch of $2B USDT last week, bringing the supply to $24.6B (up from just $4.8B one year ago). President of Real Vision Travis Kimmel (a crypto bear, unlike CEO Raoul Pal) put out an interesting thread on Tether, suggesting that “capital migration towards real dollar exchanges” where BTC trades at a premium is proof that Tether is dodgy. But Tether’s Paolo Ardoino and Stuart Hoegner were on Peter McCormack’s podcast this week and cleared up a bunch of misconceptions about Tether’s “money printing” and the court case in New York … but also avoided some tricky questions.

You’re the voice

Co-founder and Chief Technical Officer Dan Larimer has left Block.one, the company behind the EOS blockchain. He’s off to build censorship-resistant technologies, pointedly remarking on his way out the door that the EOS-adjacent social network “Voice is not immune from the censorship pressure” seen in recent weeks.

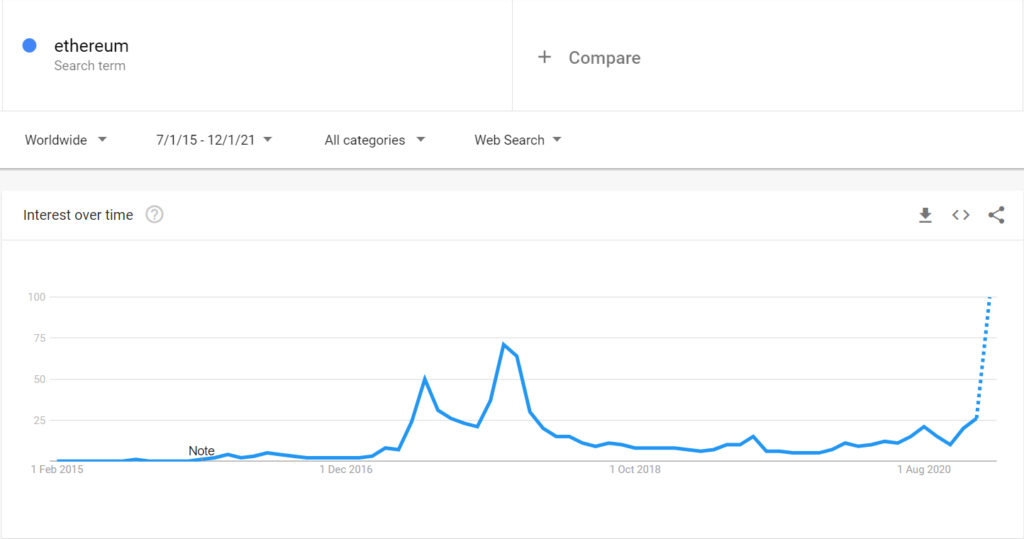

Searches for Ethereum hit an all-time high

Google searches for Ethereum hit an all-time high this week – the last time interest was so high was January 2018 when Ether reached its all-time high price. Many pundits are predicting a new record price incoming thanks to CME launching ETH futures, the successful launch of phase 0 of Eth2 and the booming DeFi sector. Bitcoin searches are now back at 50% of their ATH levels.

Bitcoin trails Facebook

Even after the pullback, BTC’s market cap is only just behind Facebook and Tencent’s, but larger than Alibaba’s and JPMorgan Chase. Meanwhile, Ethereum joined the top 100 assets in the world by market cap this week, climbing to 83 (bigger than Union Pacific and Honeywell) but falling out of the list just as quickly. Tesla’s Elon Musk, now the world’s richest man, said on Twitter he wants to be paid in Bitcoin. But Musk appears to like attention as much as Bitcoin itself as he’s only got 0.25 BTC so far.

Morgan Stanley’s BTC bet

Morgan Stanley has now bought up almost 11% of the shares in MicroStrategy, which has become a de facto Bitcoin ETF, with 70,470 BTC in its reserves. MSTR holders are now experiencing Bitcoin-style volatility, with the shares doubling in December, then plunging 13% alongside this week’s BTC drop. Meanwhile, Grayscale reports increased interest from not just hedge funds but also “other institutions, pensions and endowments … The sizes of allocations they are making are growing rapidly as well.”

JPMorgan tips $189K price over longer-term

JPMorgan strategists believe that Bitcoin could take on gold as a store of value and hit US$146K (A$189K) over the longer term. However, for this to happen, they think Bitcoin’s volatility will need to reduce to the level of gold which is “unlikely to happen quickly“. In related news, Charlie Morris, the founder of ByteTree Asset Management, attributed a 4.62% fall in the price of gold over the past week or to “flows moving towards Bitcoin“.

Bears will be Rekt

Rekt Capital has put out a three-part report on what history can tell us about the potential for the post halving bull run. Extrapolating from history the report suggests, “Bitcoin could rally anything between +1742% and 2200%.” This would see the BTC price hit between $195K and $244K … with the peak price occurring in October this year.

DeFi Digest

A round-up of the top news in Decentralised Finance

🏦 Augmentum Fintech, a $350m London-based investment fund listed on the London Stock Exchange will begin investing in decentralized finance protocols.

🍣 SushiSwap announces their roadmap for 2021.

🐋 A deep dive into 0x_b1, one of the richest Ethereum addresses with over $300M in capital deployed across various protocols.

🎤 Part 2 of the conversation between Arthur0x (Defiance Capital), Su Zhu (3 Arrows Capital) and Hasu on the Top 20 DeFi projects.

Until next week happy trading!