In markets

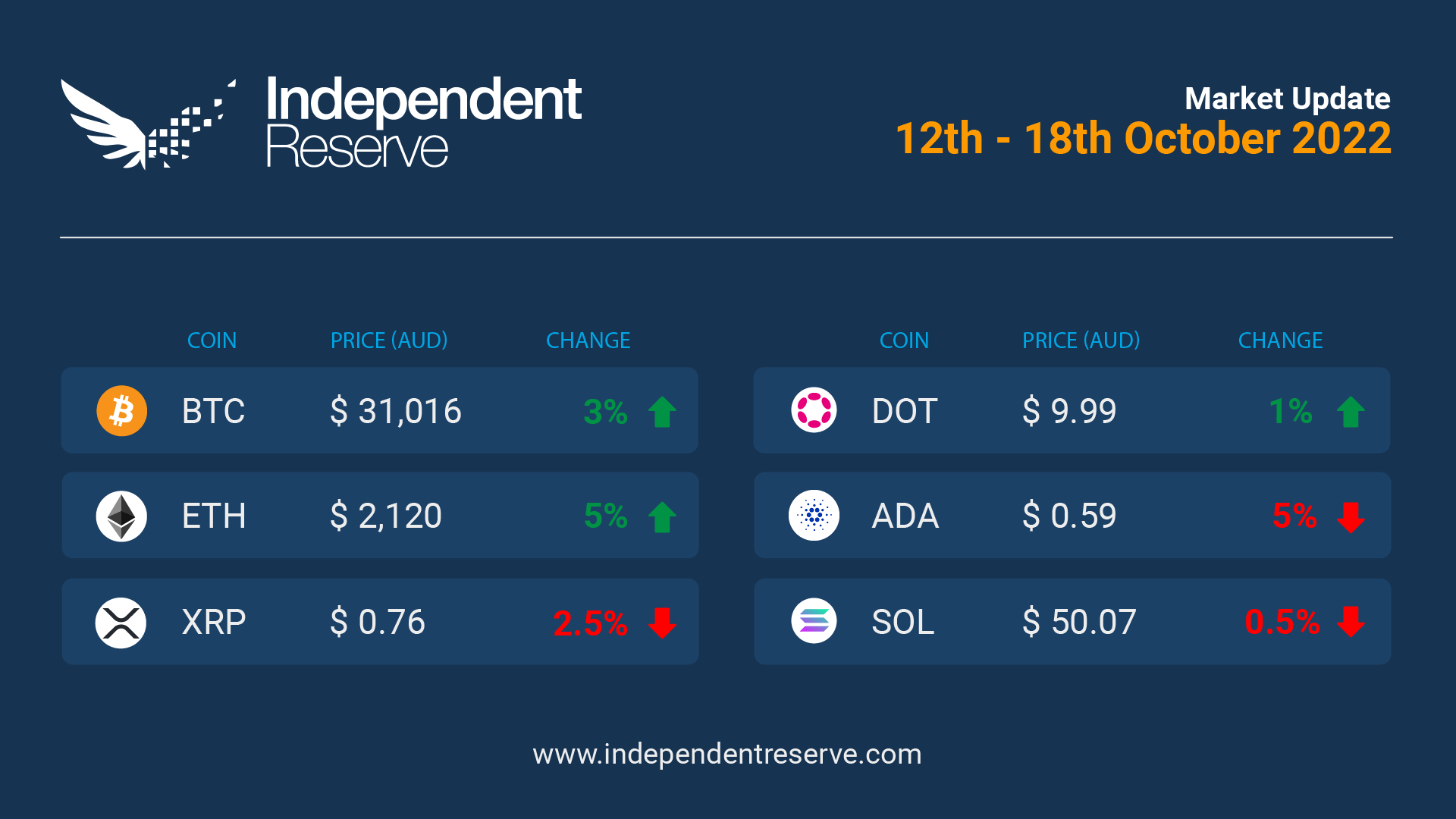

Inflation in the US rose at twice the pace forecast by economists and was up 0.4% in September and 8.2% for the year. The likelihood of a recession in the US and Europe has increased, although many pundits believe Australia may squeak through yet again. Some analysts draw comparisons with the high inflation, and the super long sideways market of 1940 to 1947 to suggest the next bull run is far away. Crypto markets appear to have found a certain amount of equilibrium at these prices, with Bitcoin up 3% for the week to trade just under A$31,000 (US$19.5K). Ethereum increased by 4.6% to A$2,110 (US$1,330). XRP lost 2.5%, Cardano dropped 5%, Solana was down 0.5%, and Dogecoin was flat. The Crypto Fear and Greed Index is at 20 or ‘Extreme Fear’.

From the OTC desk

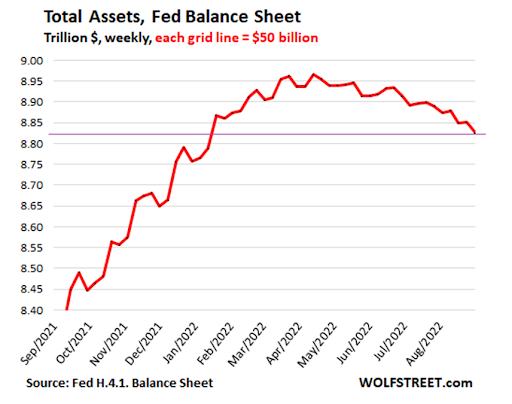

Volatility has increased in tradable assets on the back of the Federal Open Market Committee’s (FOMC) quantitative tightening (QT) activities. As previously communicated in this blog, the FOMC is now at full speed of asset runoff: the pace of QT is capped at a maximum of USD$60bn per month of Treasury securities and USD$35bn per month of mortgage-backed securities.

This reduction in front-end USD liquidity is causing Treasury bond yields, short-term interest rate yields, the DXY and equity markets to become more volatile. Surprisingly, however, cryptocurrencies have decreased in volatility, with BTC and ETH realised volatility remaining near historic lows. As a high beta risk asset, it remains unclear what is currently driving this volatility divergence – and whether this will be sustained. Importantly for the cryptocurrency asset class, the support levels of USD$18,000 in BTC and USD$1,000 in ETH remain in place.

This week, US Core Inflation MoM (September) came in at 0.6% relative to a 0.5% expectation. On an annualised basis, US Core Inflation YoY (September) continues to increase, now at 6.6% – this is the highest core inflation reading since 1982! On the ‘headline’ reading, the US Inflation Rate YoY (September) continues to print above 8%, with the official reading for September at 8.2%. Despite a significant reduction in core commodity prices, shelter and food remain the key inputs to high inflation levels.

We have highlighted that the FOMC will begin to place more emphasis on the core inflation reading once inflation begins to moderate lower. Despite ‘headline’ inflation being the legislative mandate, core inflation is a better indication of how persistent inflation will be. The Minutes to the September FOMC meeting have again confirmed that the Committee are more concerned about the consequences of doing less, than the negative impacts on the economy of doing more. Short-term interest rates continue to forecast an additional 75bp increase to the fed funds rate at the 1st-2nd November meeting, taking the target band to 3.75%-4.00%.

This week, Australia delivers labour market data (scheduled for 11:30am Thursday, the 20th of October). Market consensus is for the unemployment rate to remain at a historically low level of 3.5%. The labour market data will then be followed by the Australian Q3 CPI release on Wednesday the 26th of October. This will deliver a very clear picture of the current economic landscape to the Reserve Bank of Australia (RBA) before their November board meeting. CPI remains the most critical data point for the RBA and should be followed closely.

On the OTC desk, cryptocurrencies continue to perform well against other high beta assets – particularly US tech stocks. And as highlighted above, cryptocurrencies are currently exhibiting much lower historical levels of realised volatility. Flow across the desk has remained constant, although sellers remain much more consistent than buyers. Trading enquiry from our Singapore office has most recently focused on BTC and ETH derivatives. If options, perpetual futures, non-deliverable forwards or dual currency notes might be of interest to your trading requirements, please let us know.

For any trading needs, please don’t hesitate to get in touch.

Is Ethereum censorship resistant?

MevWatch reported that more than 51% of all Ethereum transaction blocks are now censorship compliant with the U.S. Office of Foreign Assets Control (OFAC) rules. Of the seven top Ethereum MEV relays, only three do not censor transactions forbidden by OFAC (mostly related to Tornado Cash). While that all sounds bad, Cyber Capital CIO Justin Bons points out that “Not even a single TX has been censored on ETH due to OFAC!” and argues that “it would only take one validator/miner to include such TXs for it to be included in the canonical chain… Easily less than 1% can prevent censorship!” The Ethereum community is taking the threat seriously, however, with cofounder Vitalik Buterin proposing a solution and Flashbots unveiling a decentralised block-building process called SUAVE, which aims to tackle the issue. ETH influencer Anthony Sassano says censorship is a more crucial issue to fix than scaling.

Google that ETH address

Google this week made Ethereum addresses searchable — simply type the address into the search bar, and it will (in theory) bring up the balance and Etherscan details. It doesn’t work that well just yet – plenty of addresses don’t work – and some were surprised that Bitcoin addresses are not made searchable yet.

Almost a decade of Bitcoin ETF rejections

The SEC has again rejected Wisdom Tree’s application for a spot Bitcoin ETF after rejecting every other Bitcoin ETF application since 2014. Grayscale fired the first salvo in its legal battle against the SEC for rejecting its Bitcoin ETF application, calling the knockback “arbitrary, capricious and discriminatory” and pointed out that already approved Bitcoin Futures ETFs determine their price in a similar way, so it makes no sense to deny spot ETFs on fears over price manipulation. Grayscale’s BTC Trust is trading at a record 36.7% discount which may help explain why they are so eager to transform it into an ETF.

Bull run next year, BTC to hit US$1M in 2030

Hunter Horsley, Co-Founder and CEO of Bitwise Asset Management, told Bloomberg TV that he expects the next bull run to start in 2023. This is based on the historical four-year pattern, in which one bearish year has typically been followed by three years of bulls. “So in 2014, the market down almost 60%. 2018 – market down north of 70%. And this year, obviously, 2022, the market down around 60%. The expectation, if the market continues its historical trend, would be that we begin a new cycle next year.” Ark Investments management analyst Yassine Elmandjra is even more bullish and told Bloomberg that Bitcoin was likely to hit US$1 million (A$1.58M) per coin by 2030. “When you stack every use case one on top of another, you come to about a US$28 trillion (A$44.5T) opportunity, which translates to more than a million dollars per Bitcoin,” he said.

Going troppo

In one of the crazier DeFi market manipulations, Solana-based DeFi project Mango Markets was exploited for US$114 million (A$181M). The attacker then used their millions of stolen tokens to put up a proposal to the DAO for a vote that would allow them to keep US$47M (A$75M) at a bounty on the agreement the protocol won’t pursue criminal charges. Blogger Avraham Eisenberg later outed himself as one of the attackers, claimed the whole thing was perfectly legal and returned US$67M (A$106M).

Bits and pieces

Blockchain games and metaverse projects raised US$1.3 billion (A$2.1B) in venture capital in the third quarter. This was 48% down on the second quarter, but more VC funding than in the whole of 2021. The Australian Securities and Investments Commission has issued a stop order to prevent Holon Investments from offering three crypto funds to clients covering Bitcoin, Ethereum and Filecoin. Peersyt Technology has launched a sidechain that integrates the Ethereum Virtual Machine on Ripple’s XRP Ledger. This introduces smart contracts to XRPL at low costs, and the sidechain will run at 1,000 transactions per second. A Reuters investigation of internal Binance documents between 2017 and 2022 alleges CEO Changpeng Zhao and executives plotted to evade regulatory oversight using underhanded means from UK and US authorities. CZ responded by calling the report “flagrantly inaccurate”. BNY Mellon, the oldest and largest Wall Street bank, has begun holding Bitcoin and Ethereum on behalf of its institutional clients. This upset Caitlin Long – founder of Wyoming crypto bank Custodia (formerly Avanti) – who has been waiting two and a half years for a decision on its application for a Federal Reserve master account to enable it to offer a full suite of services.

Until next week, Happy Trading!