In Markets

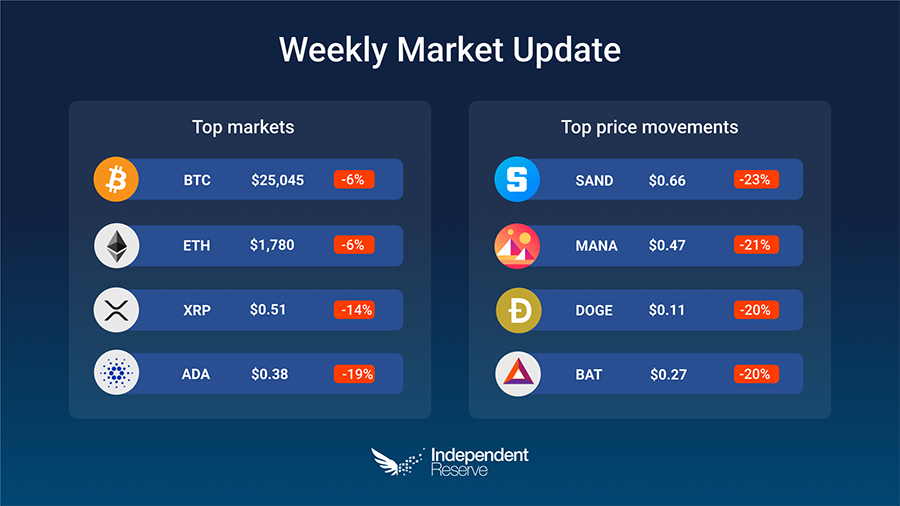

Crypto markets rose mid-week in expectation of a more positive outlook from the Federal Reserve, and Bitcoin peaked above US$18,000 (A$26.4K) for the first time since FTX collapsed. Then everything crashed after the Fed hiked rates by 50 basis points and said it will continue to raise rates into 2023. The good news is that US inflation came in at 7.1%, better than expected, and the slowest pace in nearly a year. Bitcoin finishes the week 5.5% down at A$25,045 (US$16,750) while Ethereum lost 6% to trade around A$1,780 (US$1,160). Everything else was down including XRP (-14%), Cardano (-19%) and Dogecoin (-20%). The Crypto Fear and Greed Index is at 29 or Fear.

From the IR OTC Desk

Last week we highlighted the key economic data to be released before the new year period; and suggested that this data would form the foundational view on monetary policy for 2023. This has turned out to be accurate, with the market sentiment updating to reflect central bank rhetoric which remains (currently) unwavering in their fight against inflation. The US core inflation rate YoY (November) printed softer than forecast at 6.0% versus 6.3% in October. The headline inflation rate YoY (November) also moved lower to 7.1% versus an October reading of 7.7%.

Following, the US Federal Open Market Committee (FOMC) held their final meeting for 2022, increasing the federal funds rate by 50 bps to a target range of 4.25 – 4.50%. The Committee (‘dot plot’) forecast was also updated for December, with the expected median federal funds rate for the end 2023 moving up from 4.625% to 5.10%. The Committee are expecting an additional 75 bps increase to the federal funds rate by year end 2023.

In Europe, the Bank of England lifted their underlying policy rate by 50 bps to 3.5% after receiving November inflation figures of 10.7%. The European Central Bank also lifted their three underlying reference rates by 50 bps (taking the deposit facility rate to 2%) following November euro area inflation data of 10.1%. All three central banks were resolute in their communication: that they will do whatever it takes to return inflation to their (respective) 2% target rates. This may be at the cost of the labour market and economic growth – a potential theme for 2023.

In cryptocurrencies, the macroeconomy continues to drive risk asset pricing. Over the last week, BTC has tracked circa 90% correlated with ETH and 70% correlated with the S&P 500. The wholesale trading market continues to show concern of counterpart credit risk. This is weighing on volumes and volatility within the cryptocurrency complex. In general, stable coins continue to be actively converted into fiat via the IR OTC desk. Trading in BTC, ETH, et al. has remained relatively light, as the customer base waits patiently for more favourable macroeconomic conditions – where cryptocurrencies can maximise their profile as a ‘high beta risk asset’. This also makes sense from a relative funding perspective, where current staked ETH yields are near identical to the yield of the 1 yr US treasury note.

For any further information, please feel free to reach out.

In Headlines

New House Financial Services Committee chair likes crypto

The incoming United States House Financial Services Committee chair, Patrick McHenry, likes crypto. McHenry this week wrote to U.S. Treasury Secretary Janet Yellen outlining his concern over new crypto tax provisions in the Infrastructure Bill due to come into effect in the new year. The provisions require all transactions over US$10,000 ($A15K) to be reported and expand the definition of a “broker”. He called for the provisions to be delayed and reintroduced his own bill on crypto innovation. On the opposite side of the ledger Sen. Sherrod Brown, Chair of the Senate Banking hates crypto and floated the possibility of banning it during an appearance on Meet The Press.

XRP case decision months away

Swirling rumours of a settlement in the long running SEC case against XRP for selling unregistered securities, turned out to be false. XRP proponent, attorney John Deaton says that with so many documents to work through including 17 amicus briefs (non-involved parties offering opinions) March 31 is the earliest possible date, but April and May seem more likely.

Binance FUD storm

This week’s blizzard of FUD was about Binance. In the wake of the FTX collapse, billions and billions have been withdrawn by users playing it safe due to concerns about its solvency. Paris accounting firm Mazars issued a proof of reserves audit, but it drew criticism from all quarters and the firm has since withdrawn from the crypto auditing game altogether. CryptoQuant released its own on-chain analysis suggesting that Binance’s BTC is fully backed. CEO Changpen Zhao appeared on Squawk Box and looked evasive as he avoided directly answering whether Binance could survive giving US$2.1B (A$3.13B) back to FTX (a possible claim from the latter’s bankruptcy proceedings) and why it hasn’t got a big four auditor.

Binance actually has lots of money?

Despite all the FUD Binance’s US arm has reportedly snapped up bankrupt crypto lender Voyager for US$1.022 billion (A$1.52B). Or that’s what you’d think from this morning’s coverage, however Forbes reports the deal actually involves Binance paying U$20M (US$29.8M) to acquire Voyager’s 3.5 million customers. Binance.US is technically a completely separate company from Binance, however there are doubts being raised about that. Parent company Binance has also just bought Tokocrypto, which is one of Indonesia’s largest exchanges.

SBF wants to go back to America

Disgraced FTX CEO Sam Bankman Fried has changed his mind about fighting extradition after spending a few days in the rat infested hellhole that is The Bahamas’ only prison. He appeared in court earlier today and while he was sent back to prison without a resolution, his legal team indicated he would agree to be voluntarily extradited. Questions are being asked about the suspicious timing of his arrest, the day before he testified under oath before Congress, and prosecutors are looking into his big donations to politicians. CNBC went through the court documents and reported that the CFTC believes that the fraud — using FTX customer funds for Alameda trades — started just a month after FTX.com began and that Alameda had a “virtually unlimited” line of credit on FTX along with an unfair head start on all trades within FTX’s system. Kevin O’Leary however told a Senate hearing that it was all Binance’s fault. SBF faces 115 years in jail.

Bits and pieces

a16z still has the majority of its US$4.5 billion (A$6.7B) ‘Crypto Fund 4’ left to invest in the market, founder Chris Dixon told The Block. “We’ve deployed less than 50%, so we have the majority of our recent fundraise left,” Dixon said. With the Grayscale Bitcoin Trust premium at a record low of negative 48.7% and no ETF approval in sight, CEO Michael Sonnenshein has flagged a plan to potentially return capital to shareholders with a tender offer for up to 20% of the outstanding shares. The Bank for International Settlements (BIS) has now doubled the amount of crypto it will allow banks to have in their reserves to 2%. Bitcoin Whales have sold off a record 280,000 Bitcoin in the space of a month according to Glassnode data. Crypto Slate also reported that in 2022 miners transferred 57,000 Bitcoin to exchanges. A survey of 537 financial advisors in the US found that 92% have been asked by their high net worth clients about investing in crypto in the past year. More than one third said client interest in crypto had intensified.

Stay tuned for our next Market Update issue on the 3rd January 2023.

Happy trading, see you next year!