In Markets

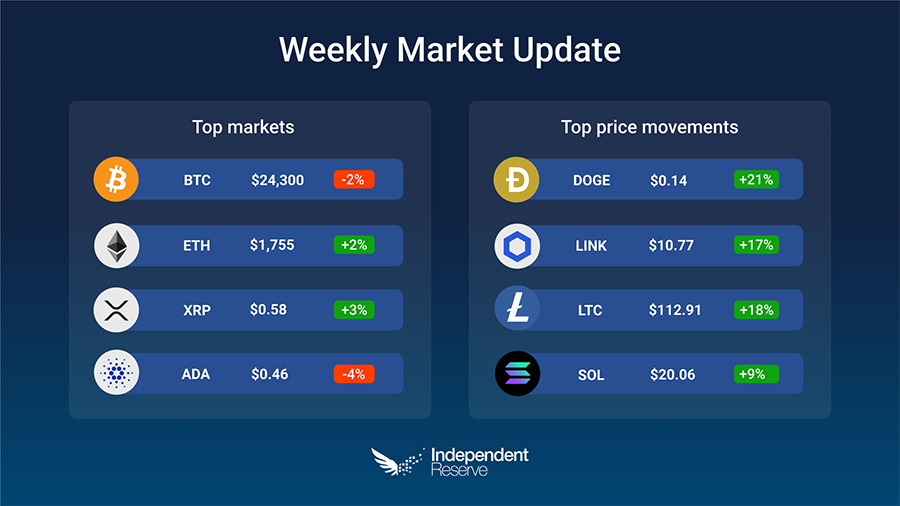

Despite acres of bad news, markets have been mostly in a holding pattern this week. Bitcoin finishes the week down 2% to trade at A$24,300 (US$16.1K), while Ethereum increased 2% to A$1,755 (US$1,167). XRP gained 3% and Dogecoin surged 21% after Twitter boss Elon Musk mentioned payments in a tweet about his new ‘everything app’. Decentrader’s Filbfilb said this week “[the] fact that we haven’t dumped harder than we actually really could have done is a good sign for the bulls,” but he also said Bitcoin could fall below A$15K (US$10K). The Crypto Fear and Greed Index increased to 26 or simply ‘Fear’.

From the IR OTC Desk

Relatively speaking, this past week has been quiet for cryptocurrencies. With no significant developments in the FTX, Alameda, BlockFi, Genesis et al. landscape, the market received a well-earned break for thanksgiving. Tight ranges have presented most recently, with front-end volatility remaining soft.

Last week we spoke about the difficulty in assessing credit risks within the crypto ecosystem – as there remains little transparency of asset rehypothecation – and this very much remains. Counterparty credit risk continues to be opaque, remaining one of our primary concerns for the cryptocurrency landscape.

In macroeconomic news, the Reserve Bank of New Zealand (RBNZ), lifted the underlying cash rate by 75bps to 4.25%. The RBNZ discussed whether a 75bp or 100bp increase may be most appropriate given the record tight labour market and strong underlying inflation pulse. The RBNZ have updated their expected maxima for the cash rate to reach 5.5% during 2023! The rapid increase in the cash rate by the RBNZ is certainly different to the slow path of monetary tightening currently being delivered by the Reserve Bank of Australia (RBA) – who are scheduled to next meet on the 6th of December.

In the US, this week delivers the PCE price index for October. The PCE index is the Federal Reserve’s preferred measure of inflation. Scheduled for release on Friday at 1230am (AEDT), Core PCE MoM (Oct) is expected to increase 0.3%, causing the yearly reading to fall to 5% (from 5.1% YoY in September). Labour market data for November is scheduled for Saturday morning at 12:30am. In this series, the unemployment rate, the non-farm payrolls, and the average hourly earnings, will all prove critically important. Watch this space.

On the OTC desk, off ramping of stable coins has continued to be the dominant theme. Broadly speaking, the market remains focused on the USDT peg – and why there hasn’t been an audited proof of reserves published. In terms of elephants in the room, USDT reserves certainly remain highly topical and well debated. The most recent pricing, however, is USDT has now moved back to peg for nearly a week now. A good sign that market outflows have now become more balanced. Elsewhere in the cryptocurrency complex, DOGE pricing remains closely correlated with Twitter announcements. For now, the opportunistic buying in both BTC and ETH has now slowed.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

BlockFi bankrupt

Cryptocurrency lender BlockFi has filed for chapter 11 bankruptcy as part of the fallout from the collapse of FTX. The filing states the top 10 creditors alone are owed close to US$1.2 billion (A$1.8B). BlockFi said it would use chapter 11 to focus on recovering all obligations owed to it by its counterparties, including FTX. At its height in 2021 BlockFi had up to US$20B (A$30B) in user deposits and lent out US$7.5B (A$11.3B). It currently has US$257M (A$386M) to support its operations during the restructuring process.

Fourth Independent Reserve Cryptocurrency Index

The annual Independent Reserve Cryptocurrency Index score fell from 54 to 45 in its fourth year, driven by a sharp drop in crypto ownership among 18-24 year-olds. Around 25.6% of Australians own crypto, down from 28.8% in 2021. A lack of regulation and consumer protection was cited by 36.1% of Australians as the reason they have not invested. The number of female investors rose from 20% to 21.4%, while male investors dropped from 38% to 29%. The good news however is that the number of people investing $500 or more per month in crypto has risen from 10.3% to 17.3%.

FTX local fallout

Aussie crypto firms hit by the FTX collapse include Apollo Capital, which has 1.5% of its flagship fund in the FTT token and Telstra Ventures, which was an investor in FTX’s US$420M (A$631M) Series B funding round. Brisbane exchange Digital Surge has suspended deposits and withdrawals due to its exposure to FTX but 13 other Australian exchanges including Independent Reserve have made a commitment in conjunction with Blockchain Australia that customers balances are held in full reserve, and agreed to provide proof through audits or on-chain data.

Crazy FTX plot twists this week

FTX boss Sam Bankman-Fried hasn’t been arrested, instead he’ll be making an appearance at the annual New York Times Dealbook Summit on November 30. Arguably soft coverage of his philanthropy in the Wall Street Journal and NYT has frustrated many and news emerged that FTX and SBF donated US$70M (A$105M) to politicians over the past 18 months. Eight congress members tried to stop an SEC investigation into crypto exchanges, FTX among them. Alameda Research was revealed to have withdrawn US$240M (A$360M) from FTX ahead of the bankruptcy filing. The Senate investigation into FTX kicks off this week on December 1. It was also revealed the exchange invested US$11.5M (A$17.3M) in Farmington State Bank which has a single branch and three employees. That’s twice as much as the bank was worth at the time and it’s unclear how an unregulated offshore crypto exchange was able to buy it given it would need approval by federal regulators. The chair of the bank is Inspector Gadget creator Jean Chalopin who is also chair of Deltec Bank in the Bahamas… whose best known client is Tether. Amazon has commissioned an eight episode TV series from directors the Russo brothers (Avengers: Endgame) about the spectacular downfall of FTX.

Genesis and DCG

The good news is that Genesis — the Goldman Sachs of crypto according to the Financial Times — hasn’t filed for bankruptcy yet, but having suspended withdrawals and appointed a restructuring expert it’s not looking good. It got hit hard in the crypto contagion earlier and has a shortfall of at least US$500M (A$751M) and outstanding loans of US$2.8B ($4.2B) on its balance sheet. Parent company Digital Currency Group has arranged a number of bailouts for Genesis so far and owes US$1.675 billion (A$2.52B) to Genesis and US$350M (A$526M) to external creditors. Investors are nervous this might affect the Grayscale Trust, which DCG owns. For its part Grayscale refused to provide proof of reserves, however a community led on chain investigation determined it really does have the funds.

Ethereum looks to the future

Ethereum’s developers have decided on eight Ethereum Improvement Proposals (EIP) to explore for the Shanghai update which is coming in the second half of 2023. One of the big features will be the ability to actually withdraw ETH that’s staked in the network (currently being tested on the Shandong Testnet), and proto danksharding which will enable layer 2 scaling solutions to operate faster and better.

Breaking records

We are currently in the second longest Bitcoin bear market in history, with Crypto Winter lasting more than 380 days this time (worse than 2018) and fast approaching the 415 days of the 2013-2015 bear market. The number of Bitcoin US ‘millionaire’ wallets fell from 113K in November last year to 23,245 today. Bitcoin dominance is currently near the lows it saw at the tail end of the early 2018 bull market when altcoins were all the rage on NZ crypto exchanges and beyond. During the 2018/2019 bear market, BTC dominance went to 70% as users abandoned ‘shitcoins’ but that hasn’t happened this time around. Glassnode’s latest report says the current period is “one of the heaviest capitulation events in history” and there are few historical precedents apart from 2018. However: “those few analogues that exist in Bitcoin history, albeit small in sample size, turned out in hindsight to be the points of absolute seller exhaustion.”

Until next week, happy trading!