In Markets

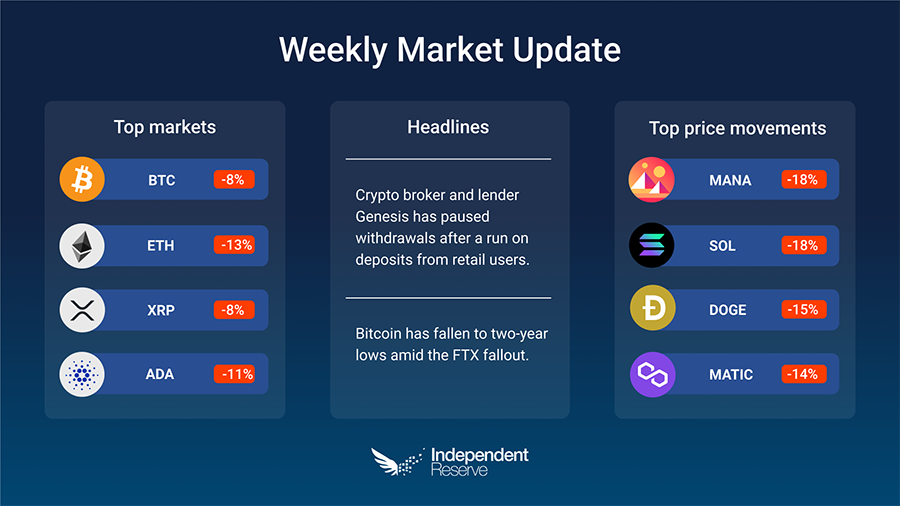

Bitcoin has fallen to two-year lows amid the FTX fallout, with just over 51% of addresses at a loss, which compares to 55% at the bottom of the previous crypto winter in January 2019, and 62% in 2015.

However, the price crash from the collapse of the world’s second largest exchange hasn’t been as severe as may have been expected, with Bitcoin down another 8% for the week to trade around A$23,990 (US$15.8K) and Ethereum down 13% to hit A$1,670 (US$1.1K). Everything else was down including XRP (-8%), Cardano (-11%), Dogecoin (-15%) and Solana (-18%). Some true believers are still buying, with Pantera Capital reportedly snapping up A$212M (US$140M) in BTC to once again demonstrate its belief in halving cycles (which will theoretically see a turnaround early in 2023). El Salvador President Nayib Bukele plans to dollar cost average in from now on, buying one Bitcoin a day. The Crypto Fear and Greed Index is at 22 or Extreme Fear.

From the IR OTC Desk

It remains incredibly difficult to assess the credit risks of the crypto ecosystem. There remains little transparency on who has locked up assets on FTX, Alameda, BlockFi, Genesis et al. Many of these entities may also have multi-counterpart bilateral loan/borrow agreements, where the posted collateral underlying the agreements is now being held as security or being sold in the market. Under this environment, the risk of contagion is growing and until there is more transparency, the sell side price pressure will likely remain. Expect volatility to remain high, and for liquidity to remain limited. Now more than ever, it is important to be aware of who you face as a counterpart.

The wholesale market has placed additional concern on stable coins this week. We have heard of pre-funding requirements for DAI and have been seeing significant off ramping in USDC and USDT via the Independent Reserve OTC desk. Last week we wrote that USDT had regained price tension back to the 1:1 USD peg. USDT has subsequently fallen below this level, although for the time being, remains ‘near’ the redemption price.

ETH/BTC has once again proven to be a very consistent market indicator for alternative DeFi staking tokens. This week, ETH/BTC has remained below 0.0700. ETH selling has been well documented, largely on the back of a misappropriated wallet linked to the most recent FTX hack. The end result being the alt complex has seen high beta, correlated selling – particularly in the layer 1 complex. Watch this space.

In economics, Australia received the AU Q3 Wage Price Index, which came in at 3.1% for the quarter, relative to a 3.0% expectation. Despite the higher than forecast increase, wage growth in Australia remains benign relative to the US – this is particularly evident in public sector wage growth. The result is most likely of muted concern for the Reserve Bank of Australia (RBA) – as there proves to be little evidence of a developing wage/price spiral.

Additional Australian data received for the week includes the October employment series. The Unemployment rate (Oct), printed a new low of 3.4% relative to 3.5% in September. This represents the tightest labour market in nearly 50 years. The RBA are due to convene on the 6th of December, where the market is forecasting an additional 25bps increase to the cash rate.

On the OTC desk, we are seeing a large amount of new customer enquiry. This is primarily due to customers prioritising counterparty credit risk. While we continue to be used primarily as a crypto off-ramp, there has also been a portion of opportunistic buying.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

This week’s black swan brought to you by Genesis

Crypto broker and lender Genesis has paused withdrawals after a run on deposits from retail users of products like Gemini Earn and the company’s failure to raise A$1.51B (US$1B) in emergency capital. Bloomberg reports it will need to file for bankruptcy if it can’t secure the funding though the company denies it has “plans to file bankruptcy imminently.” The outfit’s trading division has A$265M (US$175M) in locked funds on FTX. There are now rumours that Genesis’s owner Digital Currency Group owes A$1.67B (US$1.1B) to it and the whole situation could lead to further contagion as DCG is a huge A$15B crypto company that owns both Grayscale and Coin Desk (which ironically broke the FTX story that could threaten its own future) and has investments in 165 other companies from Ripple to Ledger and Coinbase.

Grayscale is OK

On the subject of Grayscale, creditors reportedly wouldn’t have a claim on its assets if Genesis goes under due to its trust structure. The firm has refused to provide proof of its reserves citing security concerns but Coinbase Custody attested that it holds 635,000 Bitcoin on its behalf. The Grayscale discount (the difference between the value of the shares and underlying Bitcoin each share represents) fell to 45.2%.

Contagion

TechCrunch did a survey of 70 market makers to see how much money they’d lost from the FTX fiasco. 66% lost A$38M (US$25M) or less while 7% lost between A$75.7M ($50M) to A$757M ($500M). One market maker said every big player was on FTX. “You couldn’t have a credible market making business if you weren’t on the platform.” Shares in Coinbase tanked 18%, while Silvergate Bank lost 30% after Goldman Sachs raised doubts over its links to FTX. Sino Global investment firm confirmed a “mid seven figures” exposure to FTX. Crypto exchange Liquid Global and crypto lender SALT froze withdrawals while BlockFi is reportedly mulling chapter 11 bankruptcy but Binance is looking at buying Voyager. Crypto venture company Multicoin Capital said the fund plummeted by 55% in the past month and 15% of its total assets are stuck on FTX. Celebrity FTX spruikers Larry David, Tom Brady and Stephen Curry have been named in a class action in Florida against the exchange.

FTX was a fiasco of biblical proportions

TechCrunch did a survey of 70 market makers to see how much money they’d lost from the FTX fiasco. 66% lost A$38M (US$25M) or less while 7% lost between A$75.7M ($50M) to A$757M ($500M). One market maker said every big player was on FTX. “You couldn’t have a credible market making business if you weren’t on the platform.” Shares in Coinbase tanked 18%, while Silvergate Bank lost 30% after Goldman Sachs raised doubts over its links to FTX. Sino Global investment firm confirmed a “mid seven figures” exposure to FTX. Crypto exchange Liquid Global and crypto lender SALT froze withdrawals while BlockFi is reportedly mulling chapter 11 bankruptcy but Binance is looking at buying Voyager. Crypto venture company Multicoin Capital said the fund plummeted by 55% in the past month and 15% of its total assets are stuck on FTX. Celebrity FTX spruikers Larry David, Tom Brady and Stephen Curry have been named in a class action in Florida against the exchange.

New regulations coming

New crypto regulations are a virtual certainty in the US and Australia. With 30,000 local investors having funds stuck on FTX, treasurer Jim Chalmers said the collapse highlights “the lack of transparency and consumer protection in the crypto market, which is why our government is taking action to improve the regulatory frameworks while still promoting innovation.” The G20 leaders released a similar statement following the Bali meeting. US House and Senate hearings will investigate the collapse in December with the CFTC, SBF, Alameda Research, Binance and FTX employees all asked to appear.

Solana is falling

Live by the endorsement of a crypto billionaire, die by the endorsement of a crypto billionaire. That’s the dilemma facing the Solana network with its total value locked (TVL) plunging almost 70% since the start of the month to around the same levels as little known chains like Mixin and Kava. At its peak Solana had A$15.1B (US$10B) in TVL – although much of that was faked by a couple of brothers. Tether also moved US$1B from Solana to ETH.

Ripple ODL product expands into 40 markets

Amid the doom and gloom Ripple has announced its On Demand Liquidity product that uses XRP for cross border transactions has seen record growth into “nearly 40 payout markets around the world, representing ~90% of the FX market.” New regions include Africa, Argentina, Belgium and Israel while existing RippleNet customers have upgraded to ODL in Australia, Brazil, Singapore, the UAE, the UK and the US.

CBDC pilot by the Fed

The Federal Reserve Bank of New York’s Innovation Center has announced a 12-week proof-of-concept pilot for a CBDC. BNY Mellon, Citi, HSBC, Mastercard, PNC Bank, TD Bank and Wells Fargo will participate by issuing tokens and settling transactions.

The big picture

With the mainstream media once again predicting the end of crypto, it’s worth pointing out that this year’s failures have been centralised fintechs behaving badly (apart from Terra-Luna). Ethereum cofounder Vitalik Buterin said the FTX collapse was “a problem in which technology is not to blame, but people are making the wrong decisions” and he published a proof of solvency proposal for exchanges to follow. The decentralised tech itself has performed admirably throughout this year’s turmoil with DeFi volume up 45% this month. And while things seem grim right now, analyst William Clemente pointed out to his 670K followers that when Mt. Gox collapsed in 2013 it accounted for 70% of global trading volume whereas FTX was only 10%. “FTX is worse on an absolute basis, but on a relative basis, Mt. Gox was much worse. If Bitcoin can survive that it absolutely can survive this,” he said.

Until next week, happy trading!