After increasing in price by a third in October, Bitcoin marked its second-highest monthly close ever. And to celebrate 12 years since the release of the Bitcoin whitepaper on October 31, 2008, it briefly topped US$14,000 (A$20,000) on the weekend – the highest price since January 2018. The price was unwinding back then, but this time it’s making higher highs and higher lows. Are we due a pullback, entering a period of consolidation, or headed to a new record high? The Bitcoin price is up 5.4% for the week and is currently trading at just over $19,300. Everything else headed in the opposite direction though. Ethereum lost 2.8%, XRP (-5.1%), Bitcoin Cash (-1.2%) Chainlink (-5%), Litecoin (-5.2%), Bitcoin SV (-9.6%), EOS (-6.6%), Stellar (-5.2%) and Synthetix (-20.1%).

Singapore’s largest bank DBS launches crypto exchange

DBS, Singapore’s largest bank, has announced that they will be launching a fiat-to-cryptocurrency exchange. Dubbed the “DBS Digital Exchange”, the trading platform will enable users to trade Bitcoin, Ethereum, XRP and Bitcoin Cash. In addition to an exchange, DBS will also offer tokenisation services, which will enable businesses to raise capital via digital forms of securities and assets.

The RBA is exploring a Central Bank Digital Currency (CBDC)

The Reserve Bank of Australia has announced that they have partnered with the Commonwealth Bank, NAB, Perpetual Limited and ConsenSys to explore the potential use and implications of a wholesale form of central bank digital currency (CBDC) in Australia.

The project will involve the development of a proof-of-concept for the issuance of a tokenised form of CBDC that can be used by wholesale market participants for the funding, settlement and repayment of a tokenised syndicated loan on an Ethereum-based DLT platform.

Iran turns to Bitcoin to fund imports

The Iranian cabinet has amended recent legislation on digital assets to allow Bitcoin to be used for import funding by the Central Bank of Iran (CBI). This change means that legally mined Bitcoin in Iran can only be exchanged if used to fund imports from other nations. The move will ultimately help the nation avoid sanctions that impose limits on Iran’s access to the dollar.

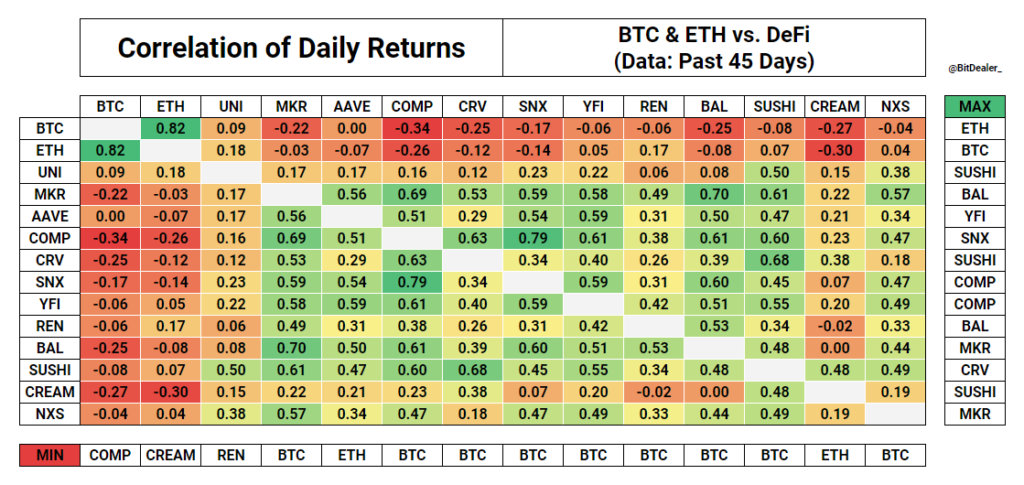

Bitcoin’s run bad news for DeFi?

There’s been a consistently negative correlation between Bitcoin and Defi over the past 45 days according to Markets Science co-founder Bitdealer. Crypto trader Flood told the Coinist Podcast that could be because Bitcoin’s price surge is sucking money out of the DeFi sector. “I didn’t have as much Bitcoin exposure as I would’ve liked on this move up, and I think that’s a representation of the market as a whole.” But don’t despair: analyst Ceteris Paribus released a chart showing that even after DeFi coins fell 50% to 90% in September and October, the majority are still hundreds of percent up year to date.

Crypto funds make bank

Reuters reports that a crypto hedge fund index launched in September 2018 by crypto ‘fund of funds’ Vision Hill Group showed a return of 126% in 2020. By contrast, non-crypto fund sectors tracked by BarclayHedge were up just 1.7%. It attributed the strong returns to the growth of DeFi and the increase in the Bitcoin price.

Buy stocks with USDT

Tether now has an additional use case: you can buy Australian stocks with it. An Aussie company operating an aquaculture farm in Malaysia called West Coast Aquaculture Group is conducting an IPO on the Stax platform and has announced it will accept Tether. It’s the first IPO in Australia to accept crypto. Stax CEO Kenny Lee called it a “transformative move in Australia and a significant step forward for cryptocurrency adoption in general. It paves the way for the future of capital markets down under.”

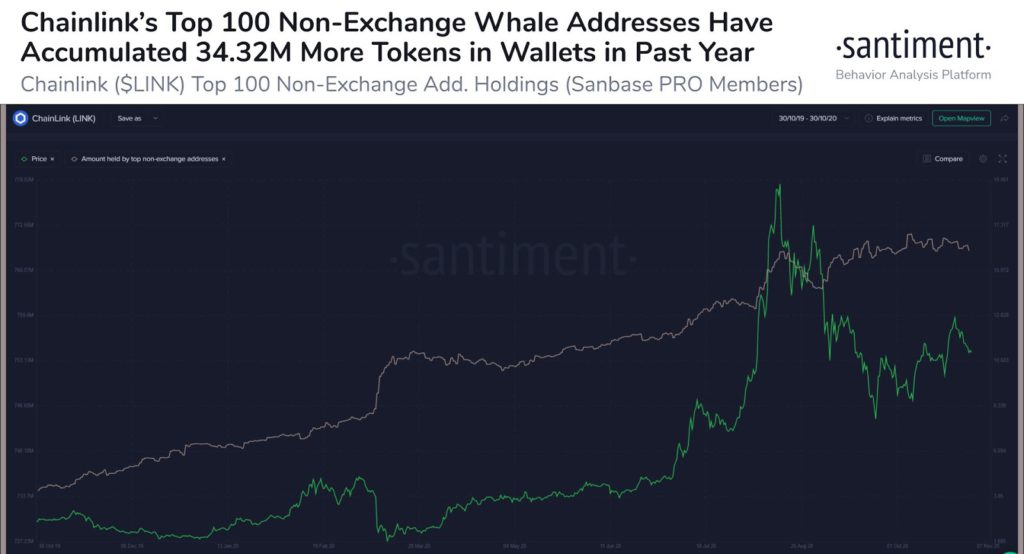

The missing LINK

Chainlink’s LINK ($16.56) is well off its all-time high price above $27, but Santiment believes the fundamentals are still strong. It released a chart this week showing the top 100 non-exchange whale addresses have accumulated 34.32 million additional tokens over the past year. “If this isn’t the depiction of steady accumulation for Chainlink’s top 100 non-exchange whales in the past year, we don’t know what is. LINK’s offline increase in tokens at this rate truly shows confidence in the asset from those with most at stake.”

DeFi a threat to ETH 2.0?

High yielding DeFi platforms could pose a threat to staking participation on Ethereum 2.0 according to the ConsenSys Q3 DeFi Report. The report said that phase 0 of the upgrade will launch by the end of the year and will require users to stake 32 ETH to become validators. Given ETH holders will need to lock up their funds from an unspecified length of time, in a deposit contract, for a variable return, ConsenSys is concerned they may opt for greater flexibility and higher returns elsewhere. This could leave “ETH 2 without the threshold of staked ETH required to render it sufficiently secure and decentralized.”

Until next week, Happy Trading!