Market Update 19th – 25th August 2020

In Markets

Bitcoin traded well above the US $12,000 ($16.7K) mark this week, but crypto markets pulled back across the board on the weekend. The dip has barely caused a blip on the Fear and Greed Index, which has hovered around ‘Extreme Greed’ for most of the month. The Bitcoin price has remained above the US$10,000 (A$13,950) mark for the second-longest stretch ever (28 days), beaten only by the 63 days above that level during the all-time high. Bitcoin is currently down 4.2% on seven days ago to trade just under $16,500. Everything else except OMG (+70%) was down (but they’re all still up on a month ago): Ethereum (-5.8%), XRP (-9.3%), Chainlink (-15.6%) Bitcoin Cash (-8.9%), Bitcoin SV (-10.4%), EOS (-10.6%) and Stellar (-9.8%).

In Headlines

Everybody’s buying, or talking about, Bitcoin

The news that listed US company MicroStrategy had moved $349 million of its cash reserves into Bitcoin has inspired others to do likewise. This week an Ottawa based graphics software startup called Snappa moved 40% of its own reserves into Bitcoin and an Ontario restaurant chain called Tahini’s switched all its reserves to Bitcoin. Meanwhile Apple Daily – the Hong Kong publication whose owner Jimmy Lai was arrested as part of China’s authoritarian crackdown – devoted its front page to advertising Bitcoin: “Now, its time is coming” the ad read.

ETH 2.0 still on track

The ETH 2.0 final multi-client testnet Medalla came to a shuddering halt on August 14 due to a time bug that took the validators offline. Some argue this shows ETH 2.0 isn’t ready for prime time, but the testnet is back up and running and Prysmatic Labs believes the phase 0 launch can proceed as planned in a couple of months. In Ethereum 1 news, miners are unhappy with an Improvement Proposal that would slash block rewards by 75% to 0.5 ETH. And major gas guzzler Tether has adopted Ethereum layer 2 scaling solution OMG network, which will enable faster and cheaper USDT transfers.

Who needs ETH 2.0 anyway?

After years of work, Cosmos’ Ethermint v0.1.0 has been released. It describes itself as “A scalable high-throughput PoS blockchain fully compatible and interoperable with Ethereum”. Shapeshift CEO Erik Voorhees said it could mark a major shift: “Prediction: Ethereum gas fees ruin Defi for normal users… To meet demand, developers start rapidly porting Defi components over to Cosmos via Ethermint which just launched and is apparently compatible with Solidity already.”

Degen Finance

DeFi craziness this week: Curve’s founder and CEO Michael Egorov were revealed to have 71% of voting power in the ‘decentralized’ project. Popular influencer Boxmining walked away from 1000% returns on YFValue due to a bug that could see $237M at risk of being locked by a single contract owner. After just four weeks, the price of Yearn.finance’s YFI token surpassed the price of Bitcoin and it’s currently trading around $19,500. That said, there are only 30,000 YFI, so it’s not going to overtake BTC as the king of crypto anytime soon.

Forking Bitcoin Cash again

It’s beginning to look as if Bitcoin Cash might fork again, due to a controversial November upgrade that requires miners to tip in 8% to development. Bitcoin ABC lead developer Amuary Sechet says without much-needed infrastructure development BCH will slowly “drift into irrelevance” without it. But supporters of rival Bitcoin Cash Node are outraged at the idea and claim to have a majority of miners behind them.

Number of record highs hit record highs

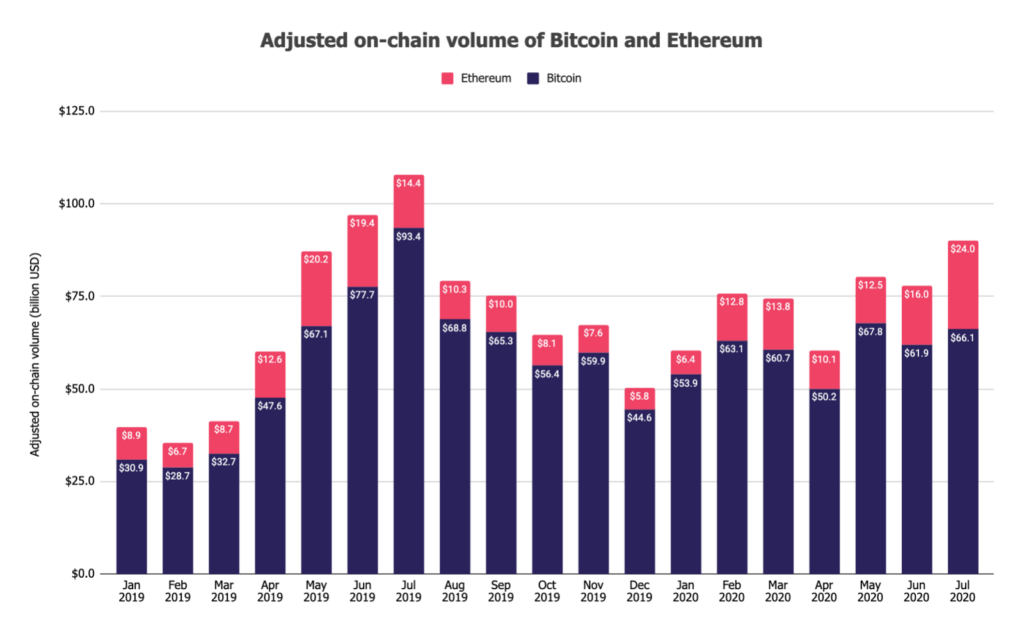

Total adjusted on-chain volume for Bitcoin and Ethereum reached a yearly high in July with a combined total of $125.8B according to the Block. That’s 15.7% up on June and is largely due to massive growth in ETH volume which grew 50% to $33.5B. According to Glassnode the circulating BTC supply that hasn’t moved in at least two years has reached 44% – a level we haven’t seen in three years. Bitcoin mining difficulty achieved a new all-time high of 17.6 trillion. Gas used on the Ethereum network hit a record daily high of 79,294,213,632 gwei on the weekend.

It’s 2016 again

Crypto fund manager Grayscale Investing released a report suggesting the current Bitcoin market structure “parallels that of early 2016 before it began its historic bull run.” The report notes various indicators showing a growing interest in crypto, an increase in HODLing over short term speculation (driving demand relative to supply) and historic lows for the amount of Bitcoin held on exchanges. These factors, combined with money printing in the US and billionaire Paul Tudor Jones tipping 1-2% of his wealth into Bitcoin, led Grayscale to predict the sky is the limit for Bitcoin.

That’s all from us. Until next week, happy trading!

Independent Reserve Trading Desk