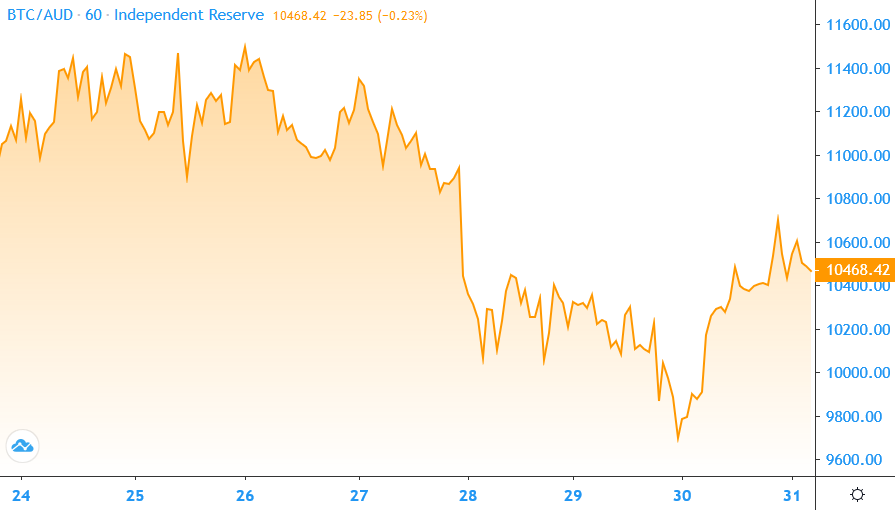

Market Update 25th – 31st March 2020

In Markets

After dropping to $9721 yesterday, the Bitcoin price was trading just under $10,500 at the time of writing to end the week close to where it began. The 9% increase since yesterday once again reflects moves on traditional markets, with the US S&P 500 up 3.3%, the FTSE 100 up 1.7%, and the ASX200 up 7% yesterday. This correlation is a potential danger sign as many pundits tip further falls on traditional markets as the coronavirus death toll rises and economic impacts become clearer. Most of the top ten are trading where they were this time last week: Ether (0.15%), Bitcoin Cash (1.22%), Bitcoin SV (-1.5%) and Litecoin (1.6%). XRP gained a more significant 9.3%, while Stellar was up 2.9%. The crypto Fear and Greed Index is at 10, indicating Extreme Fear – however Bloomberg’s GTI Vera Convergence Divergence Indicator has just flashed its first buy signal in three months.

Source: Independent Reserve Bitcoin/AUD chart

In Headlines

Stablecoins are popular right now

Transaction volumes for stablecoins surpassed $146 billion for the first time ever this quarter, an increase of 8 percent over the previous quarter. Tether on Ethereum accounts for 62% of the total, although DAI saw massive growth of 344% on the previous quarter. According to TokenAnalysts there is currently $1.62 billion of USDT and USDC sitting on the sidelines on just five of the top exchanges, waiting for the chance to jump back in.

Bitcoin price cycles getting longer?

Trader Crypto Michael this week told his 52,000 followers he believes Bitcoin’s price cycles are getting longer: that the 100 Week Moving Average (WMA) was supported in 2012, and the 200 WMA from 2014-2017 (the 200 WMA is hovering around $9500 at present). He now asks if we’ll see a “300-Week MA accumulation before the peak to 2025-2026 with Bitcoin at US$150,000?”

Does US law apply everywhere?

A US judge has granted an injunction against Telegram to prevent it from delivering its Gram tokens to investors. Telegram essentially told the court: ‘fine, we just won’t distribute $688 million worth of tokens to US investors’, and intends to carry on distributing tokens in the rest of the world. But the US Securities and Exchange Commission isn’t happy with that. The Telegram Open Network Community has raised the possibility of simply forking the project and proceeding regardless of what the US courts say.

Addresses with more than 1 BTC hit all time high

According to analytics firm Glassnode, a record 797,000 Bitcoin addresses currently have 1 BTC or more in them. The amount of BTC on exchanges is also at the lowest level in eight months, with outflows increasing daily since March 18. Glassnodes said this could be because investors are: a) choosing to maintain custody of their own assets without middlemen, b) deciding to hold on for the long term and cease trading or, c) concerned about the liquidity of crypto exchanges amid the market downturn.

Hash rate recovers after mining difficulty drop

The Bitcoin network hash rate fell 45% to around 75 TH/s after the recent price crash, but has since recovered to around 100 TH/s after this week’s almost 16% reduction in mining difficulty. The recovery suggests some miners are turning their machines back on – but this is a mixed blessing, as more miners adds to BTC selling pressure, and some argue hash rate is correlated with price.

New Bitcoin price ATH by Christmas?

A survey of 400 VIP customers by Kraken Intelligence – including institutions, traders, exchanges and miners – found a majority believe the Bitcoin price will top the all time high by the end of the year. The average price prediction was US$22,866 (A$37,033) for BTC, and the average price target for Ether was $810 (A$1,311). But cryptocurrency derivatives data provider Skew says the probability of Bitcoin hitting a new all time high by Christmas is just 4%, with the overwhelming majority of options traders tipping BTC will trade below $10,000 in December.

Bitcoin will ‘come of age’ during financial crisis

Pantera Capital Founder and CEO Dan Morehead said in a letter to investors this week he believes Bitcoin will “come of age” during the financial crisis and that it could top its all time high price within 12 months. He conceded Bitcoin has been correlated with share market falls so far this year, but says history shows the correlation tends to end after the first month or two. “We now believe that the short-term high correlation with general markets is over and that crypto will trade independently,” he said. Coinbase CEO Brian Armstrong is similarly upbeat, telling staff this week that “Bitcoin was built for this” and would thrive as money printing caused inflation: “It’s the money that people need right now,” he said.

Until next week, happy trading!

Independent Reserve Trading Desk