In Markets

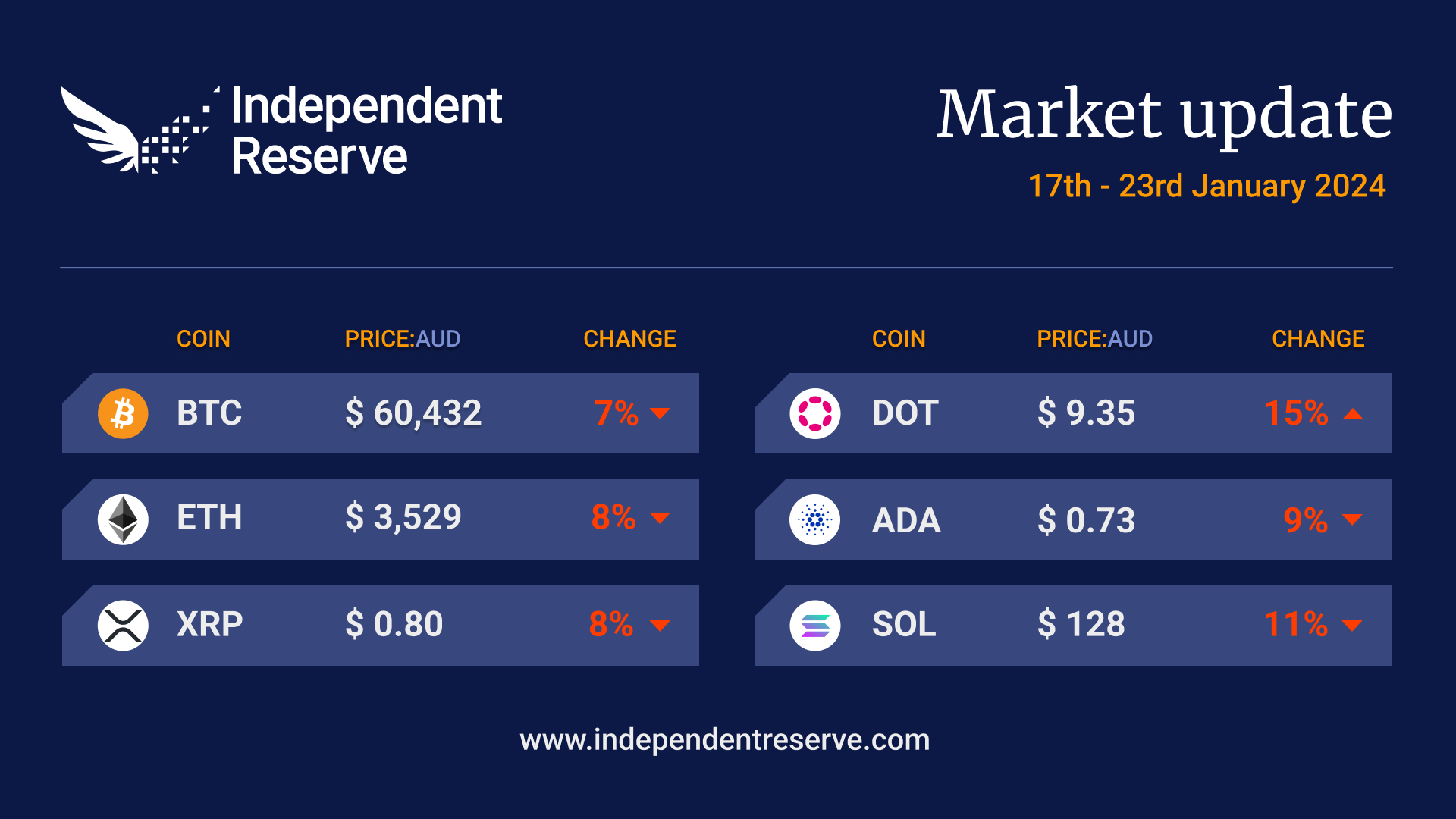

It’s fair to say things aren’t going exactly to plan with the Bitcoin ETFs, with massive outflows from Grayscale sucking much of the fun out of the launch. Bitcoin finishes the week down 6.7% to trade around A$60,430 (US$39.74K), while Ethereum lost 8% and is trading around A$3,529 (US$2,317). Almost everything else was down: Solana (-11%), XRP (-8%) and Cardano (-9%), however, Dogecoin only lost 1% on hopium that the new ‘Xpayments’ account on X might see DOGE added as a payment method. A retracement in the lead-up to the halving is normal according to Rektcapital, who points out that at the same stage in the cycle in 2016 Bitcoin had lost 16%, and in 2020 it was 63%. In traditional markets, the S&P 500 has hit a new all-time high, although there are concerns that interest rate cuts won’t come as quickly as hoped. The Crypto Fear and Greed Index is at 55, or Greed.

From the IR OTC Desk

Post the BTC ETF announcement, trading activity has finally started to calm. This has resulted in both implied and realised volatility falling on the week. As previously highlighted, the broader cryptocurrency market is now monitoring ETF inflows. These flows are analysed relative to expected outflows, as a rudimental guide of market supply/demand.

The largest outflows appear to be coming from Grayscale Bitcoin Trust (GBTC) sellers, who are using the ETF as an opportunity to switch. Specifically, GBTC holders are moving from GBTC to a BTC ETF to pay a lower management fee (GBTC currently charges 1.5%). Additionally, GBTC is now trading near flat to net tangible assets (NTA). In January 2023, GBTC traded at an NTA discount of nearly 50%! With this known, it makes sense to see profit taking into the additional ETF liquidity. It also makes sense that price smoothing continues, with any move higher a liquidity opportunity to sell into. The key question will be how long this continues as the market dynamic.

The highly correlated nature of the cryptocurrency market makes it difficult for layer 1s to perform under an environment of stagnant/falling BTC pricing. So, for now, the market waits for these supply-side dynamics to run their course. This week, US PCE inflation will likely influence US equity pricing and in turn have a small effect on the cryptocurrency complex – although this is expected to be minor. PCE inflation can have a more material effect on US bond yields and equity indices.

The ETH/BTC cross continues to perform, now trading at 0.059. Logically, ETH can continue to outperform in a scenario where the token is unaffected by specific BTC switching/liquidations. As we progress towards the halving date, this is likely to change, however.

In macroeconomics, Friday at 12:30am delivers US GDP (Q4), while Saturday at 12:30am delivers US PCE Inflation (December). PCE inflation is the Federal Open Market Committee’s (FOMC) preferred measure for inflation and will be a critical data point for their 30 January meeting (the first of the year). The current market consensus for Core PCE Inflation YoY (Dec) is 3%, relative to a 3.2% print in November. This data can cement the recent economic theme of sharply falling inflation. Watch this space carefully.

On the OTC desk, USDT has been trading materially below 1:1 USD. This has seen USDT sellers patiently wait for better levels to convert. Quite tellingly, buyers also await more stability in cryptocurrency tokens too! As we break up on desk flows by geography, Singapore-based USDT buyers have been more inclined to take advantage of these suppressed levels, and this is a theme we think will continue. We patiently wait for sell side flows to pass.

For any further information, please feel free to reach out.

In Headlines

Grayscale goes against the flow

When will the bleeding stop? The bad news is that Grayscale still has another 549K Bitcoin left to sell. The good news is that roughly half the selling pressure so far was revealed to have come from the FTX estate selling all of its 22 million shares — and that’s over now (FTX’s sister company, Alameda, has also dropped its lawsuit against Grayscale). JPMorgan analyst Nikolaos Panigirtzoglou expects another US$1.5B (A$2.3B) of “profit taking” will still flow out of GBTC – investors are also departing due to high fees and the end of the discount to NAV. Earlier today, Lookonchain reported Grayscale had deposited another 15,308 BTC to sell on Coinbase Prime. At the time of writing, Monday’s inflow figures had yet to be released, but volume was above US$2B (A$3B).

Overall picture is still positive

At present, the nine new Bitcoin ETFs have been buying up more Bitcoin than Grayscale has been selling. The picture is complicated due to delays in reporting (GBTC is yet to update Friday’s figures), but at present, the new ETFs have snapped up 94,256 Bitcoin, which is a net gain of 27,836 Bitcoin after accounting for Grayscale’s reported selling to date. BlackRock and Fidelity have amassed 63,500 Bitcoin between them and are in the top 2% of all US ETFs for daily volume. So, if the inflows into the ETFs are positive, why is the Bitcoin price going down? Lots of things apart from ETFs affect the Bitcoin price, of course, including derivatives leverage, profit taking, and miners dumping more than 10,000 Bitcoins in a day. Glassnode analyst Checkmate noted we’ve seen “the largest profit-taking event since the November 2021 ATH.”

Ethereum client bug

A hotfix was rolled out on Monday to address a critical consensus bug in Ethereum client Nethermind that prevented node operators from validating blocks. The incident has refocused attention on client diversity. Nethermind accounts for just 8.2% of clients, but Geth powers 84%, meaning a similar bug in Geth, could knock out the majority of the Ethereum network.

Ethereum upgrade

Ethereum’s Dencun upgrade hit the Goerli testnet on January 17, introducing several improvements, including EIP-4844 or “proto danksharding”, which is expected to lower costs on Layer 2 networks by a factor of 10. The Prysm client encountered a bug that took four hours to fix, but that’s the whole point of testing. The upgrade will hit another couple of testnets before a decision is made to proceed for real.

Coinbase in court

Coinbase had its day in court this week, with crypto-savvy District Judge Katherine Polk Failla hearing its arguments over a motion to dismiss the SEC’s case against it for selling unregistered securities. Coinbase argues the SEC’s definition of securities is so broad it could encompass Beanie Babies. Bloomberg Intelligence litigation analyst Elliot Z Stein says he left the hearing “thinking COIN would win full dismissal”, and if not outright on this motion, then later. Stein gives Coinbase a 70% chance of success, and for context, he was correct in his 70% prediction of Grayscale winning its case against the SEC last year, which led to the Bitcoin ETFs.

Binance in court

On Monday, Binance was seeking to dismiss the SEC’s case against it, which hinges on whether the coins traded on Binance are securities. As a number of legal commentators have pointed out, the SEC has been inconsistent on the law and argued in the Ripple and LBRY cases that the tokens themselves are not investment contracts, but in today’s Binance hearing, the SEC argued, “the token itself represents the investment contract.” In related news, the SEC admitted today that it disabled two-factor authentication on its X account because staff thought it was too much of a faff to use, leading to the account being hacked.

Crypto crime report

The latest annual crypto crime trends report from Chainalysis shows that just 0.34% of the cryptocurrency transaction volume last year was received by illicit addresses. That’s a 40% decrease from 2022, although it’s a running tally that’s expected to increase as more illicit addresses are identified. Stablecoins remain the currency of choice for criminals. Scams fell 29.2%, and hacks dropped 54.5%.

Developers report

Electric Capital’s developer report shows that almost nine in ten multichain developers are working on an Ethereum Virtual Machine compatible chain. Despite the bear market of 2023, the number of experienced devs who’ve been working in crypto for more than a year grew by 16%. Ethereum also attracted 16,700 new devs, which is triple the number on Polygon and four times that of Solana.

Bit and pieces

Presidential candidate Donald Trump this week vowed he would “never allow” the creation of a CBDC in the United States. The SEC has delayed its decision on Fidelity’s bid to launch an Ether ETF. The real decision will likely be made just before the May 23 final deadline for Van Eck’s spot ETH ETF. Direxion, Proshares and Rex Shares have each filed for numerous leveraged Bitcoin derivatives ETFs each.

Until next week, happy trading!