In Markets

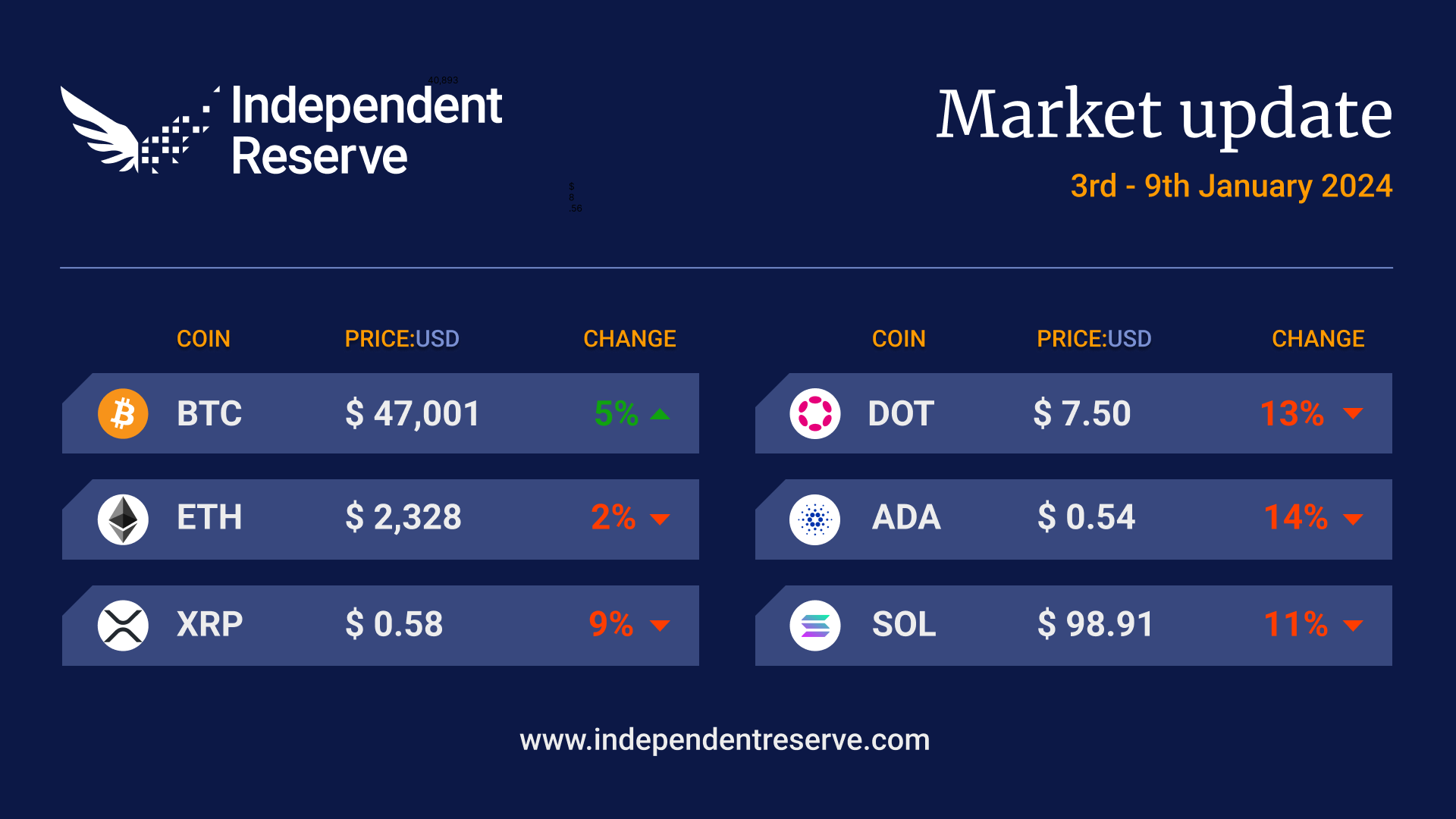

Bitcoin volatility increased this week ahead of the January 10 deadline in the US for a decision on the Bitcoin ETFs. The price fell below A$63K ($42K) on a report that the ETF would be denied and then surged again today on renewed confidence to top A$70K (US$47K). Alex Thorn, head of research for Galaxy, says that after ETF approvals, such sharp price action could become a thing of the past: “Volatility will likely dampen, along with inter-crypto cyclicality given AUM stickiness.” The price surge saw Bitcoin’s market cap once again overtake Facebook‘s. At the time of writing, Bitcoin was up 5% on the same time last week to trade at A$69,763 (US$47,100). Ethereum was flat this week and is trading around A$3,480 (US$2,328). Solana fell 11%, XRP lost 9%, Cardano was down 14%, and Dogecoin retreated 12%. The Crypto Fear and Greed Index is at 76 (+5) or Greed.

From the IR OTC Desk

As we welcome 2024, cryptocurrency euphoria continues. This week, sentiment hinges on a spot BTC ETF approval. Currently, the market is expecting that a number of spot US BTC ETFs will be approved on or before the 10th of Jan. This is the deadline date for the Ark 21 Shares application. Like the rest of the market, we wait patiently for any news. Either way, volatility is sure to remain elevated over the next few weeks while news is digested and embedded into the spot BTC price.

If approval is gained, we expect the market to move into a state of monitoring ETF AUM inflows. Currently, a number of ETF participants are offering reduced fees as an incentive to hit a nominal AUM targeted portfolio size. It makes intuitive sense, then, that monitoring month-to-month inflows will likely be the market’s next key area of interest if any approval is gained.

At the time of writing, 10 potential issuers have filed updated ETF S-1 application forms.

If Q4 2023 was defined as a cryptocurrency market driven by Solana (SOL) and, more broadly, tokens on the Solana ecosystem, Q1 2024 is set to be BTC. This week, BTC euphoria has failed to lift SOL back above US$100. SOL reached a 2023 high price of US$123.76 on the 26th of December.

In contrast, today, BTC has traded at its highest level since December 2021. Interestingly, ETH/BTC is now trading under 0.0500, a level we have not seen since April 2021 and (technically) looks to maintain its downward trend. ETH/BTC is sure to be well discussed during 2024. If a BTC US spot ETF receives approval, the market’s next focus is sure to be an ETH US spot ETF application. Watch this space.

Despite global central banks remaining on holiday, the economic calendar very much continues this week.

On Friday at 12:30am AEDT, we receive US inflation data for December, while on Saturday at 12:30am we receive US PPI data for December. In addition, Friday 12:30pm delivers China inflation data for December. Broadly speaking, the trend of lower core inflation numbers will continue to buoy risk assets.

On the OTC desk, USDT buying remains a central theme. While the majors (BTC and ETH) have only maintained a slight buying bias, despite the positive price action. Requests for SOL token have taken a breather; however, interest remains in tokens on the Solana ecosystem. Expect volatility to remain high this week as the ETF deadline approaches.

For any further information, please feel free to contact our crypto OTC desk.

In Headlines

Bitcoin ETF decision imminent

A decision on approving a raft of Bitcoin ETF applications could come through at any moment. However, BlackRock and the Bloomberg ETF analysts believe a January 10 approval is most likely. That’s the final date for a decision one way or another, and if it could be a way for SEC boss Gary Gensler to signal that the ETF is only grudgingly being approved because the regulator has been backed into a legal corner. Gensler wrote a thread about the dangers of investing in crypto this morning, which racked up 23 million views in about six hours. There has been a flurry of paperwork, with applicants filing their final 19b-4 forms at the end of last week and their S-1 form amendments yesterday (apart from Hashdex).

The filings reveal a race to the bottom on fees: Ark has a 0.25% fee waived for six months, and BlackRock is charging 0.3% (but 0.2% for the first 12 months). The annual fees for both products undercut the trading fee on a single swap on Coinbase. Analyst Nic Carter suggests the fee war indicates the funds expect massive inflows. Another view comes from GTS co-global head of ETF trading Reggie Browne, who believes the ETFs could trade at a premium of up to 8% on the underlying value of the Bitcoin they hold, which would make up for the low fees. Grayscale, however, will charge a 1.5% fee. VanEck will reportedly seed its ETF with US$72.5M (A$108M), BlackRock (US$10M/A$15M) and Fidelity (US$20M/A$30M), while Bitwise is seeding it with US$500K (A$744K) initially but Pantera will reportedly tip in US$200M (A$297M) on approval. There will be a short period between any approvals and when the funds can start trading.

ETF news not priced in

Crypto traders have been all over the potential ETF approvals since October. However, the news has not filtered through the ranks of TradFi just yet, suggesting it’s not priced in. A survey by Bitwise found just 39% of US-based financial advisors believe a Bitcoin ETF will be approved in 2024 at all, much less tomorrow.

How much is enough?

Bloomberg analyst James Seyffart estimates that around US$10 billion (A$15B) will flow into the ETFs in the first year, but it might get off to a slow start as institutional investors will need to carry out due diligence first before getting exposure. Standard Chartered meanwhile expects up to US$100 billion (A$149B) inflows into Bitcoin ETFs this year based on the historical performance of Gold ETFs, and for that to propel Bitcoin to US$200K (A$297K) by the end of next year. Not to be outdone, PointsVille founder Gabor Gurbacs argues that “Bitcoin/assets have no top, because fiat has no bottom” and that he expects USUS$2.5 trillion (A$3.72T) to flow$2.5 trillion (A$3.72T) to flow into the ETFs over the longer term.

Still a small chance Gensler could rug us all

While all signs point to yes, approval is not yet a done deal, and Singapore-based Matrixport caused a Bitcoin price crash this week by releasing a contrary report titled: “Why the SEC will REJECT Bitcoin Spot ETFs again.” Analyst Markus Thielen argued that Gensler “still sees this industry in need of more stringent compliance. From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimise Bitcoin as an alternative store of value.” The controversy over the report saw company founder Jihan Wu forced to put out a statement saying the analyst had no inside information and was just voicing an opinion. Bloomberg analyst James Seyffart meanwhile dropped his estimate of the chances of denial from 10% to just 5% and highlighted three possible but unlikely scenarios: “1) Ark withdraws with assurances about March (unlikely). 2) Genz goes nuclear & SEC denies using new reasons or ignores the court, knowing they’d end up back in court (again–Unlikely). 3) Biden admin comes down and does something to stop this (unlikely).” This is crypto, so preparing for the unexpected never hurts.

Source: Midjourney AI. Gary Gensler preparing to pull the rug on investors.

Allegedly dodgy currency group

Digital Currency Group announced it had paid back US$700 million (A$1B) it owed to its subsidiary, the collapsed crypto lending platform Genesis. CEO Barry Silbert broke the news on a Friday night, which is the traditional time to bury bad news stories. Commentator Vijay Boyapati took aim at DCG’s “chicanery” and, in a thread to his 156K followers, he untangled what he alleges is a complicated web of dodgy loans and repayments that stemmed from a “promissory note” that DCG provided Genesis to prop up its finances back in June 2022 when he says it should have declared bankruptcy. That note made it look to Gemini Exchange as if Genesis was solvent, which the exchange blames for keeping their Gemini Earn customers in Genesis, leading to more than a billion dollars of user assets being frozen. The repayment is not actually for the note, but it’s the final payment for a loan of 18,697 Bitcoin DCG taken from Gemini around the same time. Boyapati says part of that loan was paid off with Graysacle BTC Trust shares trading at a big discount (DCG also owns Grayscale), and this final repayment was in Grayscale’s illiquid ETHE and ETCG shares. Gemini Earn users are due to vote this week on whether to accept a repayment plan that will see them given their crypto’s much lower dollar value at the time of the bankruptcy rather than the much more valuable crypto itself.

15 years since the Genesis block and Bitcoin is on its way to the moon

It’s been 15 years since the Genesis block — the first Bitcoin block — was mined on January 3 2009, by Satoshi Nakamoto. For some reason, this week, a fan sent 26.9 Bitcoin to the first-ever Bitcoin wallet, known as the Genesis wallet. And a physical Bitcoin blasted off today onboard the Peregrine Mission One, a commercial operation that is expected to land on the moon on February 23.