In Markets

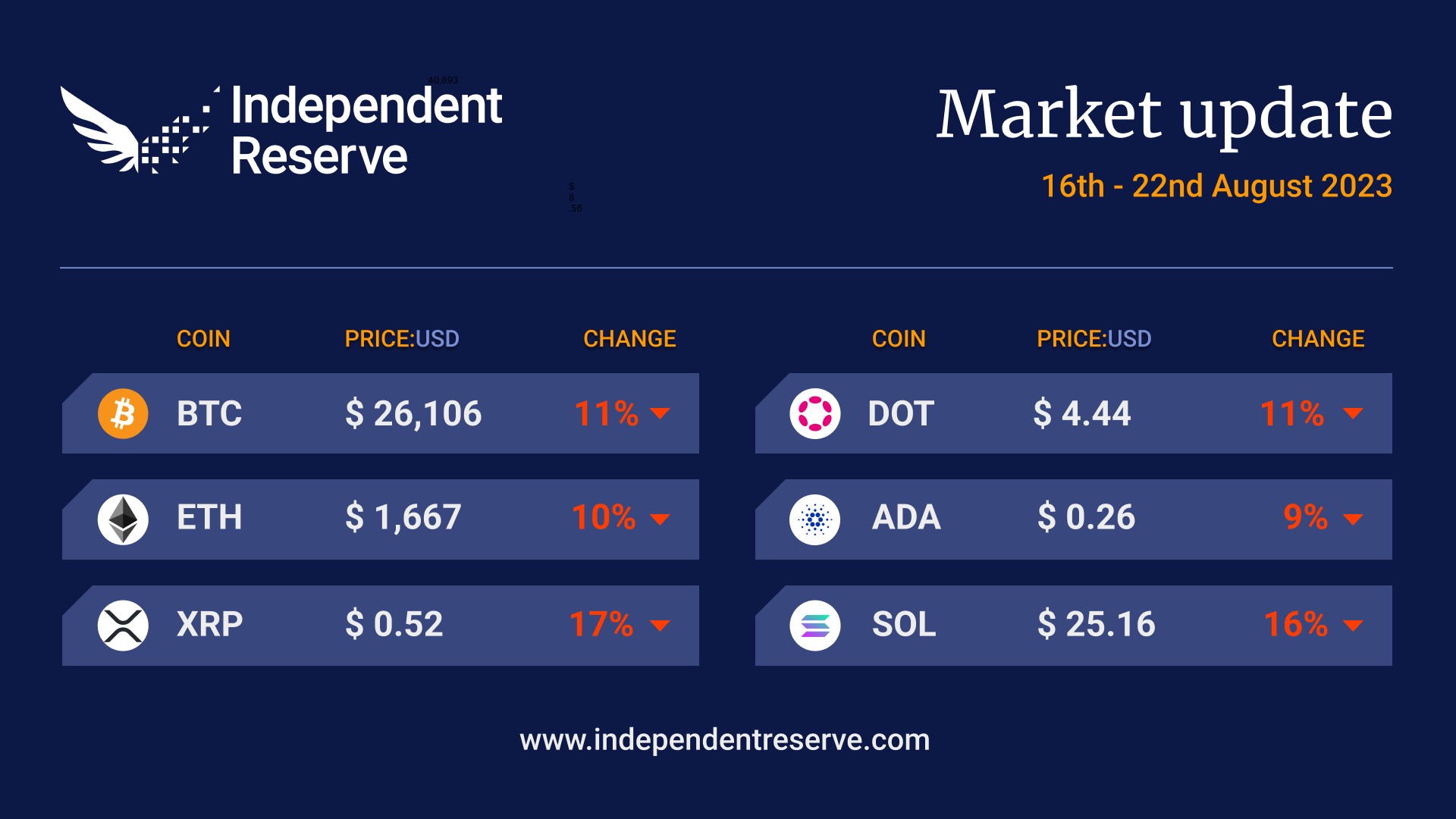

Bitcoin’s months-long sideways action ended with a bang late last week when the price dropped about 8% in ten minutes on Friday. Around US$2.5 billion of open interest in derivatives markets was cleared out in a few hours. The likely catalyst was some reheated old news about SpaceX writing down its BTC holdings and selling, but there are also fears over the Chinese economy, speculation about potential US interest rate rises, and the possible price impact of a rise in government bond yields. Bitcoin finishes the week down 11% to trade at US$26.1K, while Ethereum fared slightly better with a 10% drop to US$1,670. Everything else lost ground significantly, including XRP (-17%), Cardano (-9%), Dogecoin (-16%) and Solana (-16%). After a few months at Neutral, the Crypto Fear and Greed Index has fallen to 38, or Fear.

From the OTC desk

Cryptocurrencies have experienced a week of high volatility. Weaker global equity prices and increasing US bond yields have caused a pullback in cryptocurrency prices. The rapid speed of the intra-week move is a telling reminder that cryptocurrencies remain a developing market (which remains more susceptible to pockets of illiquidity). We continue to focus on BTC, ETH, LTC and BCH as a basket for general cryptocurrency market sentiment.

For the last few weeks, we have been highlighting large volumes of options trading activity in BTC. It is hypothesised that this increase in activity is specifically related to the event risk of a US spot BTC ETF approval. In general, the market has been trying to ‘date pick’ an approval timeline. While it remains unconfirmed, cryptocurrency pricing this week appears to have been exacerbated by the forced market liquidation of leveraged BTC futures positions. The catalyst being the expected approval time for a US spot BTC ETF moving from the end of 2023 to ‘sometime in 2024’. Without further clarification, the broader cryptocurrency market remains confused on the current pathway for approval and would benefit greatly from some SEC clarification.

The developing macroeconomic landscape has broadly focussed on: 1) increasing long-dated US bond yields; 2) softer data from China.

US 10yr treasury yields are now at their highest level since 2007 (!!), reflecting a market expectation that yields will remain elevated for longer. In general, risk assets are negatively correlated with higher yields – although the balance of supply and demand remains critical. This week, Federal Open Market Committee Chair Powell will speak at the Jackson Hole symposium. The bond market will watch carefully for any discussion on the trajectory of monetary policy.

Softer China data remains of material concern for global macro markets – particularly Australia and the AUD exchange rate. This week, China has continued to reduce their front-end lending prime rates, with the 1yr Loan Prime Rate reducing from 3.55% to 3.45%. Of surprise to the onlooking trading market, the 5yr Loan Prime Rate has remained unadjusted at 4.20%. There remains an expectation that China will provide a large amount of economic stimulus to offset slowing growth and weakening property prices – so far however, this has not eventuated. Credit risk in the onshore property segment remains highly elevated and should be watched carefully.

On the OTC desk, stablecoin conversion back to AUD has remained the primary flow. Of interest, we have been following the market cap of both USDC and USDT, which continue to diverge. USDT has remained the stablecoin of choice for access to both altcoins and decentralised finance. Stablecoin selling activity remains during the Asian trading session, relative to Europe and the US.

For the last few weeks, the softening of AUD/USD has resulted in the outperformance of AUD-denominated cryptocurrency pairs. As AUD/USD stabilises around USD 0.6400, this outperformance may reduce. While trading activity in BTC and ETH has remained constant, the OTC desk saw more sellers than buyers last week. This can change quickly with price stability.

For any further information, please feel free to reach out.

In headlines

This year, the largest single-day Bitcoin price plunge came shortly after breathless media reports that Elon Musk’s SpaceX had sold its stack of US$373 million worth of Bitcoin. The reporting made it sound like the big news had just happened. However, the story was based on a vague reference in the final paragraph of a Wall Street Journal report looking over SpaceX’s financials. The WSJ said SpaceX had written down the value of its Bitcoin holdings in 2021 and 2022 and “has sold the cryptocurrency,” which could mean all, or just some. It’s also possible some people got confused between Tesla and SpaceX. Although Musk revealed SpaceX had bought some Bitcoin in 2021, he never mentioned how much. Meanwhile, Tesla bought US$1.5B at the same time and sold 72% of it in the first half of 2022.

Taking to the green for Community Chest

Independent Reserve, the first licensed cryptocurrency exchange in Singapore, is demonstrating its commitment to local communities by sponsoring and participating in the inaugural World Corporate Golf Challenge. The event supports Community Chest, the philanthropy arm of the National Council of Social Service in Singapore. A significant portion of the registration fees will go to Community Chest, benefitting over 100 social service agencies.

Ether futures ETF to debut soon

The SpaceX news rather overshadowed a Bloomberg report that same day claiming sources had told it the SEC will not block Ether Futures ETF applications. Ether recovered 8% on the news. A subsequent report in the Wall Street Journal suggested the SEC will greenlight multiple Ether Futures ETFs at the same time. There are 16 applications in total with the Volatility Shares product likely to be the first to market on October 12 (though Valkyrie and Bitwise’s dual Bitcoin/Ether future funds may debut prior to that). The WSJ added the rider that “the launch of an Ether futures ETF is still not guaranteed.” Meanwhile, two years after it was approved, the first spot Bitcoin ETF in Europe — the Jacobi FT Wilshere Bitcoin ETF — was listed on the Euronext Amsterdam stock exchange. Coinbase also got the nod from regulators to launch its own Bitcoin and Ether futures regulated by the Commodity Futures Trading Commission.

As always, after a big price drop, the pundits start predicting further falls, with the US$20K mark getting an airing. Glassnode’s weekly trawl through the data notes that 88.3% of short-term Bitcoin holders are at a loss which could mean further selling to stem losses. The short-term holder volume to exchange bias metric shows the lowest reading since the March sell-off to US$19.8K. Glassnode also highlighted the realised loss momentum metric and noted that while false signals do occur, “Sustained declines have also preceded more violent downtrends such as in May and Dec 2021, making this week’s sell-off one to keep a close eye on.”

USDC to expand

USDC has had a horror year after getting caught up in the bank collapses in the US. Its recovery plan will see USDC expanded to six new blockchains, bringing the total to 15. Coin Desk reports Polkadot, Near, Optimism and Cosmos are likely candidates. Coinbase has also taken a minority stake (without handing over any cash, according to sources), and the two companies are dissolving the Centre Consortium partnership, with Circle bringing issuance and governance fully in-house.

XRP still won’t be a security after appeal

Despite Bloomberg’s headline stating, “SEC Moves to Appeal Ripple Ruling That XRP Token Is Not a Security”, that’s not actually happening, and the SEC accepts the XRP token itself is not a security. In its motion, the SEC stated it “does not seek appellate review of any holding relating to the fact that the underlying assets here are nothing but computer code with no inherent value.” Judge Analisa Torres has given the SEC permission to file a motion for the appeal but is yet to actually decide whether to grant the appeal itself. Ripple, of course, argues she shouldn’t.

Hopium #1

Fundstrat’s Tom Lee says that if a Bitcoin ETF is approved, the price could skyrocket to US$150,000 to $180,000 by the end of next year. Speaking to CNBC Lee said, “If the spot Bitcoin [ETF] gets approved, I think the demand will be greater than the daily supply of Bitcoin,” he said. “So the clearing price — this is done by our crypto digital strategist — is over $150,000. It could even be like $180,000.” Lee has made a lot of bullish predictions in the past, however.

Hopium #2

A mysterious Bitcoin whale address has accumulated US$3,087,545,354 worth of Bitcoin in less than three months. It is now the third biggest Bitcoin address in the world according to BitinfoCharts, which said the address began accumulating in May and is now the largest BTC address not identified as a crypto exchange. There’s probably a boring explanation like an exchange reorganising its Bitcoin reserves, but the social media hopium is that it’s US$9.4 trillion asset manager BlackRock accumulating BTC ahead of the possible launch of its Bitcoin ETF.

Until next week, Happy Trading!