In markets

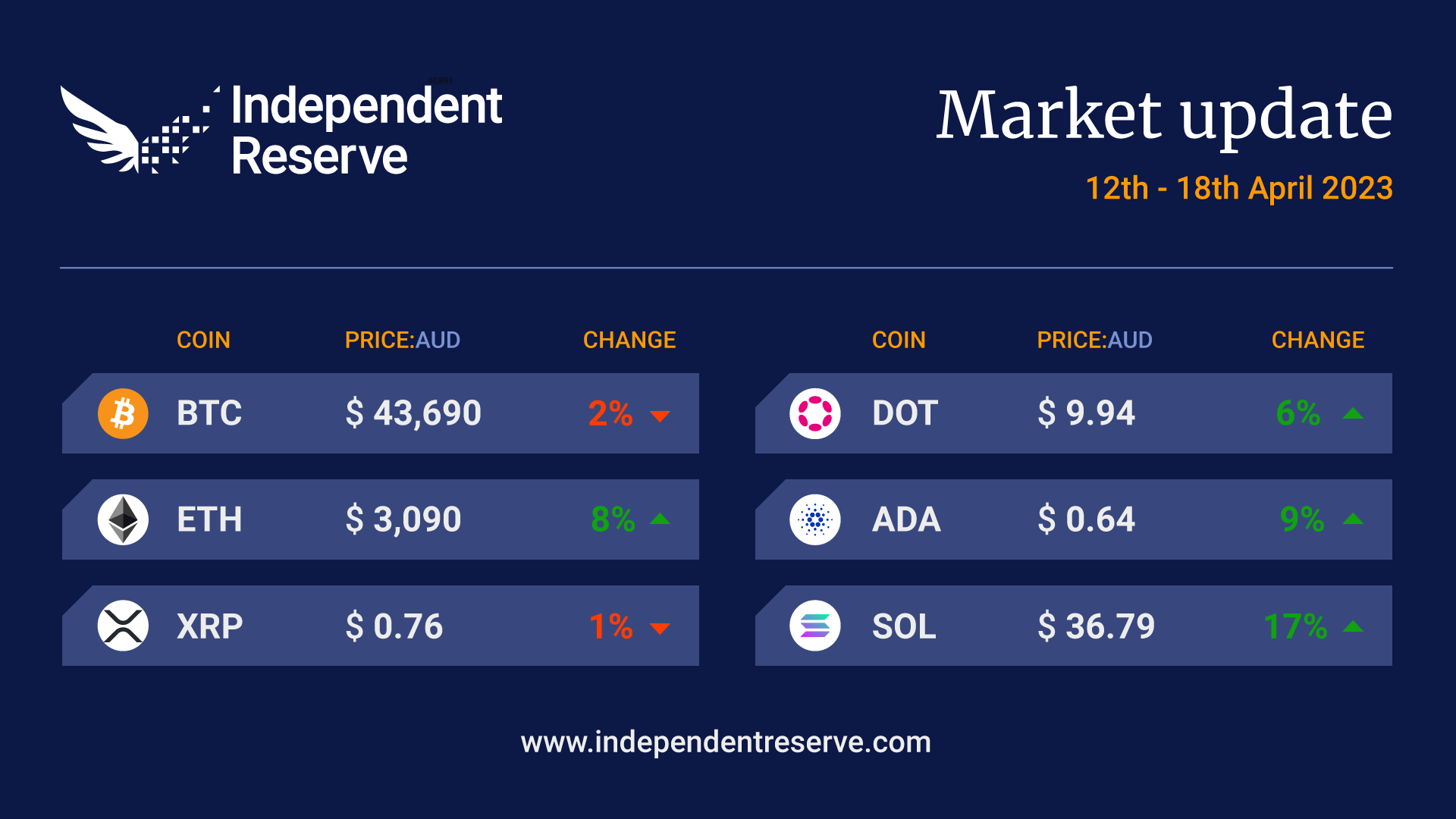

There are mixed signs on the health of the US economy, with Morgan Stanley CIO Mike Wilson stating that a “credit crunch has started” due to a very sharp decline in lending related to the collapse of Silicon Valley Bank. Balancing that out, BlackRock CEO Larry Fink said that the large amount of stimulus flowing into the economy will prevent “a big recession” (though a small one will probably happen). We’ll get a better view of what’s happening soon, with Morgan Stanley, Netflix, and Tesla all set to report first-quarter results this week. Bitcoin threatened the US$31K mark (A$46K) but finished the week close to where it began at A$44K (US$29.5K). Ethereum surged to an 11-month high following its latest upgrade topping US$2,100 (A$3,130). It remains up 9.2% on last week at A$3,100 (US$2,080). XRP finished the week flat, Cardano gained 10.1%, Dogecoin (8.5%) and Polygon (3.3%). The Crypto Fear and Greed index is at 69 or Greed.

From the OTC desk

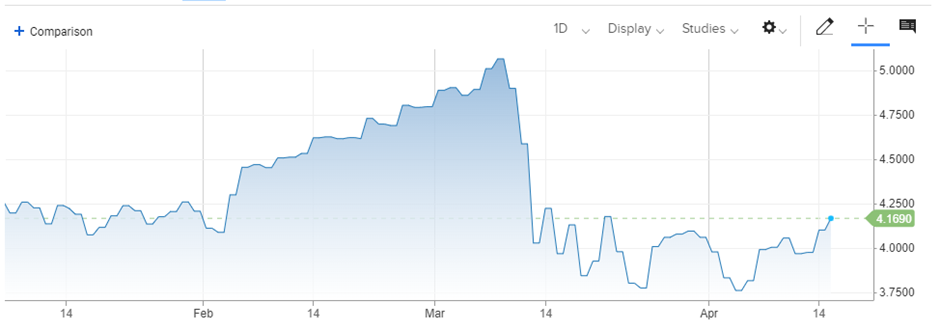

Following the fall of Silicon Valley Bank (SVB) and Credit Suisse (CS), the yield on the US 2yr Treasury note moved from circa 5% to below 4% (currently trading at 4.16%). This reflected the market’s expectation that the Federal Open Market Committee (FOMC) would be unable to sustain higher rates in 2023/2024 as credit conditions softened. The bond market was anticipating that the FOMC would ultimately be required to relax financial conditions due to softer growth, increasing unemployment and falling inflation.

US 2-year treasury note yield

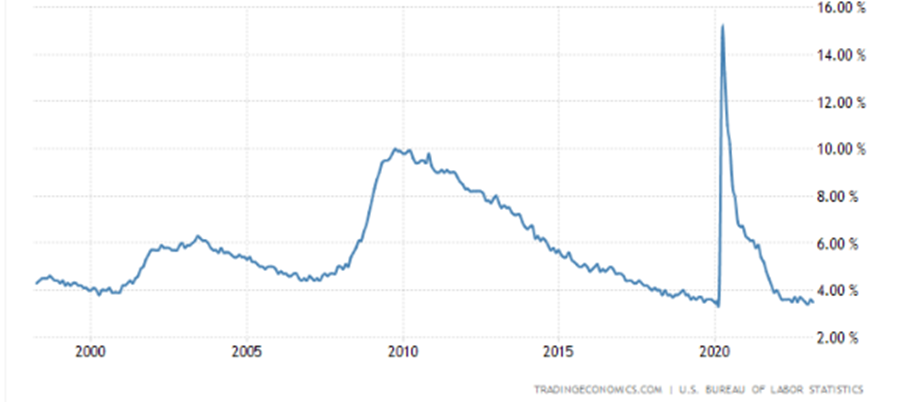

So far, the communication from the FOMC has not portrayed this thematic and has remained consistent in rhetoric and expectation that further monetary policy tightening is most likely needed to combat high core inflation. The US economic data has too, so far, remained resilient, with the unemployment rate remaining at a multi-decade low. Risk assets however, have pointed squarely at the bond market as a sure sign of a future easing in credit conditions.

US unemployment rate

Without financial turmoil, or increasing labour market slack, it seems logical that the sharp fall in the 2yr Treasury Note should retrace in some capacity. Higher bond yields (which have been retracing some of the market moves post SVB and CS), have been the macroeconomic theme this week. The question for cryptocurrency markets is whether this retracement has further to run and if financial conditions will continue to tighten. The answer will be dependent on future economic data (data dependency). So far this week however, fixed income, equities and cryptocurrencies have all moved in different directions for different reasons. This seems unsustainable in the medium term.

In Australia today, we received the Reserve Bank of Australia (RBA) Meeting Minutes for April. Describing the International Financial Markets landscape, the RBA noted:

Government bond yields had declined and their volatility had increased significantly, particularly for shorter-term maturities, as market participants adjusted their expectations for the path of policy rates and demand for liquidity increased.

For domestic policy considerations, the RBA also noted:

..it was important to be clear that monetary policy may need to be tightened at subsequent meetings and that the purpose of pausing at this meeting was to allow time to gather more information.

With the Q1 inflation data in Australia scheduled to be released on Wednesday the 26th, it will soon be known whether the RBA can remain on hold for a sustained period ahead. Last week’s employment report highlighted the tightest Australian labour market in 50 years – with the unemployment rate remaining at 3.5%. Watch this space.

In cryptocurrencies, a smooth Shapella upgrade resulted in short positions being liquidated and the price of ETH moved higher. Pre-fork, the market’s expectation was that unlocked ETH 2.0 would cause substantial sell side pressure – so far this hasn’t eventuated. Last week we wrote that BTC was leading ETH, which was in turn leading alts. This week it was ETH’s turn to guide the cryptocurrency complex. For the time being, ETH remains the most critical input to the price volatility of cryptocurrencies.

On the OTC desk, the price of USDC continues to exhibit varying prices based on traded geography. Right here and now, the market price of USDC is very different in the Asian time zone than the US. This is due to the change in speed of USD settlements following the cancellation of Signature bank’s SIGNET network. In general, USDC and USDT have been well sold during the Asia trading session. We continue to profile the price of USDT, relative to peg, as a good proxy for alt allocation.

For any further information, please feel free to reach out.

In headlines

Shapella is a “bullish event” for ETH

Ethereum’s Shapella hard fork was a success, and predictions that a huge wave of withdrawals would put pressure on the price appear unfounded. Instead, Ethereum gained 10% in a day. The withdrawal queue is currently at 920.59K ETH. Interestingly, while 1.06M ETH has been withdrawn, 452K ETH has been deposited since the fork. It’s also worth noting that around 551,000 ETH is being withdrawn by Kraken, whose staking program was shut down by the SEC. Grayscale analysts Matt Maximo and Michael Zhao put out a report concluding that: “Looking ahead, we think this is a bullish event for Ethereum, as reducing staking risks could boost the baseline demand for ETH.”

Now what?

You’re only as good as your next hard fork, and Ethereum cofounder Vitalik Buterin is targeting early 2024 for the “proto danksharding” upgrade. Buterin suggested Shapella was basically unfinished business from The Merge and the proto-danksharding upgrade is essential to avoid “$500 transaction fees” in the next bull run. The upgrade is called EIP-4844 and increases the throughput of layer-2 scaling solutions by helping with data availability through the use of “blobs” that contain large amounts of data. The upshot is a 10x improvement in scaling, and even greater scaling will come with full danksharding later on.

US war on DeFi

The US war on crypto moved up a gear this week as the Securities and Exchange Commission voted to clarify rules to ensure DeFi projects can be considered securities exchanges. “In particular, the proposal would require communication protocols—venues that bring together buyers and sellers of securities through structured methods to negotiate a trade—to comply with rules for exchanges,” SEC Chair Gary Gensler said. The SEC documentation spent a lot of time noting why objections from crypto industry figures are not valid, including the idea DeFi projects simply would not be able to comply with the requirements. The move will likely push DeFi projects out of the US, but given the US believes its crypto laws apply worldwide (if Americans can access the site), the legal threat to DeFi projects everywhere just increased.

Split vote

Two of the SEC commissioners voted against the rules, and Commissioner Hester Pierce argued that its “ambiguity undermines fundamental First Amendment protections… Because the release makes everybody involved in the relevant blockchain ecosystem part of a ‘group,’ it creates significant ambiguity around what speech requires government pre-approval, which will unavoidably chill constitutionally-protected speech.” Invoking free speech protections for DeFi might sound like a weird argument, but in 1999 courts ruled against a US law prohibiting the export of cryptography on free speech grounds.

SEC sues Bittrex

The SEC has filed a complaint against exchange Bittrex for operating an unregistered securities exchange, broker and clearing agency. The Wall Street Journal had earlier reported that a Wells Notice in March appears to have chased the exchange out of the country. Ironically, one of the tokens the SEC claims is an unregistered security is Algorand, and footage emerged today of SEC boss Gary Gensler praising Algorand “as a great technology.” John Reed Stark, former chief of the SEC office of enforcement wrote that the various enforcement actions “indicate that crypto-exchanges, platforms, etc. will have to stop doing business in the US, at least in their current form.”

Twitter enables crypto trading

Elon Musk’s plans to turn Twitter into an “everything app” are gathering pace. CNBC reported it has partnered with eToro to allow stock and crypto trading from the platform. Trading will be available through the “cashtags” that currently allow users to view real-time trading data from Tradingview.

FTX returns in 2024

The scandal-plagued FTX exchange looks like being resurrected in the second quarter of 2024, according to lawyers for the firm. The FTT token price doubled on the news. The lawyers also told an April 12 bankruptcy court hearing that the company had recovered about US$7.3 billion (A$10.9B) in liquid assets. Meanwhile, a Swiss court has greenlit the sale of FTX Europe and 133 other subsidiaries.

Bitcoin to US$40K

Veteran trader Peter Brandt revealed on Twitter (possibly inadvertently) that his Factor LLC positions are long Bitcoin, Nasdaq and Gold. Brandt’s technical analysis suggests Bitcoin formed and broke out of a “fulcrum bottom pattern” and was on its way to US$40K (A$59.7K). Back in March, Brandt tipped Bitcoin would break its all-time high of US$69K (currently A$103K) within 12 months. Not everyone is bullish, with DataDash host Nicholas Merton telling his half million subscribers that he’s now shorting Bitcoin because the recent price surge was a relief rally trap caused by “over exuberance.”

Until next week, Happy Trading!