In markets

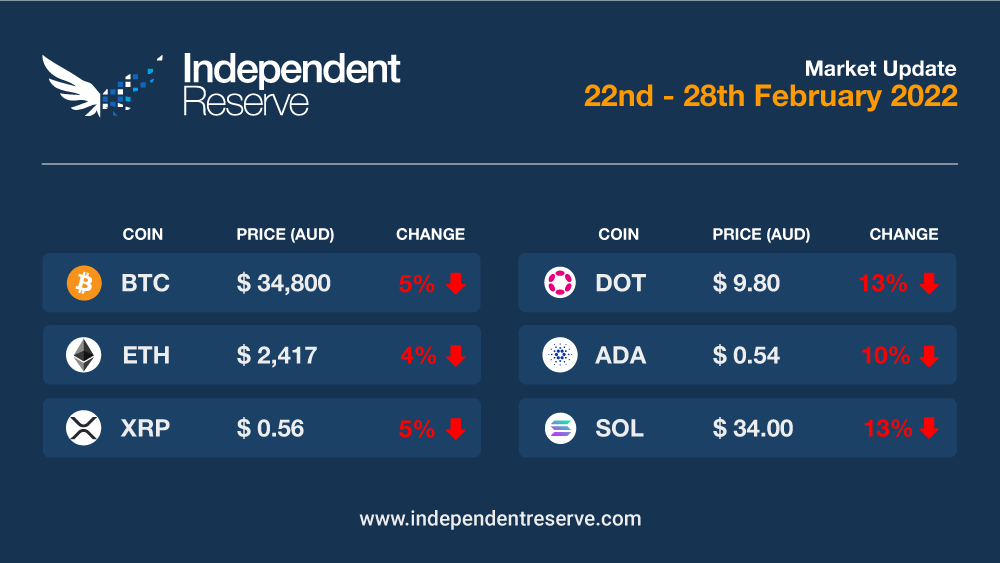

Investors seemed a little ambivalent this week, with Glassnode data showing that US$3.9 billion (A$5.78B) of Bitcoin flowed into exchanges over the past week… while US$3.8 billion (A$5.64B) flowed out. The macro picture was complicated by the release of a US Department of Commerce report indicating that the personal consumption expenditure price index rose 0.6% in January. Bitcoin finishes the week down 5.4% to trade around A$34,690 (US$23,385), while Ethereum was down 4.2% on the same time last week at A$2,410 (US$1,624). Ripple fell 4.9%, Cardano was down 10.2%, Dogecoin lost 7.9%, and Solana fell 13.5%, after the network was halted for the tenth time. The Crypto Fear and Greed Index is at 50 or Neutral.

From the OTC desk

The ‘toing and froing’ in cryptocurrencies has continued this week. This has been driven by a short-term decoupling of cryptocurrencies from other high beta risk assets. We speculate that the positive crypto inflows are likely the result of the most recent headlines out of Hong Kong, which may turn the country into a crypto trading hub; as well as continued inflows into non-stable coins from Paxos no longer being able to mint BUSD.

The headwinds have remained in the macro landscape. With the US 1 yr Treasury yield trading above 5%, and the market pricing in a higher terminal interest rate for the US yield curve this week, equities have broadly struggled. In general, history has taught us that sell side flow in equities tends to translate into softer cryptocurrency prices.

Critical to the macroeconomic landscape was stronger than forecast US PCE (Personal Consumption and Expenditure price index) inflation. As previously communicated, PCE is the Federal Open Market Committee (FOMC)’s preferred measure for inflation. With Core PCE MoM (Jan) coming in at 0.6% relative to a 0.4% forecast, or 4.7% (YoY) relative to a 4.3% (YoY) forecast, the market is now concerned that the pace of downward inflation adjustments has stalled. This would be particularly alarming for the FOMC, who will now have to re-evaluate their approach to monetary policy.

Last week we highlighted a dramatic shift in cash rate expectations for Australia – and mentioned that the terminal cash rate is forecast to reach near 4.3% in Q3 2023! This week Westpac have also updated their RBA cash rate forecast, hypothesising that the terminal rate in Australia will now reach 4.1% as their official forecast. This week will deliver Q4 GDP, which is scheduled for Wednesday at 11:30am. The current expectation is for a 2.7% YoY growth rate. Watch this space.

On the OTC desk, BUSD has regained its peg. Despite the price recovering, caution has remained in the wholesale market about the fungibility of BUSD with other stable coins like USDC – with a real risk of delayed USDC withdrawals. Flows have been much more balanced, and volumes are steadily increasing. XRP and USDT flows on the desk have been particularly busy. With a general breather in outperforming layer 1 tokens taking place, the market feels to be waiting for the next opportunity. Realistically, this may present around the timing of the Shanghai update.

For any further information, please feel free to reach out.

Shanghai upgrade

The Shangahi and Capella upgrades to Ethereum (Shapella) are being tested out on the Sepolia testnet this week. The upgrade will enable validators to finally withdraw staked ETH from the Beacon Chain and it will introduce something called ‘warm coinbase’, which should reduce gas fees. The next step is to test out the Shanghai upgrade on the Goerli testnet in March. While some have suggested the opening of withdrawals could lead to a big sell-off, an additional 254,000 Ether (A$613M) was staked in the Beacon Chain this week suggesting the upgrade may be giving stakers more confidence . Tron founder Justin Sun tipped 150K ETH into Lido in the protocol’s biggest-ever deposit.

Everything is a security

US Securities and Exchange Commission boss Gary Gensler made waves with an interview in New York Magazine where he claimed “ everything other than Bitcoin ” has an identifiable group in the middle that investors anticipate profits from and is therefore a security. Blockchain Association policy head Jake Chervinsky pointed out Gensler’s “opinion is not the law” and that “the SEC lacks authority to regulate any of them until and unless it proves its case in court. For each asset, every single one, individually, one at a time.” That probably makes the outcome of the SEC case against Ripple for being an unregistered security even more important as a precedent.

DCG loses US$1.1B

Crypto conglomerate Digital Currency Group reported a loss of US$1.1 billion (A$1.63B) in 2022 due to Crypto Winter and the restructuring of its lending platform Genesis. DCG has total assets of US$5.3B (A$7.9B) at the end of the year, and its fourth-quarter revenue was US$143 million (A$212M) with losses of US$24M (A$35M). It raised funds in 2021 at a US$10B (A$14.8B) valuation, but an independent appraisal in the report pegged it at US$2.2B (AS$3.3B) now.

Based on Optimism

Ethereum Layer 2 scaling solution Optimism got a boost when major US exchange Coinbase announced the launch of its own layer 2 called Base, which is based on the network. However, the rollout was a bit of a mess . Details are scarce, but Base may be a gateway for the company’s 100M users, including institutions, to onboard into the DeFi ecosystem in a KYC-compliant fashion. The news put a rocket under tokens in the Optimism ecosystem, which also announced its intention to become a “superchain” that connects other layer 2s together. In related news DeFi project Synthetix deployed Synthetix V3 on both Optimism and Ethereum this week.

IMF considers crypto ban

The Indian Government has reportedly been pushing hard for strict global regulations for crypto at the G20 meeting. International Monetary Fund (IMF) Managing Director Kristalina Georgieva met with the Indian PM and said a ban should be on the table: “There has to be very strong push for regulation… if regulation fails, if you’re slow to do it, then we should not take off the table banning those assets, because they may create financial stability risk.” US Treasury Secretary Janet Yellen told Reuters it was “critical to put in place a strong regulatory framework,” however said the US is not suggesting an “outright banning of crypto activities.

Centralised DeFi a risk

According to Blockworks , Jump Crypto enlisted DeFi project Oasis to use its multisig (‘god mode’ keys held by core team members) to change its smart contracts to enable Jump to steal back US$225 million (A$334M) worth of assets held in Oasis Vaults that were stolen from the Wormhole bridge a year ago. Oasis said it had been ordered by a court to do so. The move is highly controversial because it highlights that funds in DeFi projects with multisigs and upgradeable contracts can be either stolen by the core team or frozen by a court order.

The Halving

The Bitcoin halving is also now a little over a year away in May 2024 and history suggests an upswing in the markets is on the cards. The halving will see the Bitcoin block reward cut from 6.25 BTC to 3.125 BTC, which will reduce supply inflation from 2% to 1% and therefore making each BTC a little more valuable. That said, the effect has been getting smaller, and Bitcoin dominance at 43.92% is lower than in previous cycles.

Bits and pieces

Gas fees on Ethereum spiked this week as a result of money flowing from the beleaguered BUSD into other stablecoins. Bitcoin Core’s single largest contributor Marco Falke has stepped down as a maintainer, leaving just four maintainers looking after things. Devs, including Falke, are under a legal cloud due to court action by Satoshi claimant Craig Wright. On Feb 21, Arbitrum became the first rollup scaling solution to surpass the Ethereum mainnet itself in daily transaction volume. And finally, the judge in the case against Dapper Labs for selling unregistered securities in the form of NBA Top Shot NFTs has ruled that rocket ship emojis could denote “a financial return on investment.”

Until next week, Happy Trading!