In Markets

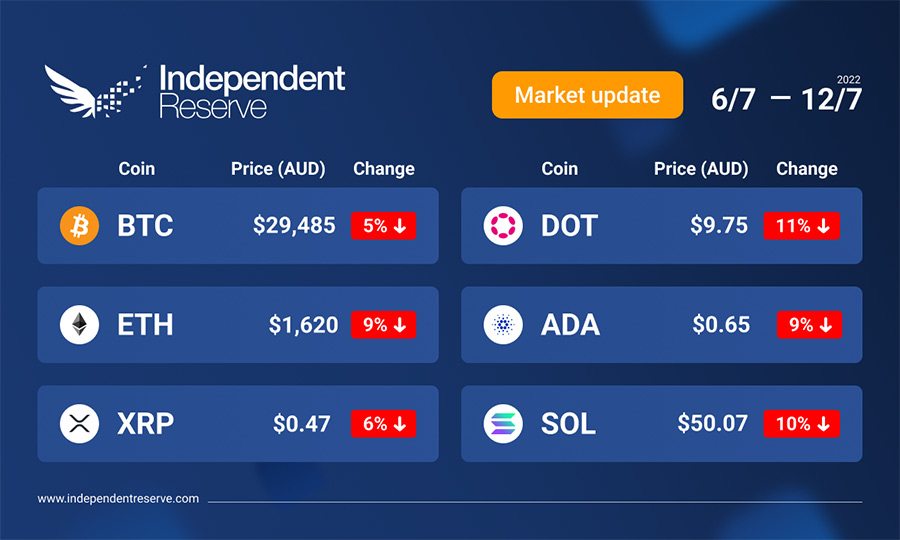

Although crypto has been dealing with its own issues, macro factors appear to be having the biggest impact. The White House expects this week’s June CPI figures to be “highly elevated” and analysts are tipping 8.8%. The Euro has also fallen to parity with the US dollar for the first time in 20 years. Noelle Acheson, head of market insights at Genesis Global Trading said: “This could negatively impact the price of Bitcoin in dollar terms, which for the past couple of years has been negatively correlated with the dollar index.” Bitcoin traded as high as A$32.5K (US$22.1K) this week but is currently around A$29,485 (US$19.8K) which is pretty much where it was seven days ago. Ethereum fell 8.6% to A$1,620 (US$1.1K), XRP lost 6.2%, Cardano (-8.9%) and Polkadot (-10.8%). The Crypto Fear & Greed Index is at 16, or Extreme Fear.

From the IR OTC Desk

Data this week will prove incredibly important for the upcoming path of monetary policy. Wednesday the 13th of July sees the Reserve Bank of New Zealand (RBNZ) convene for their July Monetary Policy Committee (MPC) meeting. As one of the first Central Banks to begin a rate hiking cycle, the RBNZ has become an important guide for policy and data interpretation for those Central Banks playing catch up in the tightening process.

This meeting will prove particularly interesting due to the recent March quarter GDP which came in at -0.2%, relative to an RBNZ forecast of +0.7%. We have spoken for several weeks now about the challenges to Central Bank decision making due to a lower growth environment. The July RBNZ meeting may provide some further direction on how to interpret the growth versus inflation trade off. Both the RBNZ’s May Monetary Policy Statement as well as the short-term interest rate market are forecasting a 50bps increase – to take the underlying cash rate to 2.50%. This would be the third consecutive 50bp increase from the RBNZ. Watch this space.

In the US, Wednesday the 13th of July delivers the inflation data for June. The market has been hoping that inflation will show a sign of peaking since the transitory label was first applied by Federal Open Market Committee (FOMC) Chair Powell more than 12 months ago! This month again, however, the Inflation Rate YoY (June) is forecast to print higher – at 8.8% relative to 8.6% in May. Last week, the US Unemployment Rate (June) remained at 3.6%. Job openings, the unemployment rate, and inflation will continue to be key economic metrics for the FOMC before their 27th of July meeting.

Of importance to Australia will be the labour market data for June – due to be released on Thursday the 14th of July. The Unemployment Rate (June) is forecast to move lower to 3.8% relative to 3.9% in May. If this were to occur, Australia would have the tightest labour market in more than 50 years!

On the OTC desk, volumes have picked up dramatically this week. Interestingly, however, almost all flows have been to the sell side. We have remained highly active in finding liquidity for USDT, USDC, ETH, DOGE, LTC, EOS, XRP and BTC et al. over the course of the week. DeFi trading activity has continued to lag in general and feels to be the limiting factor for cryptocurrency price appreciation. With DeFi continuing to be slow in recovery, expect the broader macro landscape to drive the direction of cryptocurrencies again this week…

For any trading needs, please don’t hesitate to get in touch.

In Headlines

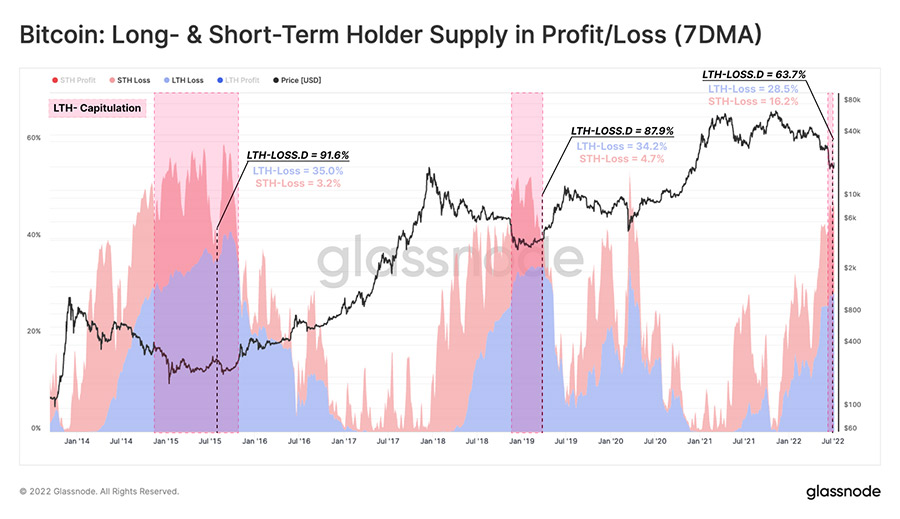

Glassnode half empty

Glassnode’s latest report highlighted that the November to July bear market has seen a peak drawdown of 75%. Around 44.7% of the Bitcoin supply is at a loss, but Glassnode warns “there may still be a combination of both time pain (duration), and perhaps further downside risk to fully test investor resolve, and enable the market to establish a resilient bottom.” Shark Tank star and crypto proponent Kevin O’Leary also believes a massive capitulation event is possible. “I like a big, big panic event. That’s always been a great way to bottom…. It’s total panic in the streets and always a great buying opportunity… It’ll be a great thing because it’ll take out all of the bad broken business models, the heavy leveraged [and] the speculation that was too risky.” Delphi Digital meanwhile thinks all indicators suggest we’ve hit the bottom but may be here some time: “BTC will likely continue to consolidate until we get some kind of macro catalyst.”

Long-term holders hold greater than 155 days, Short-term holders hold less than 155 days | Glassnode

Buying opportunity

Bloomberg’s senior commodity analyst Mike McGlone compared the current market to that of 2018 before the big rise in prices in 2019 and consequently thinks Bitcoin could be in for “one of the greatest bull markets in history” over the next six months. A survey of 4,400 US adults by Morning Consult found that crypto owners expect the price of Bitcoin to shoot back to US$38K (A$56.4K) by the end of the year. Wolf of Wall Street Jordan Belfort also believes the price will “almost certainly” climb over the next three to five years while investment strategist Lyn Alden thinks Bitcoin is in a “deep value zone” (but she isn’t ruling out further falls in the short term.) Wall Street Investors surveyed in Bloomberg’s latest MLIV Pulse report are split, with 60% expecting Bitcoin to fall to US$10K (A$14.8K), while the rest think Bitcoin could soon go back above the US$30K (A$44.5K) mark.

WSJ attacks Bitcoin ETF denials

The Wall Street Journal slammed the SEC in a blistering editorial this week over chair Gary Gensler’s ongoing denials of spot Bitcoin ETF applications. It said the rationale for the refusals made no sense in light of the approval of Bitcoin futures ETFs in the US in October 2021. Grayscale has launched legal action over its denied application, arguing the approval of futures ETFs and the rejection of spot ETFs amounts to ‘unfair discrimination”. The case is expected to take 12 to 24 months.

3AC and Celsius updates

A court filing shows that Three Arrows Capital founders Zhu Su and Kyle Livingstone Davies are currently in the wind and the liquidators are worried they’ll “dispose” of its assets. They’ve sought orders to get 3AC to hand everything over so that creditors can get some funds back. Celsius meanwhile has been paying off loans left right and centre and managed to free up US$528.9M (A$785M) worth of wrapped Bitcoin by paying off a DAI loan from Maker. It’s being sued by staking software and investment firm KeyFi which alleges it was operated in a Ponzi like fashion. Celsius has also changed its legal team to the firm that handled Voyager’s bankruptcy filing to help it with restructuring.

Mt Gox Bitcoin dump?

The Mt Gox hack of 850,000 Bitcoin back in 2011 wiped out the emerging market and there are concerns recovered funds could tank markets again, after the Rehabilitation Trustee told creditors they would receive repayments from August. This led to a wave of speculation about a potential dump of the trustee’s 137,000 BTC. However, many creditors sold their claims to crypto funds for early payouts and others will no doubt hodl so it’s too soon to say how it will play out.

The Merge incoming

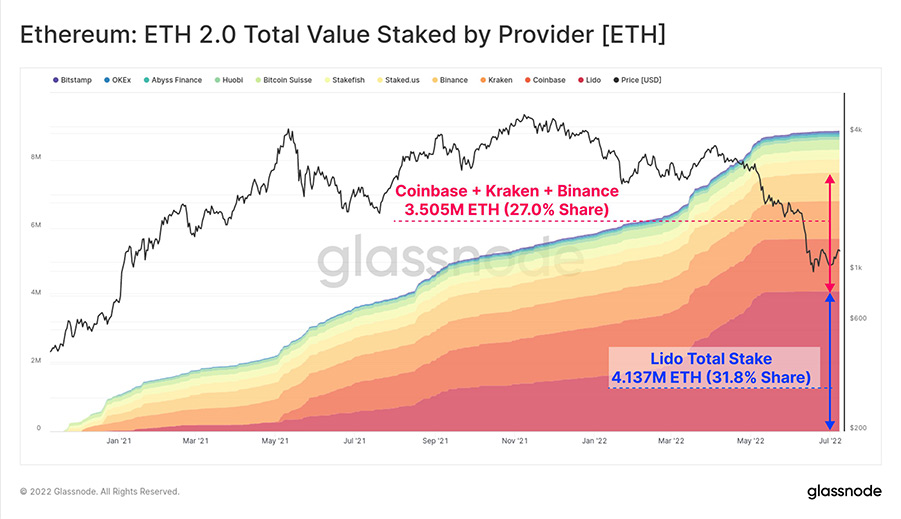

Ethereum has just one dress rehearsal Merge left (when the network switches to proof of stake) before the real thing. The Sepolia testnet Merge was a success on July 7, although around one third of the validators went offline shortly afterward due to configuration problems. They fixed it pretty quickly. The final trial will occur on the Goerli test network. According to Glassnode, there is now 13 million ETH staked in the 2.0 contract, which is 10.9% of the entire supply. Sadly, the average deposit price was US$2,375 (A$3,520) meaning depositors are sitting on a 50% loss, but it’s academic as they can’t withdraw. Deposits have fallen to around 122 ‘nodes’ a day, down from the 500-1000 it saw in better days. Researcher Vivek Raman noted that after the Merge, ETH supply inflation will fall 95% (from 4.3% annually to 0.22%) and that security will improve as it will cost more to attack the network. He argued the upgrade would mean ETH can complement Bitcoin’s use case as digital gold, by being a digital bond and DeFi’s main asset for collateral.

Over 13 million ETH staked in the 2.0 contract | Glassnode

Until next week, happy trading!