In Markets

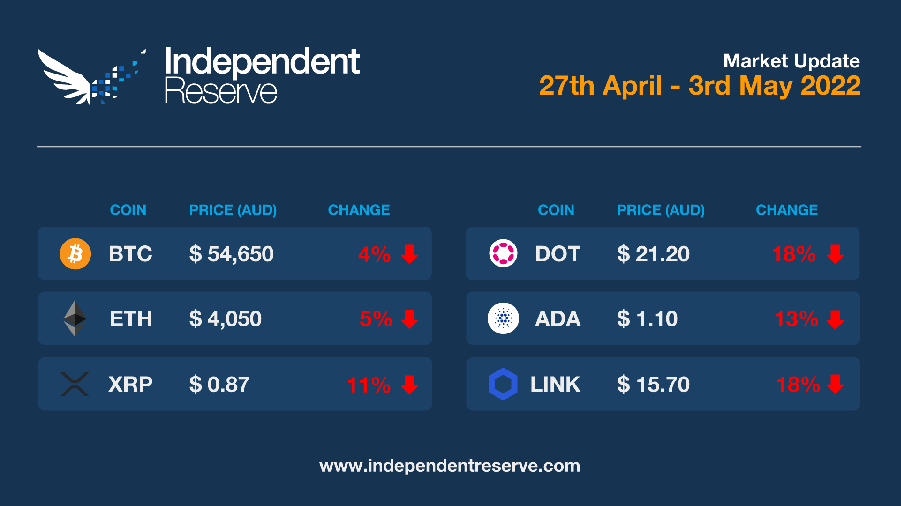

April wasn’t a great month and May isn’t looking too hot either. Traditional markets are tanking, the Federal Reserve is hiking rates in the US, and the RBA increased the cash rate by 25bps to 0.35% today. The tech-heavy Nasdaq (crypto’s closest proxy on traditional markets) plunged on Friday and lost 13% all up in April, its worst month since 2008 and its worst start to a year on record. By comparison, Bitcoin isn’t actually doing that badly, remaining above its year-to-date low of around US$33K (AU$47K). Bitcoin is currently trading at US$38.6K, or AU$54,650, which is 4% down for the week. Ethereum lost 5% to trade at US$2,865 (AU$4,050), XRP was down 11%, Cardano (-13%), and Polkadot (-18%). As a small sign of hope, the Crypto Fear and Greed Index is at 28, which is simply Fear, rather than Extreme Fear.

From the IR OTC Desk

This week promises to be a highly technical week for central bank monetary policy decision making. Today, the Reserve Bank of Australia (RBA) increased the underlying cash rate by 25bps, to a target cash rate of 0.35% – the first increase in more than 10 years. In the Monetary Policy Decision statement, Governor Philip Lowe mentioned, “the central forecast is for the unemployment rate to decline to around 3 ½ per cent by early 2023 and remain at that level thereafter” (the lowest level in almost 50 years). Additionally, “the central forecast for 2022 is for headline inflation of around 6 per cent and underlying inflation of around 4¾ per cent; by mid 2024, headline and underlying inflation are forecast to have moderated to around 3 per cent. These forecasts are based on an assumption of further increases in interest rates.” Last week, the Inflation Rate YoY, Q1 was announced at 5.1% (versus 4.6% expectation).

In the US, 10 year Treasury Bond yields continue to hover around 3% – their most elevated level since December 2018. Short term interest rate futures (as profiled by the federal funds futures) are profiling a 50bp rate rise in May, June, July and September: with an additional 50bps in the remaining meeting for the calendar year. Last week we received wage data, as represented by the Employment Cost Index. Employment Cost – Wages QoQ, Q1 increased by 1.2% relative to a 1.4% forecast. And while this release was softer than forecast, wages in the US have increased by 4.6% over the last 12 months. This is sure to give the Federal Open Market Committee (FOMC) an enormous amount to consider at this week’s monetary policy meeting (scheduled for release 4am Thursday the 5th of May AEST). Watch this space.

On the OTC desk – cryptocurrencies remain highly correlated with US tech stocks. As speculation about the path of FOMC policy action continues, downside protection strategies are increasingly looking at the relative cost of cryptocurrency volatility within their hedging baskets. In general, cryptocurrencies will continue to have a high correlation with risk assets. USDT, USDC, UST (terra) and DAI remain the most traded pairs across the OTC desk.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Solana’s new operating hours

Solana has been criticised for prioritising speed over security, stability and decentralisation and that has led to seven outages so far this year. The network went dark for nearly seven hours on the weekend after bots swarmed the Candy Machine NFT mining tool with 4 million transactions a second. Austin Federa, head of comms for Solana posted on Twitter: “PSA: Solana mainnet beta fell out of consensus and the validator network couldn’t recover…it wasn’t ‘paused’ or ‘halted’ – better to say it ‘crashed’. Funds are safe.”

The Sandbox trading

Trading has just gone live today for The Sandbox (SAND) on Independent Reserve. The Sandbox is one of the first and most comprehensive demonstrations of how the Metaverse will look – it’s a decentralised virtual gaming world that allows users to build it’s components , and to buy and sell assets including virtual real estate. The native SAND token facilitates transactions of land and content and can be staked to participate in the governance of the decentralised autonomous organisation (DAO).

Singapore embracing crypto

Independent Reserve’s latest survey found that 58% of Singaporeans perceive Bitcoin as an investment asset or a store of value, around 15% see it as money and 9% of holdouts still see it as a scam. More than half of those surveyed said they were likely to recommend crypto investments to family and friends and almost half (47%) intend to increase their investments in their current crypto portfolios within the next 12 months. You can download the report here.

Stupid pet tricks

Bored Ape Yacht Club creators Yuga Labs launched the Otherside Metaverse with an NFT drop on the weekend. It raked in US$320 million ($450M) by selling virtual land at a set price of 305 APE each. Unfortunately, users competed to mint the 55K available Otherdeeds by paying ever more extravagant gas fees, some forking out up to US$14K (AU$20K) to mint just one. This caused insanely high gas fees across the network rendering it unusable (and even made some layer two solutions expensive). In the process Ethereum burned US$200M (AU$283M) worth of fees in a day, or around 71,500 ETH, which is 11 times the previous record. BAYC has promised to refund ETH lost in gas fees on failed transactions.

Regulatory stuff, both good and bad

The New York State Assembly passed a two year moratorium on any new Bitcoin mining facilities that don’t use renewable energy — and banned existing mines from expanding without green power. The bill heads to the Senate for a vote with the Blockchain Association promising to ramp up efforts to defeat the “anti-technology bill.”

It turns out the Forbes report we mentioned last week about the Central African Republic adopting Bitcoin as legal tender was correct, with President Faustin-Archange Touadéra signing it into law this week. The country is very poor, however – its GDP is just US$2.4B (AU$3.5B) – and many people don’t even have the internet, so it’s more symbolic than practical at this stage.

Elsewhere, Panama’s National Assembly approved a bill to regulate the use of crypto assets for trading, as digital securities and for payments. Brazil’s Senate has also approved its own bill setting up a framework for the regulation of crypto. It’s headed to the Chamber of Deputies for another vote.

Tesla keeps the BTC faith

Tesla is the second biggest corporate holder of Bitcoin with 43,200 BTC, and its latest filing with the SEC suggests it doesn’t plan on changing that. Tesla said Bitcoin has “long term potential” and is a “liquid alternative to cash.” Meanwhile, billionaire Mark Cuban has put forward a potential use for Dogecoin in fighting spam posts in a reply to Telsa CEO Elon Musk: Every Twitter user puts up 1 Doge as a bond for unlimited posts, and if another users spots them creating spam or scams, they get the spammer’s Doge, who is then forced to put up a 100 Doge bond to post again. However, if the user was wrong about the spam, they forfeit their own Doge. Shibetoshi Nakamoto, creator of Dogecoin, thought it was a good idea.

The Merge, not difficult

Ethereum devs have put off work on a hard fork to delay the ‘difficulty bomb’ in order to focus efforts on getting the Merge up and running, making ETH proof-of-stake. The difficulty bomb was designed to incentivize PoS by making it harder to mine proof-of-works blocks, so it’s arguably working. The risk is The Merge will be delayed once again, and the difficulty bomb will make the Ethereum network temporarilly difficult and slow.

Hopium

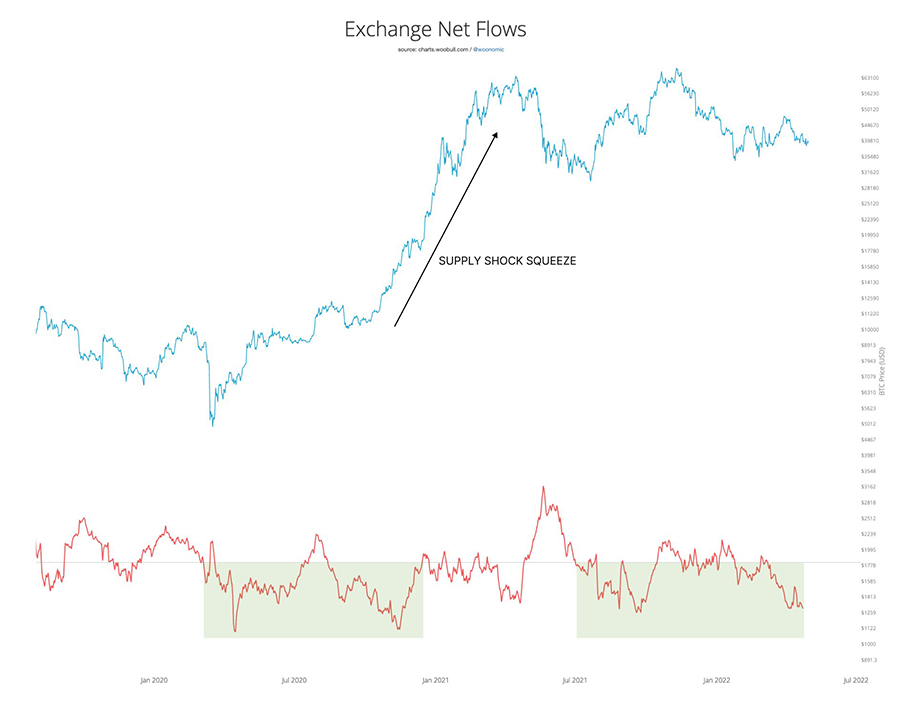

Last week may have seen a plunge on traditional markets, but on-chain analyst Willy Woo thinks the picture isn’t too bad for Bitcoin, which is holding up relatively well due to what Woo says is “unprecedented spot buying.” He wrote: “#Bitcoin price is sideways because Wall St is selling futures contracts in a macro risk-off trade. Meanwhile, institutional money is scooping spot BTC at peak rates and moving to cold storage. It’s times like these I remember the Q4 2020 supply shock squeeze.”

Source: Will Woo [Twitter]

Strong sign of adoption for El Salvador’s Chivo wallet

El Salvador’s government-backed Bitcoin wallet has reached significant adoption, according to Felipe Vallejo, an executive at the cryptocurrency exchange behind the ‘Chivo’ wallet. Referring to a study by the National Bureau of Economic Research, 40% of those who downloaded the Chivo wallet continued to use it after they received their government incentives. Vallejo also noted that 20% of all El Salvadorans continued using the Chivo wallet after spending their free $30 bonus BTC. He stated that this should be viewed as a “strong signal of increasing adoption,” especially when compared to traditional financial services According to some sources, only 29% of adults in El Salvador had bank accounts as of 2017.

Until next week, happy trading!