In Markets

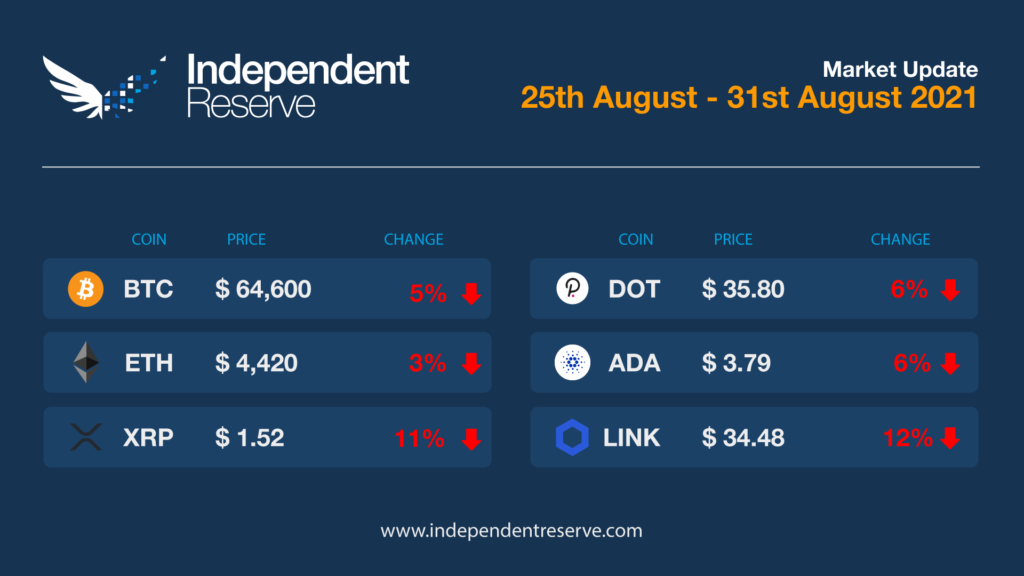

It was a week of consolidation for Bitcoin as it held on to most of the gains made over the month and traded in a range from A$64K (US$46.6K) to A$69K (US$50.3K). It’s currently down 5.1% from seven days ago to trade around A$64,600 (US$47.5K). Elsewhere prices eased across the board: Ethereum lost 3%, Cardano (-6.1%), Ripple (-11.3%), Dogecoin (-14.6%), Polkadot (-6.2%). The Crypto Fear and Greed Index is at 73, or greed.

From the IR OTC Desk

The central message from US Fed Governor Powell at the Jackson Hole Economic Symposium, last Friday, was that the economic hurdle to begin tapering the asset purchase program (QE) has likely been reached: and that tapering could occur ‘this year’. No additional details on timing or market specifics were addressed. Governor Powell did highlight however, that the Fed will be “carefully assessing incoming data and the evolving risks”. Expect more details to emerge from the September 21-22 policy meeting.

What was also made very clear was the significantly higher economic hurdle needed to be reached in both non-transitory inflation items and the labour market, before consideration would be given to lifting interest rates. Powell’s balanced delivery was broadly accepted as a positive for risk assets into the weekly market close, cryptocurrencies included (it is expected that changes to US monetary policy will remain crucial for cryptocurrencies and the AUD).

On the OTC desk, buy flow has appeared to temporarily lighten in BTC and ETH. With the market closely following the price action in Layer 1 blockchains, we have seen increased interest from both new and established customers within this space. On the data front, watch out for Aussie GDP on Wednesday.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Conundrum

Curiously, prices have been rising this month while on chain activity has been muted. According to Glassnode, active entities on the Bitcoin network currently hover around 275K per day, which is more than one third down from the peak in January. Active addresses on Ethereum are also down by one third, to 450K per day. Bitcoin transactions are down to around 200K per day, which is 37.5% below the peak, and the USD value of transactions (filtered for internal transfers and self spends) is down 62.5% from the April high to US$6B (A$8.23B). Ethereum transactions have also declined one third to around 1,100K per day. Surging gas prices also appear to be killing activity on DeFi platforms that use complicated, and thus expensive, smart contracts, including UNI, AAVE, COMP and YFI. Glassnode says the divergence between activity and price is “historical abnormal” in a bull market, but it’s not that unusual in a “pre bull and pre supply squeeze dynamic”.

Gas fees hurting Ethereum, good news for Cardano

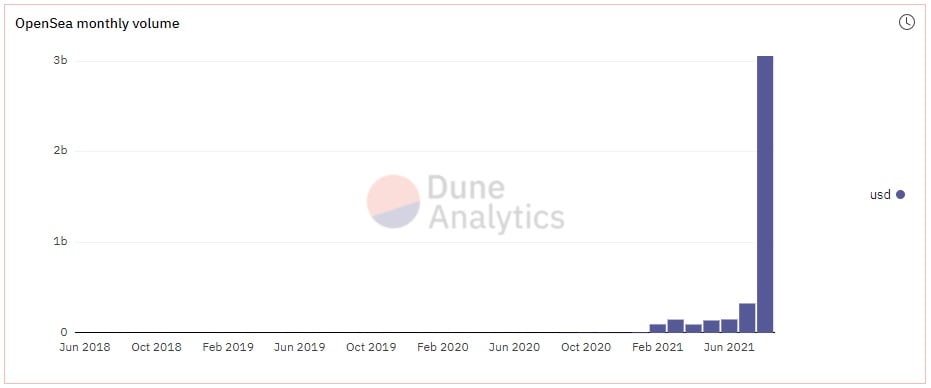

With NFT platforms like OpenSea recording $3B (A$4.1B) in volume this month, gas prices on Ethereum have gone through the roof. A single transaction on OpenSea can cost US$1,000 (A$1,371). The average cost for an Ethereum transaction has risen to US$30 (A$41), while on DeFi protocols like Uniswap a transaction can cost ten times that. While this has come about after the introduction of EIP-1559, the upgrade doesn’t appear to have caused the issue. Admittedly it hasn’t helped either, but it has reduced ‘overspending‘ relative to the gas fee.

Sustained network congestion opens up space for competing Layer 1 blockchains like EOS, Polkadot, Solana, Terra, Tron, and of course Cardano, after it launches smart contracts on September 12. The upgrade to Eth2 is not expected until next year.

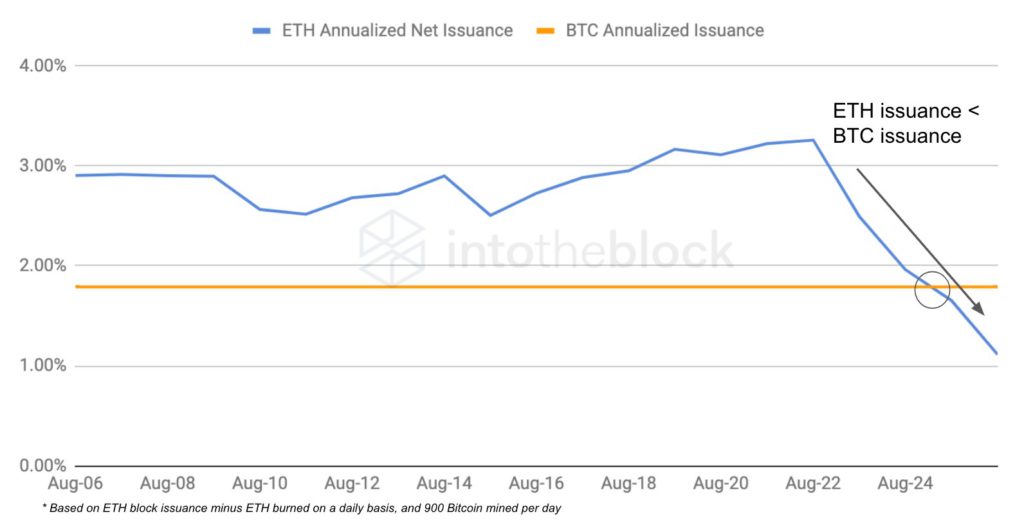

Eth inflation dips below Bitcoin’s

Lucas Outumuro, head of research at Into The Block, says Ethereum’s net inflation fell to an annualised rate of 1.11% compared to Bitcoin’s annualised rate of 1.75% during the middle of this week. He said: “Ether’s decreasing issuance raises questions about how it is valued. Previously closer to ‘digital oil’ ETH’s value moved in tandem with its usage. Now that its issuance is provably lower (and potentially deflationary), it is likely to develop a monetary premium like BTC.”

Chain split

Almost half the Ethereum ecosystem split into a separate chain temporarily after a previously identified bug was exploited. The bug affected nodes running the Geth Client that had failed to update their software with a bug patch. Fortunately, most of the affected nodes quickly upgraded allowing the primary network to soldier on but things could have turned out much worse.

NFT Blitz

The month of August has shown to be a record month for NFT sales, almost reaching US$900 million in the past 30 days, according to Nonfungible. The NFT surge, which has more than tripled its last run in sales, has been largely attributed to projects such as ArtBlocks and CryptoPunks, with the average sale price of a pixelated punk sitting at US$214,000. Credit Card giant Visa made headlines this past week with the announcement of its CryptoPunk purchase for 49.5 ETH, worth around US$150,000 at the time. The head of crypto at Visa made the statement, “With our CryptoPunk purchase, we’re jumping in feet first. This is just the beginning of our work in this space.” While it may seem that the big dollars are being missed out on in the marketplace, NFT data analyst NiftyTable points out that only 1.9% (5210/268280) of OpenSea traders have earned US$100K+ selling NFTs.

Overly optimistic predictions

There were numerous news reports this week that Jurrien Timmer, Director of Global Macro at Fidelity had given a webinar where he suggested that not only was a $1M (A$1.37M) Bitcoin price feasible based on the stock to flow model, but so was $100M (A$137M) per coin by 2035. The major crypto publications didn’t pick this up so consider it unconfirmed or at least taken out of context. More than a few people noted that $100M per BTC would make Bitcoin’s market cap $2,100 trillion (A$2,879T), which is in excess of the total wealth of the world, which is $418 trillion (A$572T). For a more down to earth prediction, Midas Touch Consulting’s Florian Grummes tipped this week that Bitcoin will hit $100K (A$137K) within six months, but could dip to $25K (A$34.3K) in the short term.

Billionaire Bitcoin plunge

According to a recent SEC filing, billionaire fund manager Bill Maher has allocated a healthy position in Grayscale’s Bitcoin Trust (GBTC). The Miller Opportunity Trust owns 1.5 million shares of GBTC, which equates to US$44.7 million or about 1.55% of the fund’s net assets. A growing positive attitude towards cryptocurrency saw the manager call investing in the space a suitable risk management strategy earlier in the year, adding not so long after that he couldn’t see another asset with Bitcoin’s combination of liquidity and upside potential.

Infrastructure bill

The controversial infrastructure bill will be voted on by Congress unamended by September 27 according to speaker Nancy Pelosi. It contains crypto tax provisions that would seem to define everyone from miners to validators as brokers, meaning they’d need to report for taxes and have KYC requirements. Given it has bipartisan support, things aren’t looking promising. However a treasury official told CNBC that reporting requirements will not be imposed on entities that are unable to comply.

Bitcoin DEX with fiat onramp?

Jack Dorsey has announced that Square’s DeFi division – called ‘TBD’ at this stage – will build “an open platform to create a decentralized exchange for Bitcoin“. Project lead Mike Brock elaborated: “This is the problem we’re going to solve: make it easy to fund a non-custodial wallet anywhere in the world through a platform to build on and off-ramps into Bitcoin. You can think about this as a decentralized exchange for fiat.”

Bullish on Doge

Three Arrows Capital CEO Su Zhu has outlined his bullish thesis for Dogecoin in a podcast. He pointed out that the meme coin was popular among “blue-collar style” traders on Robinhood, where it makes up 60% of the platform’s crypto revenue “and crypto is 40% of Robinhood’s revenue, so Robinhood is basically a DOGE proxy.” He noted Dogecoin has “four times the name brand recognition over Ethereum” among ordinary people and compared it to XRP in the last cycle. “It is just simple. And it’s also fair launched by the way. So there’s no risk of having it ever be deemed a security, right?” he added. Despite the fair launch, Chainalysis research shows that 0.01% of holders hold 82% of the total supply of Dogecoin. Just 535 entities (likely including large exchanges) hold 106 billion (of 129.5B) coins between them.

Until next week, happy trading!