In Markets

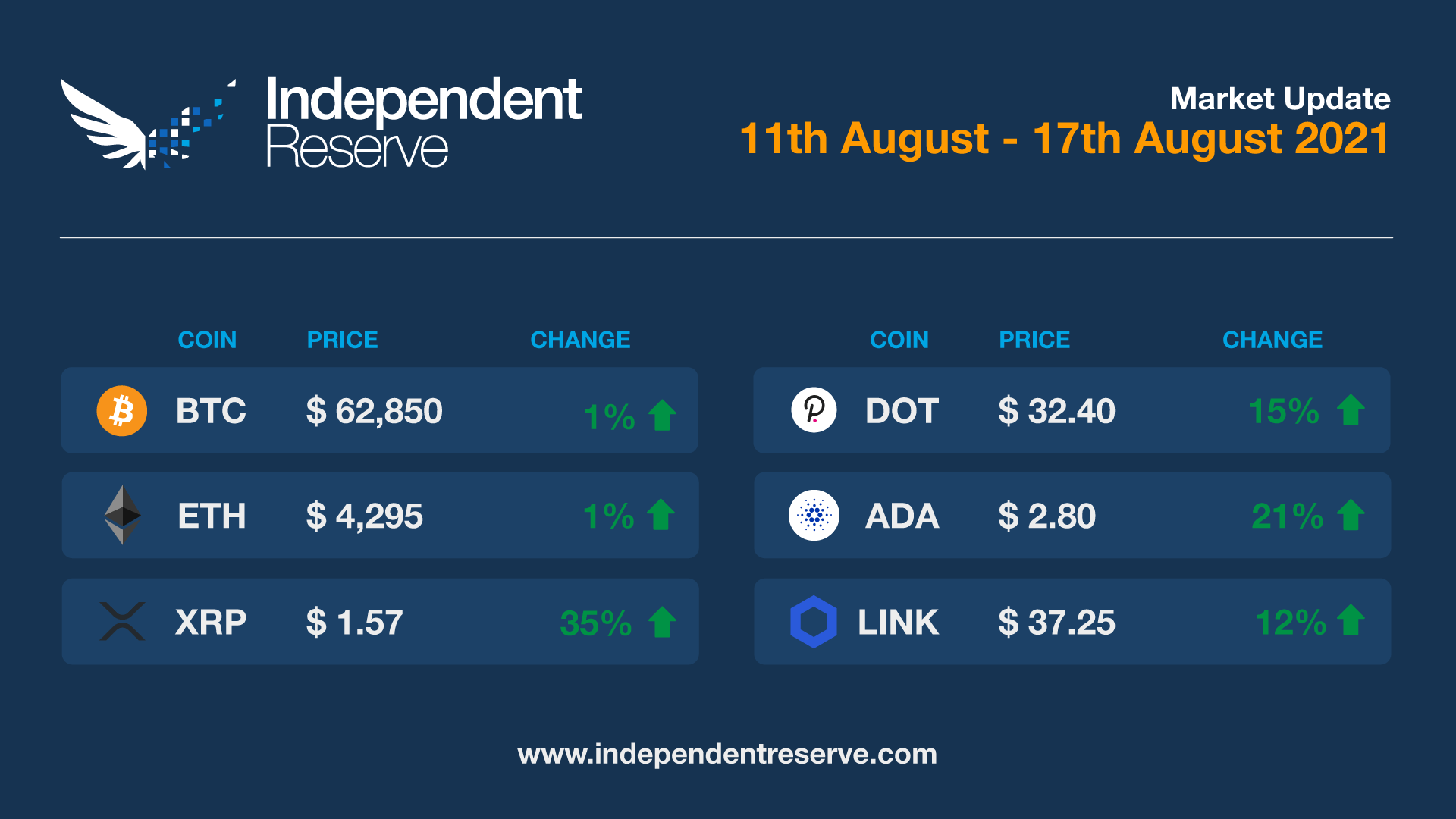

Although markets have taken a breather in the past 24 hours, the bull run appears to be back on in earnest, with most of the top coins up 50%-100% on a month ago. Crypto markets are once again near a US$2T market cap (A$2.69T) and 19.2% of Bitcoin hodlers have returned to profit since the low of $29.7K (A$40K) set in July. The total Bitcoin supply is holding unrealised profits equivalent to 50% of the market cap which Glassnode says indicates we’re experiencing a ‘bull market disbelief rally’. Influencer Lark Davis says the hash ribbons indicator is flashing a strong buy signal, which correlated with a 250% gain last time. Bitcoin peaked at A$65.5K but finished the week around A$62,850 up 1%. The Crypto Fear and Greed Index is at 72 (greed), while last month it was around 15 (extreme fear).

From the IR OTC Desk

This week has marked the 50th anniversary of one of the most significant changes to the monetary system in modern times. On 15 August 1971, Richard Nixon confirmed that the United States was unilaterally terminating the convertibility of the US dollar to the price of gold, rendering the USD a fiat currency. In contrast, this week has also corresponded to a large amount of OTC inquiries into Alt coins – following on from the broad rally in BTC and ETH. Right now, the focus on correlation trades (mainly between a mid market cap coin and either BTC or ETH) appears to be particularly in focus for cryptocurrencies.

In traditional markets, the S&P 500 has extended its rally to make all time highs: US CPI for July has remained at 5.4% (YoY): and attention will be given to the Reserve Bank of New Zealand this Wednesday (18th August), to confirm whether their stance on emergency monetary policy continues to remain appropriate.

For any trading needs, please don’t hesitate to get in touch.

In Headlines

Plan A is still on

Plan B still has full confidence in his stock to flow model and says we’ll hit $100K (A$136K) by the end of the year. Scott Melker, The Wolf of All Streets, is also tipping $100K within six to twelve months. He told Kitco News the debate over the infrastructure bill had given crypto the sort of publicity money can’t buy, causing a surge in demand: “I believe that this correction is likely over and that we should see new all-time highs by the end of the year. I would not be surprised at all to see Bitcoin trading in six figures within the next six to 12 months, or Ethereum even pushing towards $10,000 (A$13,624) in that time.”

Happy 21st

The 21st crypto ETF has been filed in the US this year – Kryptcoin’s Ethereum ETF Trust. There’s now real hope that a Bitcoin ETF will be approved after SEC boss Gary Gensler said he was open to approving an ETF exposed to regulated futures contracts under the Investment Company Act of 1940. “When combined with the other federal securities laws, the ’40 Act provides significant investor protections,” he said. Scott Melker said a Bitcoin ETF would be “the biggest single event in the history of Bitcoin for that large wall of money to have the confidence to enter – pension funds, endowments, sovereign wealth funds. They will come in when there’s an ETF.”

Biggest DeFi hack in history

Showing just how big crypto has become, a hacker stole more than $612M (A$834M) in the biggest DeFi hack in history from Poly Network (not to be confused with Polygon) and the markets didn’t even blink. That’s possibly because no one has heard of the Chinese platform. Showing crypto is just as weird as it ever was, the hacker conducted an AMA saying “cross chain hacking is hot” and then returned the vast bulk of the funds to Poly’s multi sig wallet, though is yet to hand over the final key.

Institutional demand is back

JPMorgan’s crypto analyst Nick Panigirtzoglou said in a note to clients: “there are clear signs of demand improvement in futures markets pointing to rising institutional demand for crypto.” The Wall Street Journal however reports that it’s small investors driving the rebound.

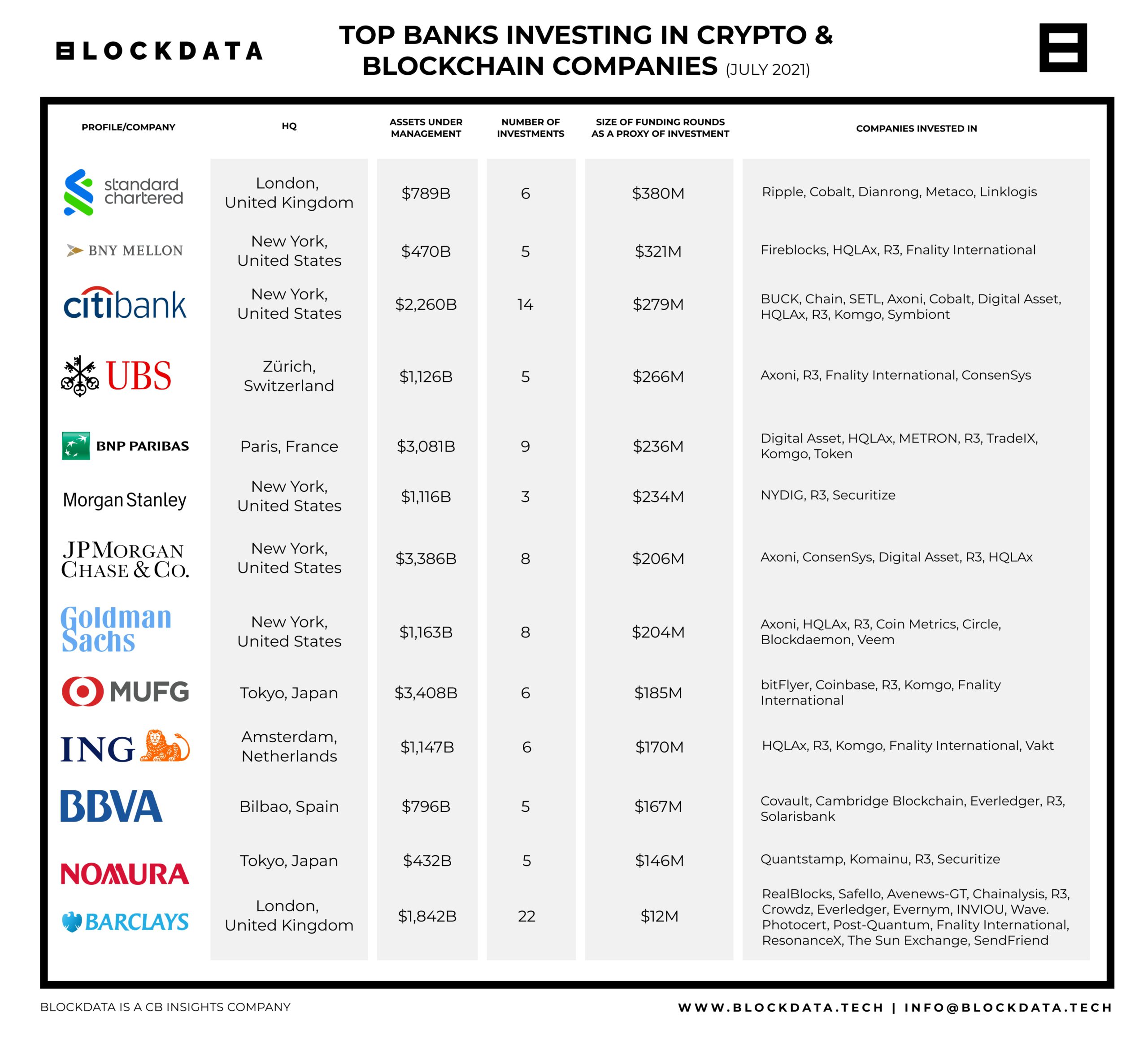

Majority of banks exposed to crypto

Banks may not always seem too crypto friendly to their customers, but a new survey by Blockdata found that more than half of the top 100 banks in the world have exposure to crypto and blockchain. The report names Barclays, Citigroup, and Goldman Sachs as among the most active of the 55 banks with exposure, followed by JPMorgan and BNP Paribas.

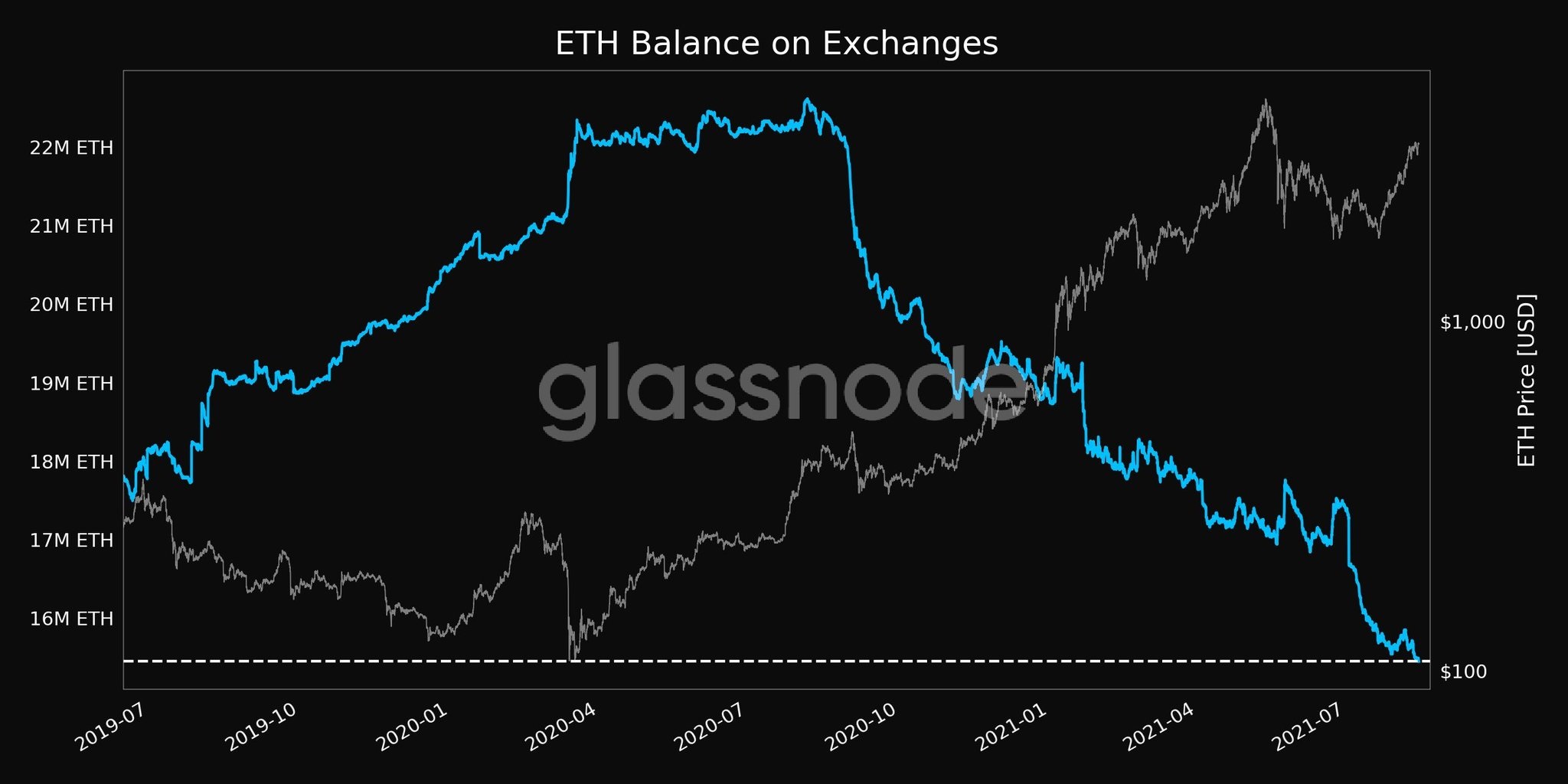

Greatest trade is ETH

Everything is looking good for Ethereum right now, apart from high gas fees caused by a surge of NFT projects. The network is currently reaping 34X more daily fees than Bitcoin and the chain capacity has increased 9% following the London upgrade. The Ether balance on exchanges has hit a two-year low and there are signs of a big supply squeeze. There’s now 6.6M ETH locked up in Eth2 (and you can stake via your Ledger), 9.5M ETH locked in DeFi and the inflation rate has just halved. Around 54,187 ETH (A$234M) has been burned so far, with 1840 blocks flipping into deflation (where the ETH burned is greater than the mining reward). Real Vision CEO Raoul Pal wrote recently that ETH is set up for the “greatest 6-9 month trade in the history of financial markets” due to a “massive supply shock in an asset with exponential demand.”

NFTs surge once again

Total sales volume for NFTs have seen a surge of US$2.5 billion in the first half of 2021 according to Dune Analytics. This is compared to a mere fraction of US$13.7 million in the first half of 2020. According to DappRadar, in the last 30-days alone, NFT marketplace OpenSea has processed 1.18 million transactions worth US$1.06 billion. Despite the surprising NFT boom earlier this year, the majority of OpenSea’s trading volume happened after June, with digital art like CryptoPunks attracting nearly US$207 million in sales in just one week.

Argentinian President for Crypto

Cryptocurrencies have entered the conversation as potential legal tender in Argentina. In a recent interview, President Alberto Fernandez was open to the idea, reiterating that the country should not be against it as it could bring important advances to inflation issues. In addition to this, he made clear that “this is a subject that must be treated carefully” – acknowledging the lack of understanding and doubts shared by many. The President of the Central Bank of Argentina shares a different perspective, stating that such a thing would be “prejudicial” to the system.

Until next week, happy trading!