In Markets

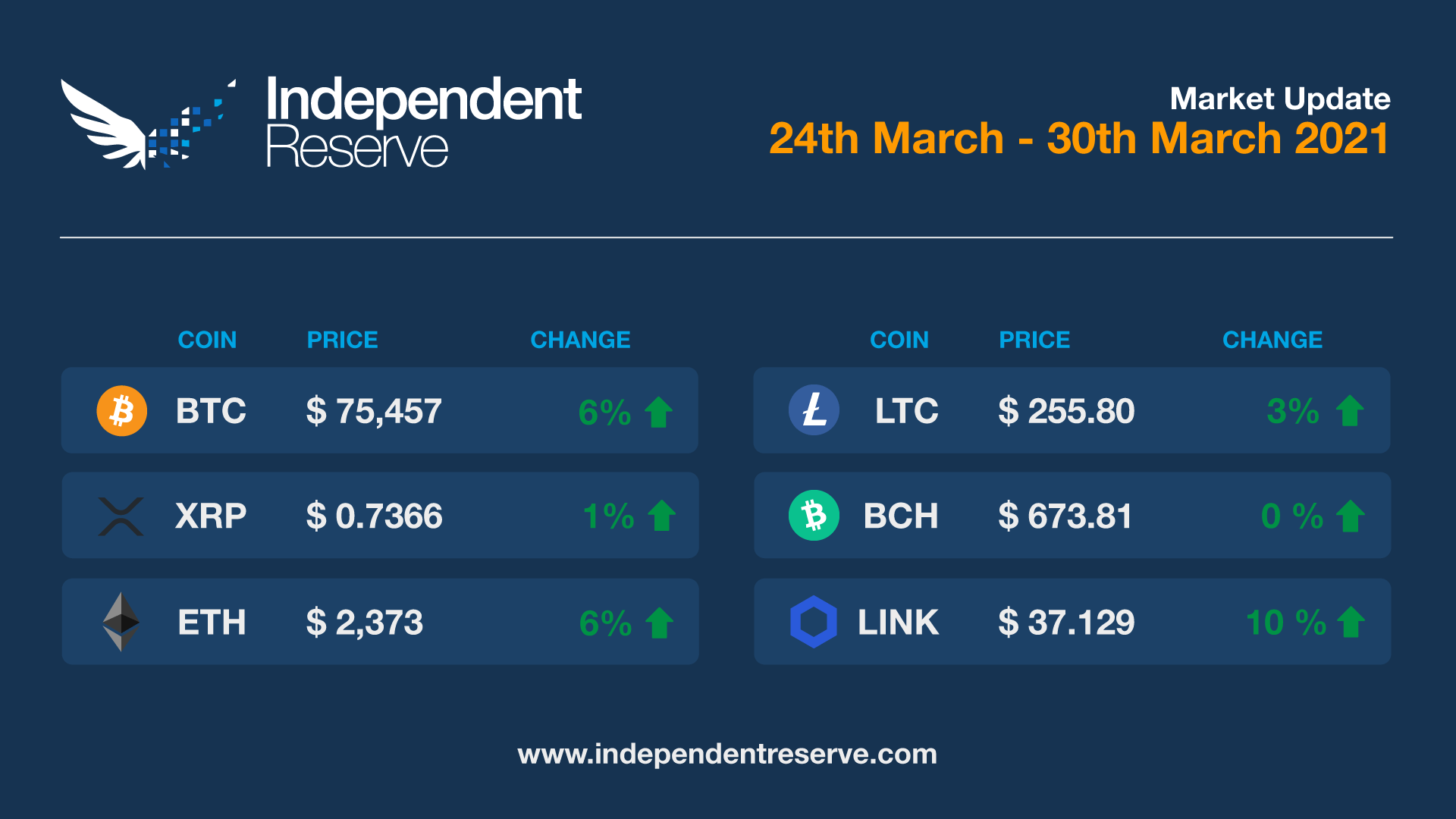

After taking a tumble to the A$67,000 mark on Friday following the expiration of a record $6B in options contracts, Bitcoin has recovered to trade above A$75,000. It finishes the week up 5.4%. Ethereum was up even more (6.5%) on this time last week after Visa announced it was settling some transactions on the network. Litecoin was up 3.1%, Stellar (1.6%) Aave (3.5%) and EOS (3.2%). Ripple, Chainlink, and Bitcoin Cash were all flat, Polkadot lost 4.3% and Synthetix lost 3.3%. Analyst Filbfilb, co-founder of Decentrader, believes alt season has arrived, pointing to Bitcoin dominance falling below 60%, the lowest point since October 2020. The Crypto Fear and Greed Index is at 72 or Greed.

In Headlines

Visa becomes ETH ‘sidechain’

Visa will settle fiat transactions using stablecoin USDC on the Ethereum blockchain. David Hoffman from Bankless argues Visa is becoming an Ethereum “sidechain” and using its 1500 transaction per second network to scale ETH. “Thousands of transactions can happen internally on Visa’s network, and then Visa can make a single, batched transaction to Ethereum that updates the balances of its partners that leverage Visa for USDC transfers,” he wrote. So it’s not going to create a lot of extra demand on the ETH network but it is a big vote of confidence.

Eth 2 scaling timeline overly optimistic

Optimism’s layer two scaling solution for Ethereum was due to launch this month but the mainnet has been delayed until July. The team said the delay would give ETH based projects “time to integrate, audit and test” because there was a “very real risk” of bad guys forking popular projects to rip off users if they launched too early. This will also delay scaling on Synthetix as well as on Uniswap V3, which will launch in May on Eth1 moving to an Optimism version.

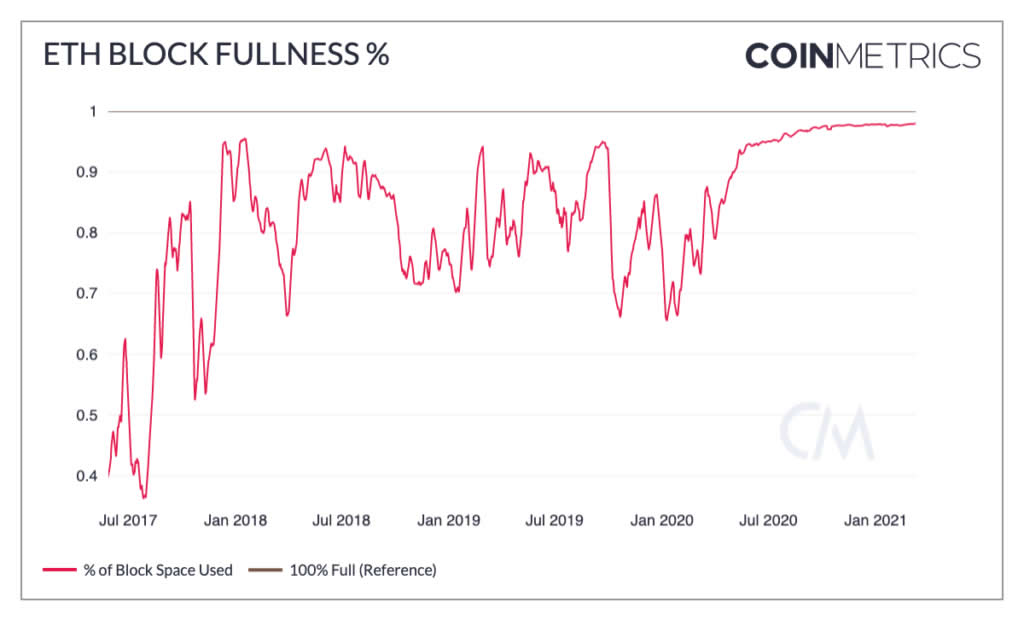

Merge transaction for Eth 2

Work on Eth2 continues with Sigma Prime announcing its first merge transaction between Eth and Eth2 using its Lighthouse client. It estimates that Eth2 will use 99.98% less electricity than Eth1 – or Bitcoin for that matter. Meanwhile Coin Metrics has released a report suggesting the EIP-1559 upgrade in July will not solve high gas fees, although it will make the fees themselves more predictable. The report blamed gas fees (consistently over A$13 per transaction this year) on 95% to 98% full blocks. Interestingly it’s an overall surge in users, rather than an increase in complex DeFi transactions, that’s behind the demand. “Since January 2020, the amount of gas used per transaction has trended downwards. This shows that increased transaction complexity is not responsible for high transaction fees,” the report noted.

Blockchain mergers and acquisitions

Mergers and acquisitions among crypto and blockchain companies more than doubled in 2020, from A$629 million in 2019 to A$1.44 billion. PwC reports the average deal size increased from A$24.9M to almost A$70 million and the overall number of deals trebled in the US. PwC global crypto leader Henri Arslanian said 2021 is “already on track to significantly surpass it from every single metric.”

Billionaire warns of Bitcoin ban

Billionaire hedge fund manager Ray Dalio has gradually warmed up to Bitcoin and now thinks it has proven itself over the past ten years as “an alternative store of wealth”. However he warns there’s a “good probability” the US government might ban it, just as it banned citizens from owning gold from the 1930s until the 1970s. He pointed to an impending ban in India as more evidence.

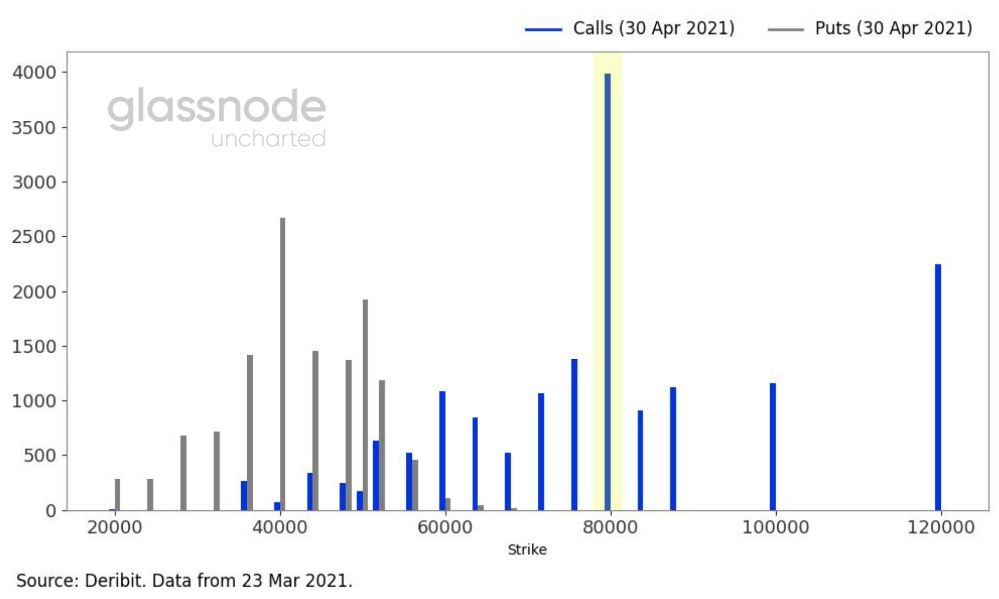

US$80K by May

Options traders on Deribit are placing a substantial number of bets on Bitcoin hitting US$80,000 by April 30 ($A105K), with contracts worth 4,000 BTC taken out on the level. Some are even betting on US$120K (A$157K) – however due to various exotic trading strategies, they may not actually think the price will hit that level. Skew Analytics prediction engine gives Bitcoin just a 6% chance of $80K by May however.

Super Kiwis

The A$320 million New Zealand superannuation/retirement fund KiwiSaver Growth made a 5% allocation to Bitcoin last year. Chief investment officer James Grigor told Stuff, “We bought in in October at US$10,000 (A$14.8K). It was US$62,000 (A$79K) at the weekend, and it’s back at US$55,000 (A$72K) today.” That’s a 450% return in a few months.

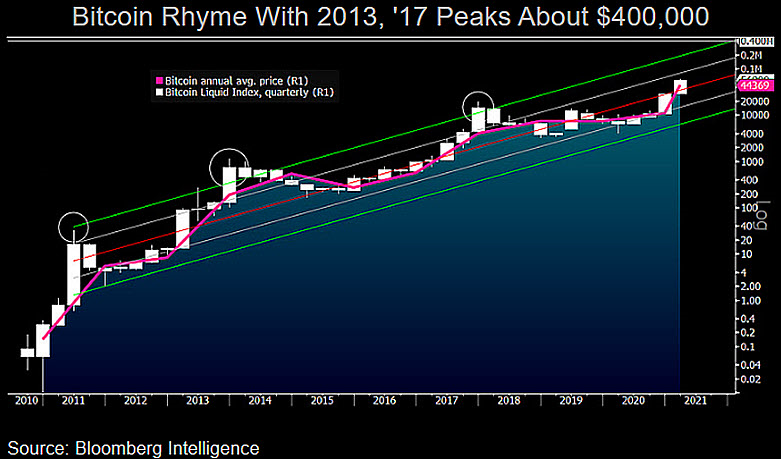

Bitcoin, shooting for the moon or the stars?

Bloomberg Intelligence commodity strategist Mike McGlone says that if this bull run follows 2013 and 2017, the price will peak around US$400,000 (A$524K). He said Bitcoin was, “Well on its way to becoming a global digital reserve asset, a maturation leap in 2021 may be transitioning Bitcoin toward a risk-off asset, in our view.” Grayscale’s Barry Silbert (which now has US$37.3B (A$48.8B) worth of Bitcoin under management) posted the story saying “I approve this message“. Veteran trader Peter Brandt is also super bullish, predicting BTC could appreciate more than 250% in the current bull cycle to US$200,000 (A$262K) based on historical parallels. “I think we’re in that midpoint pause where in 2017 Bitcoin swirled around for a month or two before we saw the final move up,” he said, dropping the bombshell that his own financial goals have now moved from accumulating USD to accumulating Bitcoin.

DeFi Digest

A round up of the top news in Decentralised Finance

🐉 Dragonfly Capital launches a US$ 225m fund to invest in DeFi, NFTs and Layer 2 solutions.

🍣 The SushiSwap ecosystem expands as they launch Kashi Lending and Margin Trading.

🦄 UniSwap v3 launches and is touted to be the most flexible and capital efficient AMM. Mainnet Launch with Optimism L2 deployment was delayed until May 5.

💵 A review on the best yields in DeFi for US Dollar stablecoins by the Bankless team.

Until next week, happy trading!