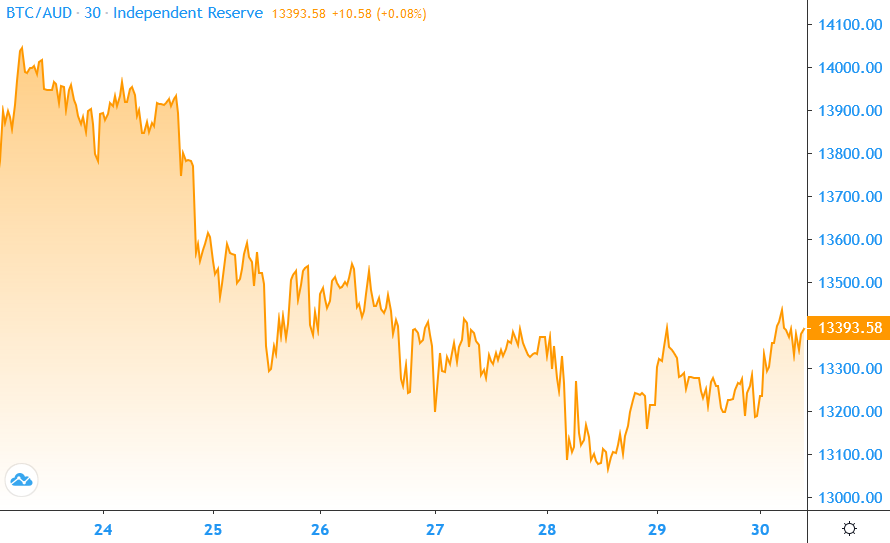

Market Update 24th – 30th June 2020

In Markets

Bitcoin dropped briefly below the US$9000 ($13,100) mark on the weekend, but it was on fairly thin volumes. At the time of writing, Bitcoin was 4.24% down on the same time last week, to trade around $13,400. Its performance was better than most of the top ten coins: Ethereum lost 5.7% this week, XRP (-5.7%), Bitcoin Cash (-6%), Bitcoin SV (-9.3%), Litecoin (-5%), EOS (-7.1%). Stellar lost 8.4%.

In Headlines

Low volatility to end with a bang?

The seven-day moving average of Bitcoin inflows from miners to exchanges has reached the highest level it’s been this year – although there’s debate over how significant this is. Skew data also shows that Ether-Bitcoin implied volatility dropped to an all-time low over the weekend. CoinGecko research analyst Daryl Lau says low volatility may well end with a “big move”. One reason for Bitcoin’s recent price action could be because, as crypto analyst Michael van de Poppe says, “everyone is expecting March to happen again”.

Highly correlated

Larry Cermak, analyst from The Block, says the correlation between Bitcoin and the S&P 500 disappeared in May, but it’s back to levels last seen in early March. The trend returned primarily after June 11 when equities dumped by 6% and the market got nervous. “Needless to say this is not a good trend and something to keep in mind if you are trading BTC/ETH. I don’t expect it to go away until macro confidence returns,” he said. But in more encouraging news, Morgan Stanley released a report this week predicting the stock market recovery will hold.

Grayscale wants all the Bitcoin

Grayscale Investments has ramped up its Bitcoin purchases, buying 19,878 BTC last week alone. Since the halving it’s purchased an average of 1190 BTC per day and if it continues to buy at this rate it will own 3.4% of the world’s BTC supply by New Year’s Eve – and 10% by the time of the next halving in 2024.

DeFi bubble good for BTC and ETH?

Forbes predicts that surging interest in DeFi will ultimately pump up the price of Bitcoin and Ethereum after the bubble pops. Kelvin Koh, a partner at crypto fund Spartan Group said, “At some point, the valuation of these alts will start to look frothy and the capital will flow back to BTC.” Weiss Crypto Ratings also thinks it’s “ludicrous” to think that DeFi tokens will decouple from the wider market: “Eventually, the mania will end, and DeFi will trade in line with the rest of the market.” In other DeFi news Bitcoin-on-Ethereum tokens are now approaching $140 million in locked value. These tokens enable hodlers to use their BTC in Ethereum based DeFi protocols, often by lending it out to earn interest.

Impact of PayPal selling Bitcoin

Messari research analyst Ryan Watkins ran the ruler over the potential impact of PayPal customers getting into Bitcoin and found the effect on price would be negligible. If 1% to 5% of PayPal users buy Bitcoin, the price would only increase by a couple of hundred dollars. However, he also found that if institutions followed billionaire Paul Tudor Jones’ example and allocated 1% to Bitcoin it could “easily bring Bitcoin’s market cap above $1 trillion, or over $50,000 per BTC.” Capital CEO Chamath Palihapitiya this week encouraged everyone to invest 1% of their capital into Bitcoin as ‘disaster insurance’. He knows how well it can pay off: he invested $80 million in Bitcoin when it was $80 (yes – he bought 1 million bitcoins).

Most bitcoins haven’t moved

Around 61% of all bitcoin hasn’t moved in a year – that’s an all-time high. Data analytics firm Glassnode tweeted that “The last time we saw this amount of #Bitcoin that had not moved in over a year, was in early 2016 – preceding $BTC’s bull run to $20k.”

Woo hoo says Willy Woo

Crypto analyst Willy Woo has unveiled a new price model for Bitcoin that suggests BTC was setting itself up for a new bull run until COVID-19 came along. But that’s not all: “This model suggests we are close to another bullish run. Maybe another month to go … The longer this bull market takes to wind up, the higher the peak price.”

Time to do your taxes

The 2019-2020 financial year is almost at a close and it’s time to start getting your paperwork in order. If you have bought and/or sold crypto in the last financial year, from July 1 you can download your KPMG Tax Estimate report for your Independent Reserve account. Log in to your Independent Reserve account > click on the accounts menu item at the top of the page > click the Tax – Powered by KPMG tab > click Generate Tax Summary.

Until next week, happy trading!

Independent Reserve Trading Desk